Overview

The article outlines proven strategies for business restructuring services, emphasising the critical role of:

- Thorough assessments

- Stakeholder engagement

- Effective communication

in enhancing the success rates of reorganisation initiatives for fund managers. Furthermore, it details best practices such as:

- Conducting financial analyses

- Fostering a culture of adaptability

- Leveraging technology

to facilitate the restructuring process. Collectively, these strategies help mitigate risks and improve operational efficiency, making them essential for any fund manager looking to navigate the complexities of business restructuring.

Introduction

In the dynamic world of business, restructuring has emerged as a crucial strategy for companies aiming to boost efficiency and profitability amid ever-evolving market conditions. As organisations confront complex challenges, fund managers assume a pivotal role in grasping the nuances of restructuring, whether through operational changes, financial realignments, or organisational shifts. Furthermore, the landscape of business restructuring in 2025 is increasingly shaped not only by traditional metrics but also by sustainability practices and stakeholder engagement.

With a growing emphasis on environmental, social, and governance (ESG) factors, it is imperative for fund managers to adapt their strategies to align with both investor expectations and regulatory demands. This article delves into the intricacies of business restructuring, exploring key indicators, effective strategies, and the critical importance of communication. By empowering fund managers to make informed decisions, we drive the long-term success that organisations seek.

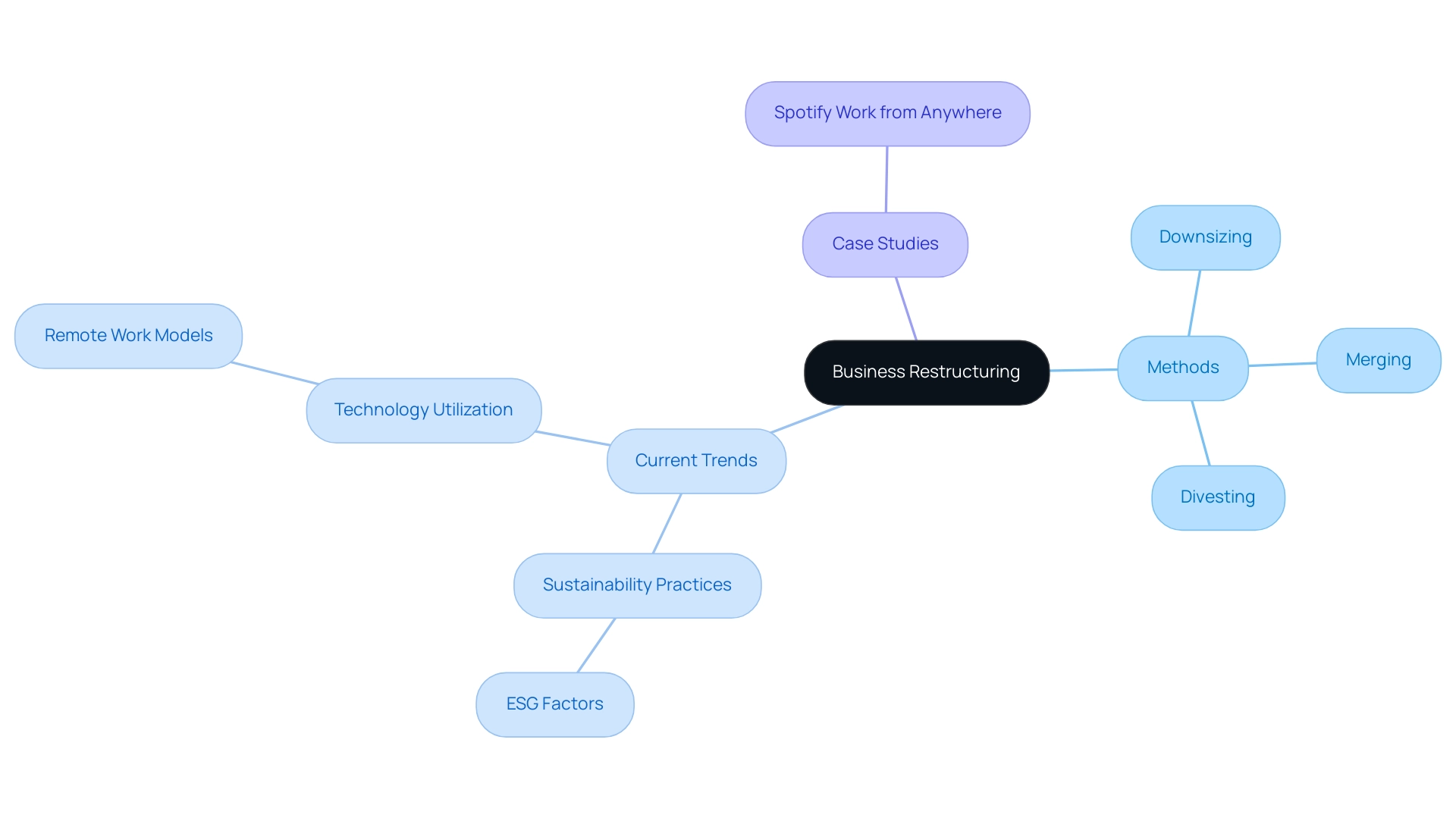

Understanding Business Restructuring

Business restructuring services represent a strategic initiative designed to reorganise a company’s structure, operations, or finances, ultimately enhancing efficiency and profitability. This multifaceted approach encompasses various methods, including downsizing, merging, or divesting specific business units. For investment leaders, understanding the diverse forms of reorganisation, operational, financial, and organisational, is crucial for identifying the most effective strategies for their investments.

In 2025, the landscape of business reorganisation is evolving, with a pronounced emphasis on sustainability practices, particularly in sectors that generate substantial waste. Fund supervisors are increasingly expected to consider environmental, social, and governance (ESG) factors when evaluating reorganisation opportunities. This shift not only aligns with regulatory trends but also addresses the rising demand from investors for responsible business practices.

Naismiths operates across eight cities in the UK, offering valuable insights into successful business transformations that resonate with managers. For example, companies that have embraced hybrid work models report significant enhancements in employee satisfaction and retention.

Current trends indicate that businesses are increasingly leveraging technology to facilitate transformation processes. The emergence of video conferencing and cloud-based collaboration tools has revolutionised company operations, enabling more efficient communication and decision-making. This technological advancement is particularly significant in the context of remote and hybrid work models, which are gaining popularity as organisations respond to employee preferences for work-life balance.

Expert opinions underscore the necessity of a collaborative approach to business transformation. Statistics reveal that firms adopting structured business restructuring services achieve higher success rates, highlighting the importance for investment managers to be well-versed in these methodologies.

In conclusion, a comprehensive overview of business reorganisation strategies equips investment managers with the insights needed to navigate complex situations effectively. By remaining informed about current trends and successful case studies, investment professionals can make strategic decisions that not only enhance their portfolios but also promote sustainable practices.

Identifying Key Indicators for Business Restructuring

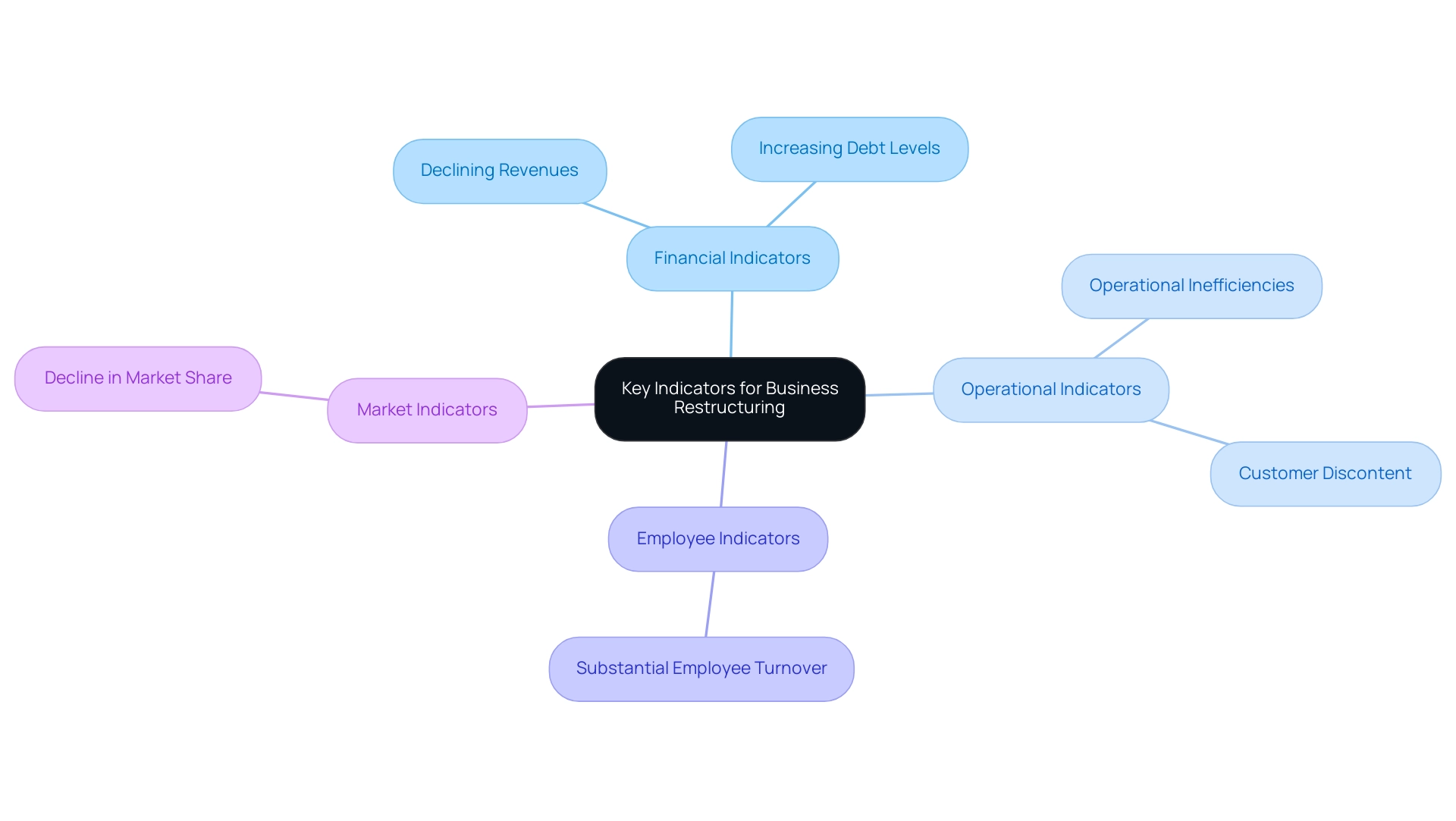

Recognising when a business requires reorganisation is essential for fund managers aiming to safeguard their investments. Key indicators include declining revenues, which have been a significant concern in recent years, alongside increasing debt levels and operational inefficiencies. Furthermore, substantial employee turnover, customer discontent, and a clear decline in market share are critical indicators that must not be overlooked.

In 2025, the business distress environment is characterised by a marked increase in the demand for business restructuring services, as numerous companies grapple with the repercussions of economic changes. For instance, the private equity sector has witnessed limited partners experience net positive cash flows for the first time since 2015, indicating that general partners are effectively addressing liquidity demands. However, the overall decline in returns underscores the ongoing challenges that necessitate robust business restructuring services.

In 2024, the S&P 500 yielded over 17 percent during the first and third quarters, surpassing all private equity sub-asset classes. This highlights the importance of strategic modifications in response to evolving market conditions.

Fund supervisors should actively monitor these indicators to assess the health of their investments. Early identification of warning signs enables timely intervention, which can avert more severe financial distress and help preserve investment value. As financial experts underscore, maintaining confidentiality during the resolution process is vital for achieving effective outcomes.

This reinforces the necessity for a strategic approach to business restructuring services. By fostering open communication and initiating collaborative meetings with appreciation to build positive relationships, fund managers can navigate these challenges more adeptly and ensure that their investments remain resilient in a fluctuating market. The case study on Limited Partners’ Distribution Growth illustrates the current landscape of private equity and the challenges faced, emphasising the need for effective business restructuring services as an integral component of reorganisation strategies.

Effective Strategies for Successful Business Restructuring

Successful business restructuring services necessitate a comprehensive and strategic approach. A critical first step involves conducting an in-depth financial analysis to pinpoint areas ripe for cost reduction. This analysis not only highlights inefficiencies but also serves as a foundation for informed decision-making.

Engaging stakeholders early in the process is equally vital; fostering buy-in from key players can mitigate resistance and enhance collaboration throughout the transition journey.

A well-defined communication plan is essential for managing expectations and ensuring transparency. This plan should outline the reorganisation objectives, timelines, and the roles of various stakeholders, thereby reducing uncertainty and building trust. Furthermore, implementing performance metrics allows organisations to track progress effectively, enabling timely adjustments based on real-time feedback.

This adaptability is crucial in navigating the complexities of organisational change.

Fund managers are encouraged to leverage external advisors who can provide objective insights and facilitate smoother transitions through business restructuring services. These experts bring a wealth of experience and can help identify best practices tailored to specific organisational needs. For instance, recent statistics indicate that organisations focusing on stakeholder engagement and clear communication can significantly reduce the common 60-70% failure rate associated with change initiatives.

In this context, Naismiths’ platform offers comprehensive solutions for accurate cost data, project performance assessment, and risk management. Its intuitive interface allows users to easily input and track key data for property development projects, ensuring that financial analyses are grounded in reliable information. The platform’s secure database supports standardised reporting and analysis, while its built-in development appraisal tools enable users to quantify technical risks associated with projects.

By utilising precise benchmarking and real-time monitoring, fund managers can make informed choices that enhance the likelihood of successful transformation outcomes.

Successfully navigating organisational change comes with its own set of unique challenges: high failure rates, employee resistance, and the need for effective communication. This underscores the importance of addressing these challenges head-on.

Given the present market conditions, where the need for office space is low and numerous owners are contemplating transforming underused office properties into residential real estate, the necessity for efficient reorganisation approaches is more urgent than ever.

In summary, successful business reorganisation strategies in 2025 hinge on thorough financial analysis, proactive stakeholder engagement, clear communication, and the use of performance metrics. By implementing these optimal strategies and utilising Naismith’s platform, financial managers can improve the chances of favourable results in their business restructuring services and revitalisation efforts.

The Importance of Financial and Operational Assessments in Restructuring

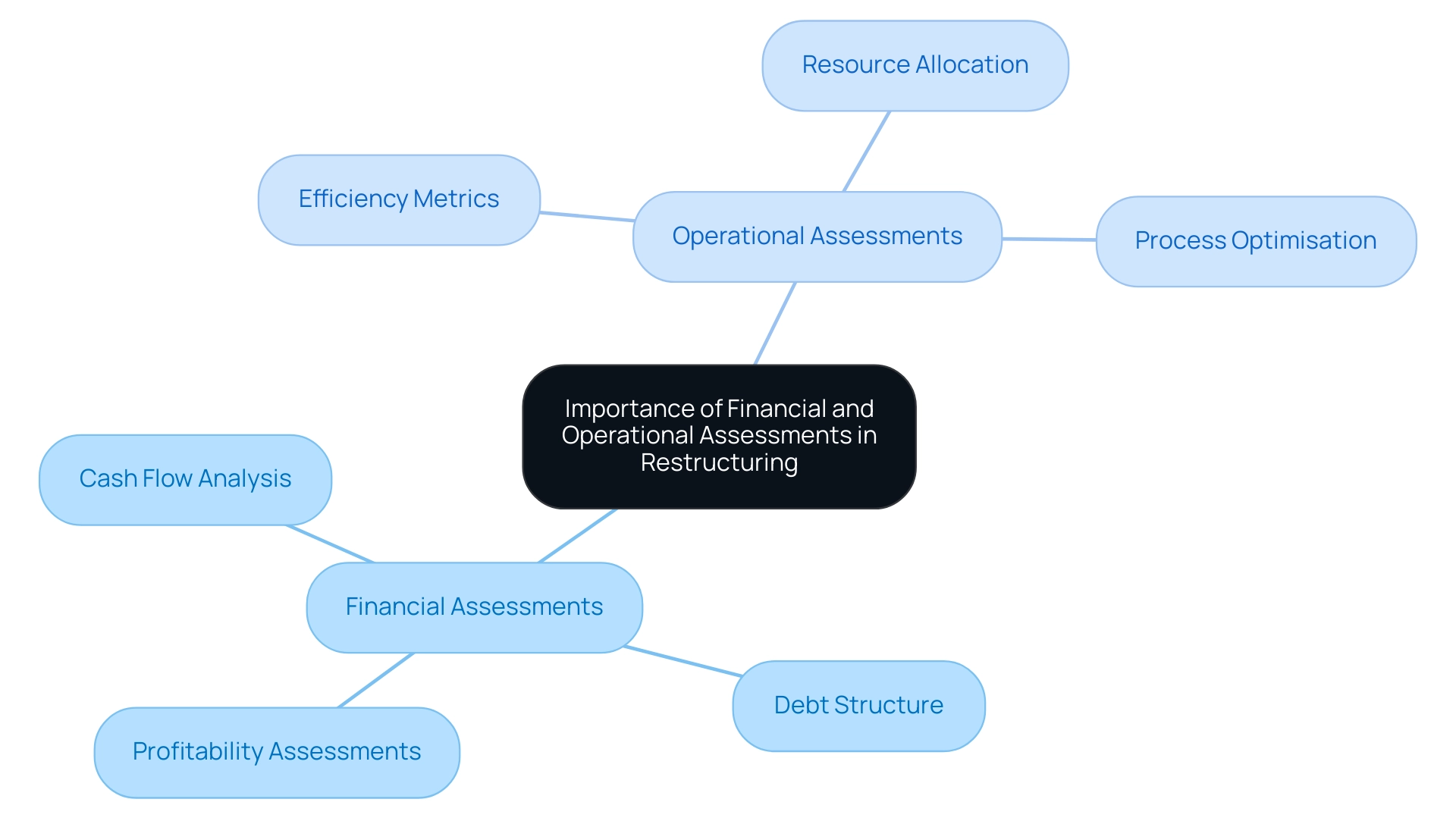

Conducting thorough financial and operational assessments is paramount for gaining a clear understanding of a company’s current status and pinpointing areas ripe for improvement. Financial assessments should encompass:

- A detailed cash flow analysis

- An evaluation of the debt structure

- Profitability assessments

These elements are crucial as they reveal the financial health of the organisation and highlight potential risks.

On the operational side, assessments should focus on:

- Efficiency metrics

- Resource allocation

- Process optimisation

By examining these factors, fund managers can uncover inefficiencies and identify opportunities for enhancement.

In 2025, the importance of these assessments is underscored by economic trends indicating a sustained increase in bankruptcy cases, which necessitates proactive measures for financial stability. A recent report highlighted that financial institutions must adapt their business models to maintain profitability amidst evolving market conditions, emphasising the need for digitisation and alternative financing solutions.

Moreover, operational assessments have indicated that companies that implement structured evaluations can enhance their efficiency by up to 30%, significantly affecting their success in reorganisation. This data reinforces the necessity of integrating comprehensive assessments into the business restructuring services process.

Expert insights reveal that a well-executed financial assessment not only aids in identifying immediate challenges but also lays the groundwork for long-term strategic planning.

Ultimately, these assessments provide investment leaders with the essential insights required to create focused modification strategies that align with both the company’s goals and current market conditions, thereby enhancing the effectiveness of business restructuring services and increasing the chances of favourable results. The current market conditions, including weak demand for office space post-COVID-19, further emphasise the importance of operational assessments in navigating these challenges.

Pros and Cons of Business Restructuring: What Fund Managers Should Know

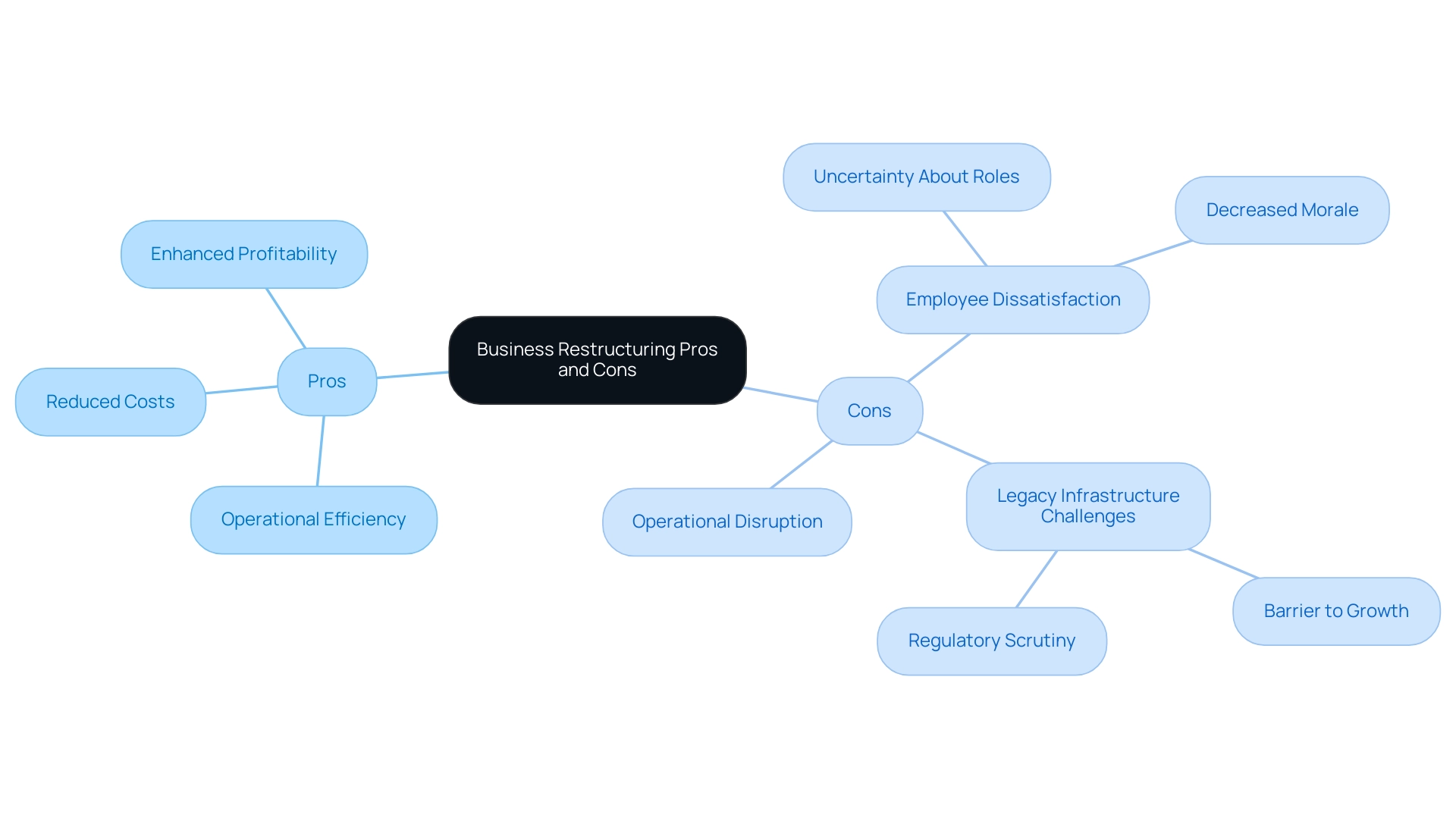

Business reorganisation presents a dual-edged sword for fund managers, offering significant benefits alongside notable challenges. On the positive side, effective reorganisation can lead to improved operational efficiency, reduced costs, and enhanced profitability. Organisations that effectively manage changes often report a marked increase in productivity and a more agile response to market demands.

However, this process is fraught with pitfalls. Employee dissatisfaction is a common concern during organisational changes, with studies indicating that nearly 60% of employees express uncertainty about their roles and job security during such transitions. This discontent can lead to decreased morale and productivity, ultimately undermining the intended benefits of the reorganisation initiative.

Moreover, the disruption of operations during the transition phase can pose significant risks. Fund managers must weigh these challenges against the potential for long-term gains. A strategic approach is essential; this includes thorough risk assessment and clear communication with all stakeholders to mitigate negative impacts, particularly through business restructuring services.

In 2025, the landscape of business reorganisation is shaped by ongoing economic uncertainties, with corporate borrowing expected to remain stable. This stability may encourage increased debt issuance and mergers and acquisitions, provided that market conditions improve. Industry experts emphasise that legacy infrastructure remains a top challenge for growth, with nearly six out of ten banking leaders identifying it as a critical barrier.

Case studies demonstrate the complexities of reorganising. In the wealth management sector, despite top banks holding only a 32% market share, they face increasing competition and regulatory scrutiny. Wealth advisors must navigate fee transparency and customer dissatisfaction while seeking growth opportunities, emphasising the need for a well-planned reorganisation strategy that addresses both operational and client-facing challenges.

Ultimately, while the advantages of business restructuring services in 2025 are evident, investment supervisors must remain vigilant to the related risks. A balanced perspective that considers both the pros and cons, supported by data and expert insights, will be crucial for navigating this intricate process successfully.

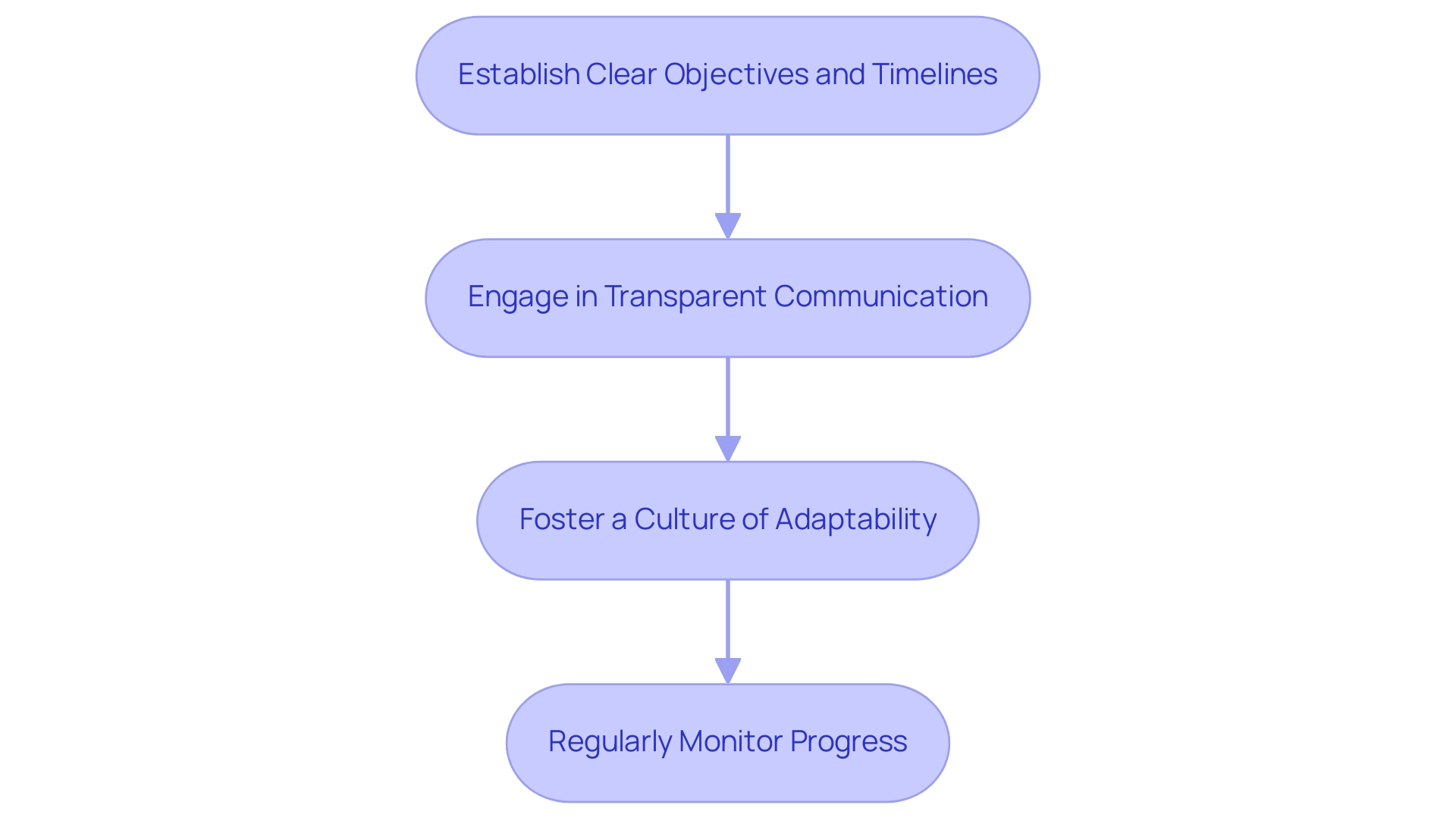

Best Practices for Implementing Business Restructuring Initiatives

To successfully implement business transformation initiatives, fund managers must prioritise several best practices that significantly enhance their effectiveness. First and foremost, establishing clear objectives and timelines is essential. This clarity not only guides the restructuring process but also aligns the efforts of all stakeholders involved.

Engaging in transparent communication throughout the organisation fosters trust and ensures that everyone is on the same page, which is critical during times of change.

Fostering a culture of adaptability is another key component. Organisations that encourage flexibility are better equipped to respond to unforeseen challenges and can pivot strategies as necessary. Regular monitoring of progress is vital; this allows fund managers to assess the effectiveness of their initiatives and make informed adjustments based on real time feedback and evolving circumstances.

Naismiths’ platform enhances this process by providing interactive dashboards and bespoke reports that facilitate accurate project performance assessment and risk management, all supported by a secure database that ensures data integrity and accessibility.

Statistics indicate that organisations with well-defined reorganisation objectives see a marked improvement in outcomes. For instance, companies that align their transformation efforts with the daily activities of their employees report higher engagement levels, which is crucial for successful change management. A study revealed that only 32% of employees felt their organisation considered individual change capabilities, highlighting the need for alignment between leadership plans and employee roles.

This aligns with the findings from the case study titled “Organisational Relevance in Change Initiatives,” which emphasises the importance of connecting change initiatives with employees’ daily activities to enhance engagement and effectiveness.

Moreover, the growing trend of private capital involvement has enabled many struggling companies to avoid bankruptcy through business restructuring services. This shift highlights the importance of proactive management approaches, including business restructuring services and aggressive liability management, to navigate economic challenges effectively. As noted in recent news, management teams are increasingly using these strategies to ensure stability and growth.

By following these best practices and utilising Naismiths’ comprehensive property development platform, which features a built-in technical library offering early-stage guidance and cost implications, fund administrators can not only improve the effectiveness of their reorganisation efforts but also promote positive results for their investments, ensuring that all parties attain the best possible outcomes while upholding high-quality standards throughout each project.

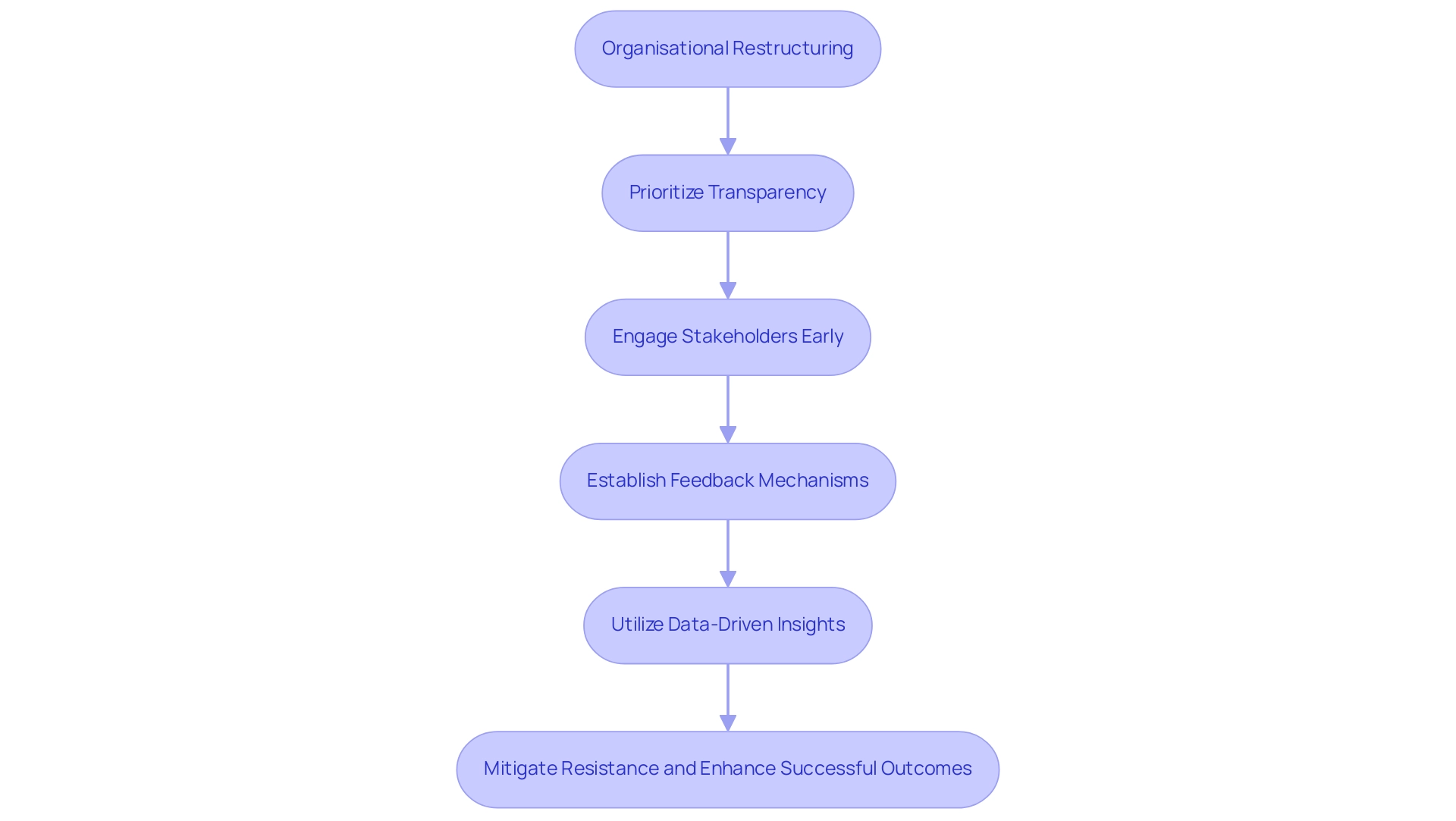

Navigating Communication and Stakeholder Management in Restructuring

Navigating communication and stakeholder management during organisational changes requires a strategic and proactive approach. Fund managers must prioritise transparency by delivering timely updates to stakeholders regarding the reorganisation process and its implications. Engaging key stakeholders, such as employees, investors, and suppliers, early in the process is crucial for fostering trust and collaboration.

Research indicates that effective communication can significantly boost employee confidence and engagement, ultimately saving organisations millions by reducing miscommunication.

Establishing robust feedback mechanisms is essential, allowing stakeholders to voice concerns and actively contribute to the reform efforts.

Furthermore, the success rates of stakeholder management during organisational changes in 2025 emphasise the significance of a collaborative spirit.

By effectively managing communication and stakeholder relationships, fund managers can mitigate resistance and enhance the likelihood of successful outcomes in their business restructuring services, ultimately positioning their organisations for long-term success.

Conclusion

In the ever-evolving landscape of business, effective restructuring is vital for enhancing efficiency and ensuring long-term profitability. This article highlights the intricate strategies fund managers must employ to navigate the complexities of restructuring successfully. Key indicators such as:

- Declining revenues

- Operational inefficiencies

- High employee turnover

serve as critical warning signs that prompt timely intervention. By closely monitoring these metrics, fund managers can safeguard their investments and help organisations adapt to market fluctuations.

The importance of thorough financial and operational assessments cannot be overstated. These evaluations not only uncover potential risks but also provide a foundation for informed decision-making. Furthermore, the integration of sustainability practices and stakeholder engagement into restructuring strategies emphasises the need for a comprehensive approach that aligns with contemporary investor expectations and regulatory demands.

Moreover, successful restructuring hinges on clear communication and stakeholder management. By fostering transparency and collaboration, fund managers can mitigate resistance and enhance employee engagement, ultimately leading to better outcomes. Leveraging technology and real-time data analysis tools, such as those offered by Naismiths, empowers fund managers to track progress and make informed adjustments throughout the restructuring process.

In conclusion, as businesses face increasing pressures and uncertainties, adopting best practices in restructuring becomes imperative. By prioritising strategic assessments, effective communication, and stakeholder involvement, fund managers can not only navigate challenges but also drive sustainable growth. The future of business restructuring lies in the ability to adapt to changing environments while fostering trust and collaboration among all stakeholders involved.