Overview

In today’s complex market landscape, investment managers must optimise their strategies within construction advisory services. By leveraging specialised expertise, such as that offered by Naismiths, they can enhance decision-making and effectively navigate the intricacies of the market. Naismiths provides comprehensive services that include:

- Risk management

- Advanced analytics

These services significantly improve project oversight and financial outcomes. Consequently, engaging with Naismiths positions managers for long-term success, particularly in the face of challenges such as market volatility and labour shortages.

Introduction

In the intricate world of construction investment, advisory services play a pivotal role. Investment managers face a myriad of challenges—from market volatility to labour shortages—making strategic guidance essential for navigating the complexities of project execution. Naismiths distinguishes itself by providing comprehensive construction advisory services that enhance decision-making and drive financial success.

As the construction sector experiences a surge in activity and an increased demand for skilled oversight, the significance of expert consultation in securing robust investments becomes increasingly apparent.

This article delves into the essential functions of construction advisory services, illustrating how Naismiths empowers managers to achieve optimal outcomes in their projects.

The Role of Construction Advisory Services in Investment Management

The essential construction advisory services deliver crucial insights and strategic direction for asset oversight throughout the complete lifecycle. Naismiths provides extensive project oversight services, including contract administration, risk assessment, and technical due diligence, which are vital for ensuring that resources remain resilient and adaptable to changing market conditions. For fund managers, partnering with Naismiths significantly enhances decision-making processes, leading to improved financial returns on their projects.

In 2024, the building industry witnessed a remarkable rise in activity, this increase underscores the growing importance of construction advisory services in navigating the complexities of capital allocation. By leveraging the expertise of seasoned advisors at Naismiths, fund managers can effectively navigate intricate building environments, safeguarding their assets while optimising them for success.

Naismiths’ customer-focused strategy emphasises risk management and collaboration, ensuring that all parties are aligned, ultimately resulting in exceptional outcomes. Naismiths’ thorough analysis and timely reporting foster strong working relationships and guarantee that projects are executed to the highest standards.

The impact of construction advisory services extends beyond mere supervision; they play a crucial role in enhancing financial decision-making. As the building sector continues to evolve, the significance of construction advisory services for investment fund managers will only increase, establishing Naismiths as an indispensable partner in achieving strategic investment objectives.

Navigating Challenges: Key Issues for Investment Fund Managers in Construction

Investment fund managers in the building industry encounter a myriad of challenges that can significantly impact outcomes and financial returns. One of the most pressing issues is market volatility, which has become increasingly pronounced in 2025. This volatility can lead to fluctuating expenses and unpredictable timelines, necessitating that managers adopt proactive strategies to navigate these uncertainties.

Regulatory compliance presents another critical concern, demanding continuous attention to mitigate penalties and delays. The construction sector is grappling with persistent labour shortages, exacerbating execution challenges. In 2024, statistics underscore the growing demand for skilled labour amidst these shortages.

Moreover, supply chain disruptions continue to pose significant hurdles, affecting material availability and further complicating timelines. As investment managers assess these factors, they must prioritise risk oversight and develop comprehensive strategies that incorporate construction advisory services. This approach will address immediate concerns while positioning their investments for long-term viability and profitability. While liability waivers can reduce the likelihood of lawsuits, they do not eliminate the need for insurance or legal defence, highlighting the importance of robust risk management strategies. In this context, Naismiths’ expertise in monitoring is essential, particularly as they oversee the over 400 live development sites.

The financial implications of construction initiatives has increased significant in the past few years, with anticipated returns varying since the initial outset of numerous projects, further influencing asset portfolios. Additionally, fund managers must navigate regulatory compliance challenges specific to projects, ensuring that all standards are met to avert potential setbacks.

Case studies illustrate the impact of these challenges on funding within construction services. For instance, ongoing government funding is expected to bolster nonresidential infrastructure initiatives, creating growth opportunities while necessitating that companies adapt their operations to leverage these incentives.

By understanding the intricate dynamics of market volatility and labour shortages, fund managers can better prepare for the complexities of the development landscape in 2025, ensuring that their capital yields optimal returns.

Tailored Solutions: How Naismiths Supports Fund Managers in Construction Projects

Naismiths offers a comprehensive suite of tailored construction advisory services specifically designed to support investment managers throughout the construction lifecycle. Their monitoring services are pivotal in ensuring that endeavours remain on schedule and within budget, providing a structured framework for oversight that is essential in today’s dynamic market. In fact, with 51% of UK companies adopting Agile as their primary management method, the effectiveness of Naismiths’ monitoring services is underscored by this industry trend.

In conjunction with their construction advisory services, Naismiths provides strategic insights that significantly enhance viability and success rates. Utilising Naismiths bespoke analytics tool N3, an advanced cost benchmarking, forecasting and monitoring tool, the company equips managers with the ability to make informed decisions grounded in real-time data. This platform not only delivers accurate cost prediction models but also facilitates scenario simulations and stress-testing of key variables, ensuring that investment decisions are based on comprehensive risk assessments and reliable data.

This proactive strategy not only mitigates potential risks but also enhances the overall financial performance of building projects. The adoption of advanced technologies in the building sector, as demonstrated by a recent case study, indicates that many firms are still in the early stages of incorporating these technologies, underscoring the significance of Naismiths’ construction advisory services in this field.

Understanding asset oversight in this area is crucial for effective task supervision and success. Naismiths ensures that all aspects of asset management are monitored, from workforce and to cost assessments, thereby enhancing results. Their in-built technical library offers early-stage guidance and cost implications of key design features, further assisting fund managers in navigating the complexities of construction projects.

As managers navigate these complexities, Naismiths stands out as an invaluable partner providing construction advisory services, committed to maximising returns and ensuring that every initiative aligns with strategic objectives. With IT-related initiatives dominating organisational portfolios, effective monitoring becomes increasingly crucial. Their director-led instruction and dedication to prioritising clients’ commercial interests further distinguish Naismiths from competitors, making them a vital partner for fund managers seeking to enhance their portfolios.

Ensuring Success: Effective Project Oversight and Risk Management Strategies

Effective oversight of initiatives and robust risk control strategies are essential for fund managers seeking successful outcomes in construction advisory services. As we approach 2025, the rise of Project Management Offices (PMOs) as strategic powerhouses underscores the growing significance of structured oversight within the industry. Fund managers must prioritise regular reviews and establish clear communication channels with all stakeholders to promote transparency and accountability.

Implementing comprehensive risk assessment frameworks is crucial for early identification of potential issues, facilitating timely interventions that can mitigate risks before they escalate. This proactive approach not only reduces the likelihood of delays and cost overruns but also safeguards investments, enhancing overall success. Moreover, the critical role of risk oversight in construction advisory services cannot be overstated.

Firms are encouraged to enforce stringent quality control measures, invest in professional liability insurance, and provide training on proper building techniques. Reviewing contracts to clarify defect liability and dispute resolution terms further fortifies risk management strategies. Naismiths’ monitoring surveyors play a pivotal role in ensuring compliance and high-quality delivery through regular site visits and detailed reporting, offering a comprehensive view of progress and potential risks.

Key competencies for managers—technical expertise, communication mastery, an agile mindset, and leadership—are indispensable for effective oversight. The programme coordination process typically encompasses two stages:

- Establishing objectives, evaluating budgets, and analysing cost implications;

- Engaging in procurement and contractor participation.

Case studies indicate that half of all PMOs cease operations within three years due to difficulties in demonstrating sustained value and alignment with organisational goals.

This reality emphasises the necessity for PMOs to align their objectives with measurable impacts, ensuring both longevity and effectiveness in oversight. By fostering a culture of proactive risk management and employing a data-driven, commercially focused strategy for asset management, investment fund managers can adeptly navigate the complexities of construction advisory services, ultimately attaining the best possible outcomes.

Building Strong Partnerships: The Importance of Communication in Advisory Services

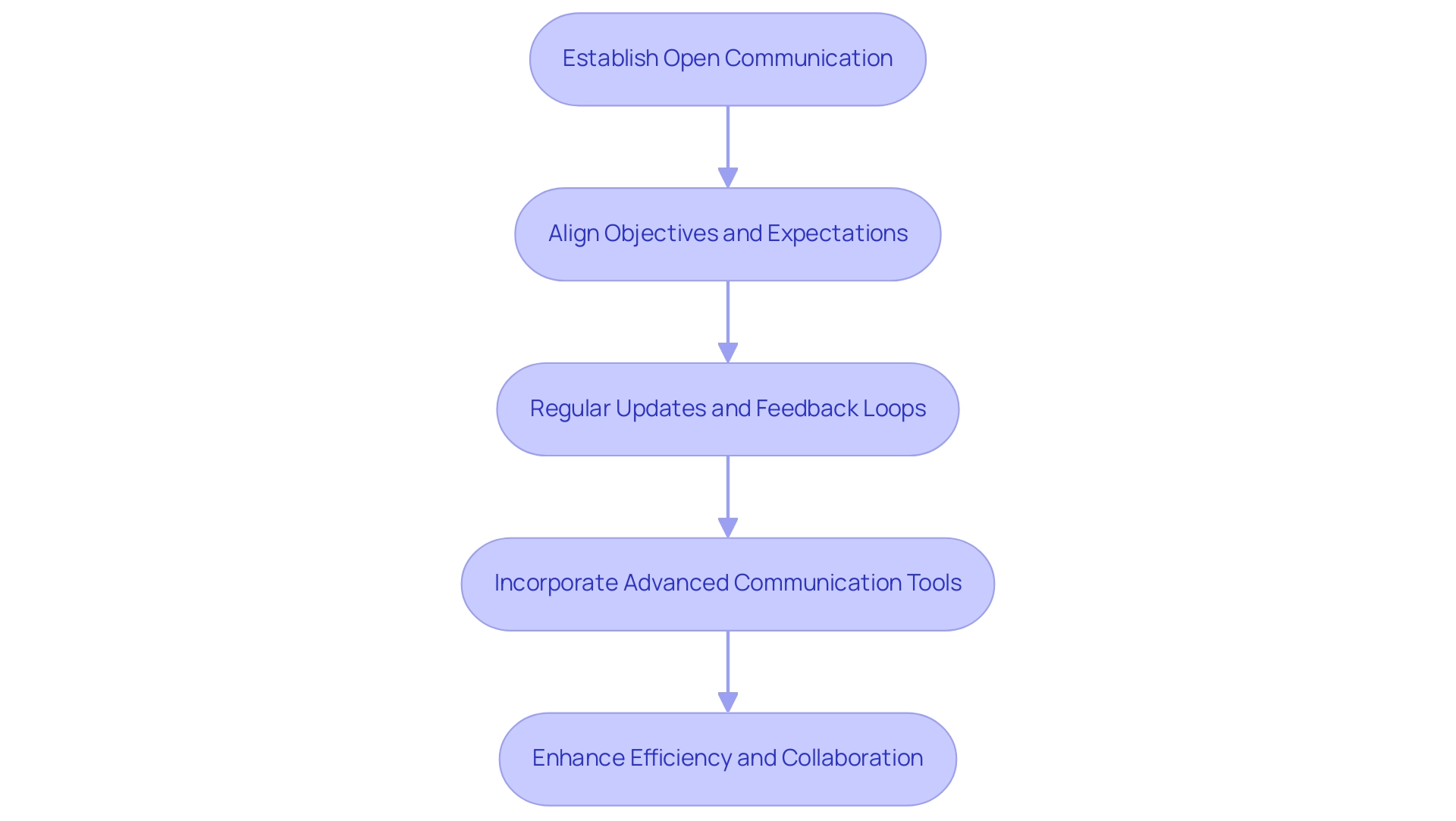

Building robust partnerships through effective communication is essential in providing construction advisory services. Fund managers must prioritise establishing open lines of communication with their advisory teams, ensuring alignment on objectives and expectations. Regular updates and feedback loops are crucial for identifying potential issues early, fostering a collaborative environment that significantly enhances efficiency.

Statistics indicate that effective communication can improve outcomes, with studies showing that teams spend approximately 23% of their time on in-person business communication. This underscores the importance of direct interaction in achieving success.

Incorporating advanced communication tools, such as visual aids like Gantt charts and flowcharts, can simplify complex information and enhance understanding among stakeholders. These tools not only illustrate timelines and processes but also facilitate clearer dialogue, which is vital for navigating the complexities of modern construction endeavours. By effectively utilising these visual aids, teams can ensure that all members are on the same page, thereby reducing misunderstandings and improving overall coordination.

By cultivating strong relationships grounded in trust and transparency, managers can effectively leverage the expertise of their advisory partners. This cooperative spirit, emphasises risk oversight and a teamwork approach, ensuring that all parties strive for the best possible results while upholding high-quality standards throughout every endeavour. The focus on open communication is crucial in tackling challenges and enhancing delivery in the constantly changing building environment.

Furthermore, Naismiths’ comprehensive construction advisory services—including contract administration, risk management, feasibility studies, and defect diagnosis—highlight the importance of effective communication in successfully managing endeavours. Their bespoke N3 platform features an intuitive interface and secure data storage, providing robust solutions for accurate cost data, project performance assessment, and real-time monitoring, further enhancing client success in construction consultancy. Testimonials from satisfied clients underscore Naismiths’ effectiveness and commitment to delivering high-quality services.

Conclusion

The pivotal role of construction advisory services in investment management is paramount. Naismiths provides a comprehensive suite of solutions designed to empower investment managers in effectively navigating the complexities of the construction landscape. From project monitoring to risk management, the firm’s expertise ensures that projects remain on track and within budget, ultimately enhancing financial returns.

Managers face numerous challenges, including:

- Market volatility

- Labour shortages

- Regulatory compliance

These challenges highlight the necessity for strategic guidance. Naismiths’ tailored approach emphasises collaboration and communication, fostering strong partnerships and enhancing decision-making processes. By leveraging advanced tools and methodologies, fund managers can make informed choices that mitigate risks and capitalise on opportunities.

In a rapidly evolving construction industry, effective project oversight and robust communication are critical. As demonstrated through case studies and expert insights, Naismiths emerges as an indispensable ally for managers striving to achieve strategic investment goals. By prioritising proactive risk management and cultivating strong relationships, managers can confidently navigate challenges and secure optimal outcomes for their projects. The future of construction investment hinges on these essential advisory services, marking them as a critical component of successful project execution.