Overview

Mastering restructuring advisory is essential for business leaders, as it provides specialised guidance to navigate financial challenges and operational inefficiencies. This ultimately positions companies for sustainable growth.

Effective restructuring strategies, supported by data-driven decision-making and stakeholder engagement, significantly enhance the likelihood of achieving operational efficiency and financial stability.

Furthermore, case studies demonstrate successful transformations, underscoring the importance of these practices.

By leveraging such insights, leaders can foster a resilient organisational framework that not only addresses current challenges but also paves the way for future success.

Introduction

In the ever-evolving landscape of business, organisations encounter a myriad of challenges that can jeopardise their very existence. As financial pressures intensify and operational inefficiencies become increasingly apparent, the role of restructuring advisory emerges as a beacon of hope. This specialised guidance transcends mere survival; it revitalises a company’s structure and positions it for sustainable growth.

In 2025, the significance of these advisory services has never been more pronounced, as companies grapple with market volatility and liquidity constraints. By implementing effective restructuring strategies, businesses can navigate complexities, enhance operational efficiency, and ultimately thrive in a competitive environment.

Through compelling case studies and expert insights, this article explores the critical components of successful restructuring advisory, highlighting the essential skills and strategies required for transformative change.

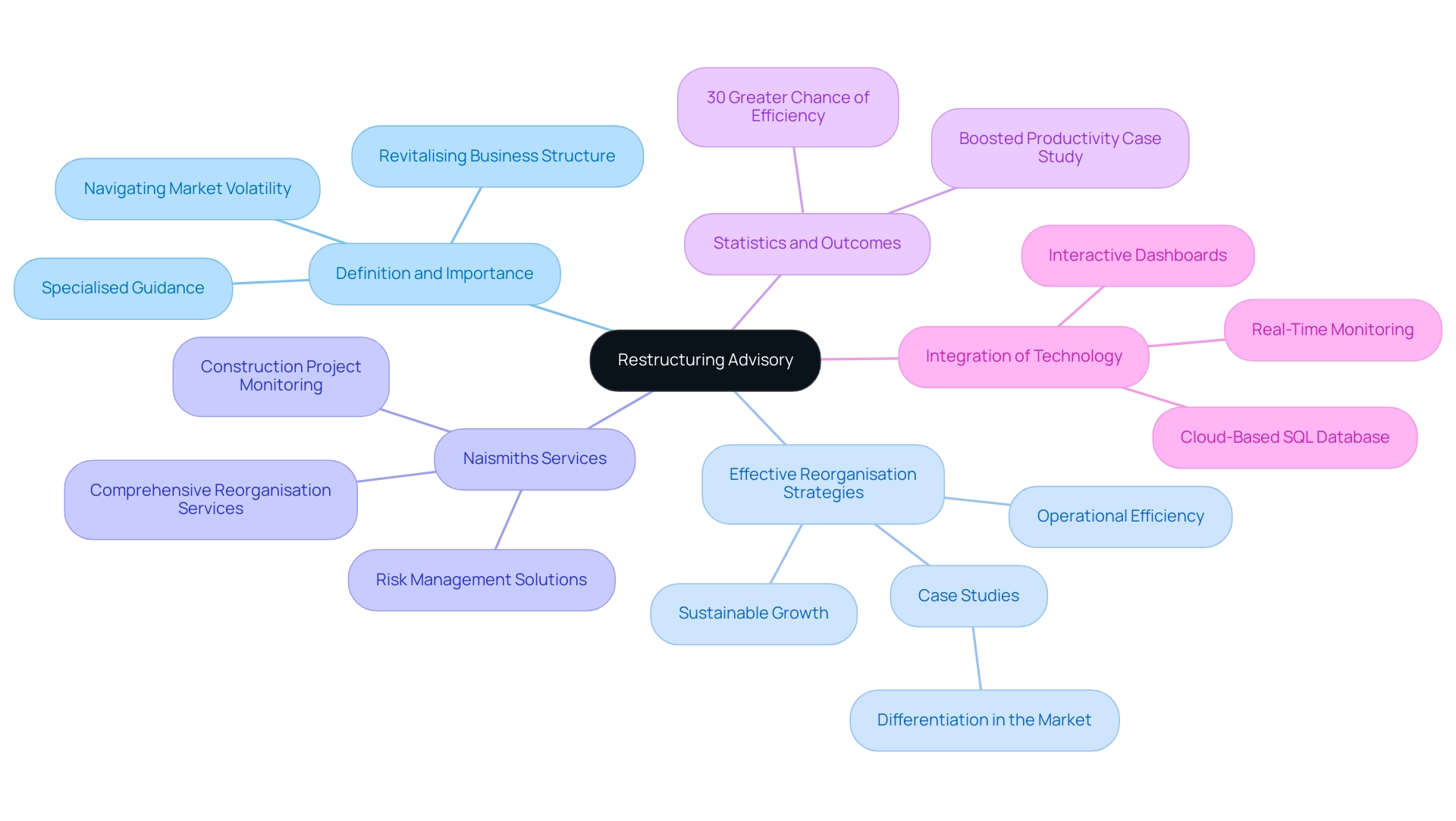

Understanding Restructuring Advisory: Definition and Importance

Restructuring advisory provides specialised guidance for entities facing financial challenges or operational inefficiencies. This multifaceted service is essential for revitalising a business’s structure, operations, and overall financial health. In 2025, the significance of restructuring advisory has become increasingly pronounced, particularly as companies encounter heightened market volatility and liquidity constraints.

Effective reorganisation strategies not only assist organisations in navigating these complexities but also position them for sustainable growth and recovery in a competitive environment.

Naismiths offers comprehensive reorganisation services that align with these needs, underscoring the critical role of advisory services in this domain. The Naismiths platform delivers accurate cost data, project performance assessments, and risk management solutions, all essential for investment fund managers aiming to make informed decisions. The platform integrates information from external data sources, enhancing reporting and analysis capabilities.

Recent statistics indicate that companies engaged in extensive overhaul initiatives report a 30% greater chance of achieving operational efficiency and financial stability compared to those that do not. This data underscores the tangible advantages of expert insights in executing strategies that foster resilience and adaptability. Furthermore, successful case studies highlight the transformative effects of restructuring advisory.

For instance, a notable contracting company grappling with significant operational inefficiencies sought assistance from specialists, resulting in a streamlined process that boosted productivity by 25% within a year. Such outcomes not only improve a company’s bottom line but also enhance stakeholder confidence. Naismiths distinguishes itself through director-led instruction and a commitment to prioritising clients’ commercial interests.

This customer focused approach emphasises risk management and collaboration, ensuring optimal results for all parties involved. Expert insights further reinforce the importance of advisory services. Industry leaders assert that a proactive approach to reorganisation can mitigate risks and unlock new growth opportunities.

In light of recent trends, the emphasis on advisory services has shifted towards integrating technology and data analytics, enabling businesses to make swift, informed decisions. This evolution reflects a broader acknowledgment of the importance of agility in today’s fast-paced market, which captures dealmaker sentiments and expectations shaping market trends. Ultimately, the benefits of restructuring advisory extend beyond immediate financial recovery; they establish a foundation for long-term success, ensuring that organisations are equipped not only to survive but also to thrive in an ever-evolving landscape. The built-in technical library on construction projects further supports early-stage advice and cost implications, enhancing the overall effectiveness of the Naismiths platform.

Key Responsibilities of Restructuring Professionals

Restructuring professionals are indispensable in navigating the complexities of organisational change, carrying several key responsibilities that are essential for achieving successful outcomes in 2025.

- Assessment of Financial Health: These experts conduct thorough analyses of financial statements, pinpointing vulnerabilities and opportunities for improvement. Recent statistics reveal that professionals providing restructuring advisory in organisational change have conducted over 75% of financial health assessments in organisations undergoing transformation, underscoring their critical role in diagnosing issues.

- Stakeholder Engagement: Effective collaboration with stakeholders—including creditors, management, and employees—is crucial. Research indicates that effective stakeholder engagement in the context of restructuring advisory can enhance success rates of reorganisation by as much as 30%, emphasising the significance of fostering agreement and trust among all involved parties.

- Implementation of Strategies: Restructuring professionals oversee the execution of tailored strategies that align with the company’s long-term goals. Their ability to adapt and implement these strategies is vital, especially in industries facing rapid changes. For instance, healthcare organisations must adjust their business and care models to leverage provider-driven metrics, illustrating the need for flexibility in strategy implementation.

- Monitoring Progress: Continuous evaluation of transformation initiatives is essential. Professionals must assess the effectiveness of implemented strategies and make necessary adjustments to ensure that the desired outcomes are achieved, thereby enhancing organisational resilience.

- Communication: Transparent communication is fundamental to fostering trust and facilitating a smooth transition process. Maintaining open lines of communication with all stakeholders helps mitigate resistance and encourages collaboration.

In addition to these duties, expert insights indicate that incorporating riskand compliance measures early in the reorganisation process can significantly enhance financial recovery efforts. A recent case study in the banking sector illustrated that organisations prioritising sustainable cost management and operational efficiency achieved better financial health outcomes. By focusing on automation and cost transparency, these banks not only improved their financial standing but also effectively addressed regulatory compliance challenges.

Overall, the role of experts in restructuring advisory is increasingly vital in today’s dynamic business landscape, where their skills in financial recovery and stakeholder involvement can lead to successful transformations. Moreover, the stability offered by long-term agreements with provider partners, typically lasting 20 years, underscores the importance of building dependable relationships during the reorganisation process.

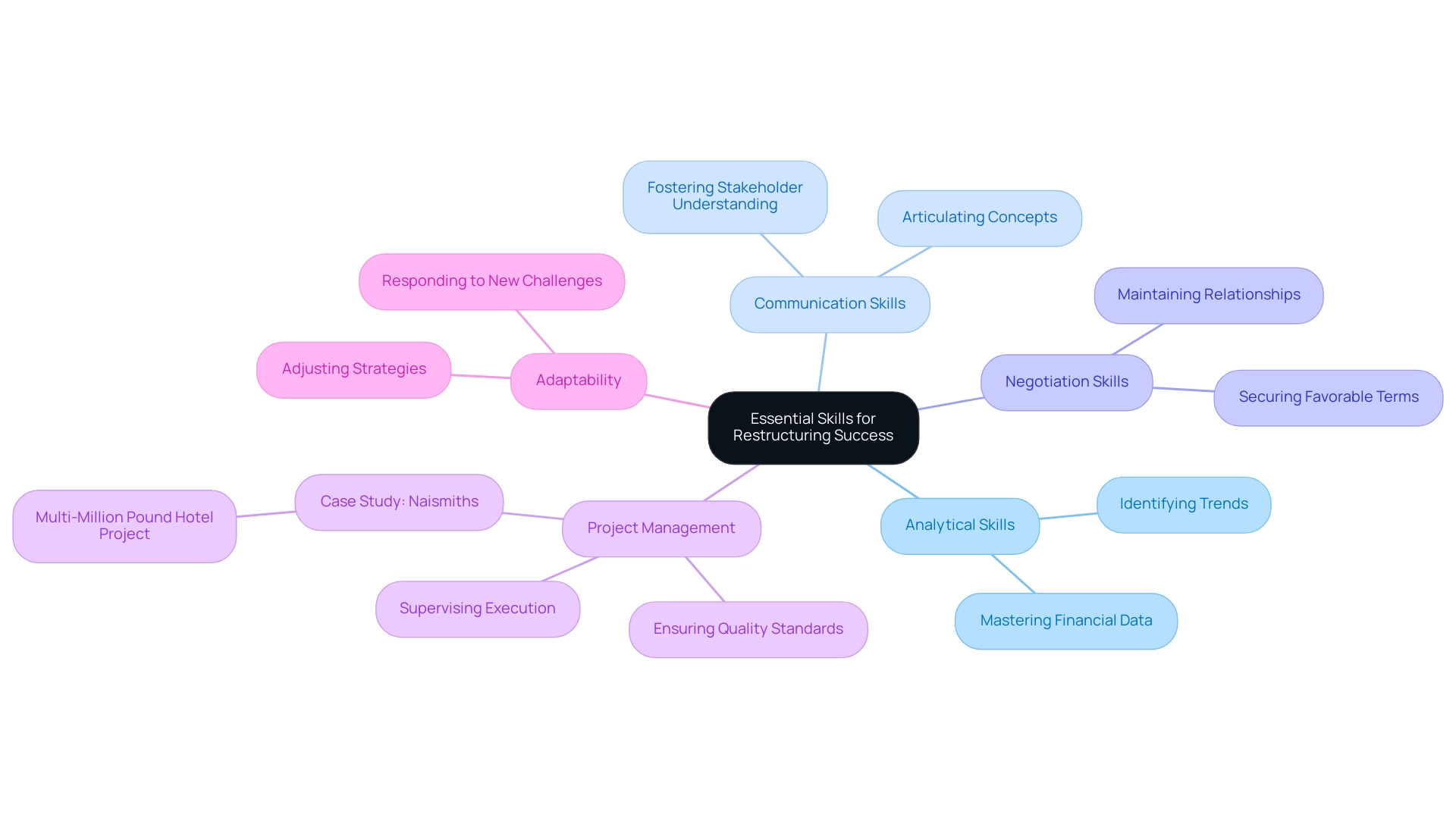

Essential Skills and Capabilities for Restructuring Success

Successful professionals in organisational change must cultivate a diverse set of skills and capabilities to effectively navigate the complexities of restructuring advisory in business transformation. Key competencies include:

- Analytical Skills: Mastery in analysing intricate financial data is crucial. Professionals must identify trends that significantly influence business performance, enabling informed decision-making.

- Communication Skills: The ability to articulate complex concepts clearly and concisely is vital. Strong verbal and written communication fosters understanding among stakeholders, ensuring alignment throughout the reorganisation process.

- Negotiation Skills: Proficiency in negotiation is essential for securing favourable terms with creditors and other stakeholders. Effective negotiators can advocate for their clients’ interests while maintaining constructive relationships.

- Project Management: Successful reorganisation requires adept project management skills. Experts must supervise the execution of reform plans, ensuring adherence to tight timelines and quality standards.

- Adaptability: The business environment is continuously evolving, and those in charge of realignment must be agile. The ability to adjust strategies in reaction to new challenges is essential for attaining desired results.

In 2023, a significant statistic showed that only 43% of employees believed their workplaces were skilled at handling change, a drop from almost 60% in 2019. This highlights the significance of skilled experts in restructuring advisory who can effectively lead successful organisational changes. To enhance skill development, organisations can create or utilise tools within a Learning Management System (LMS), which can facilitate ongoing training and competency growth for professionals undergoing change.

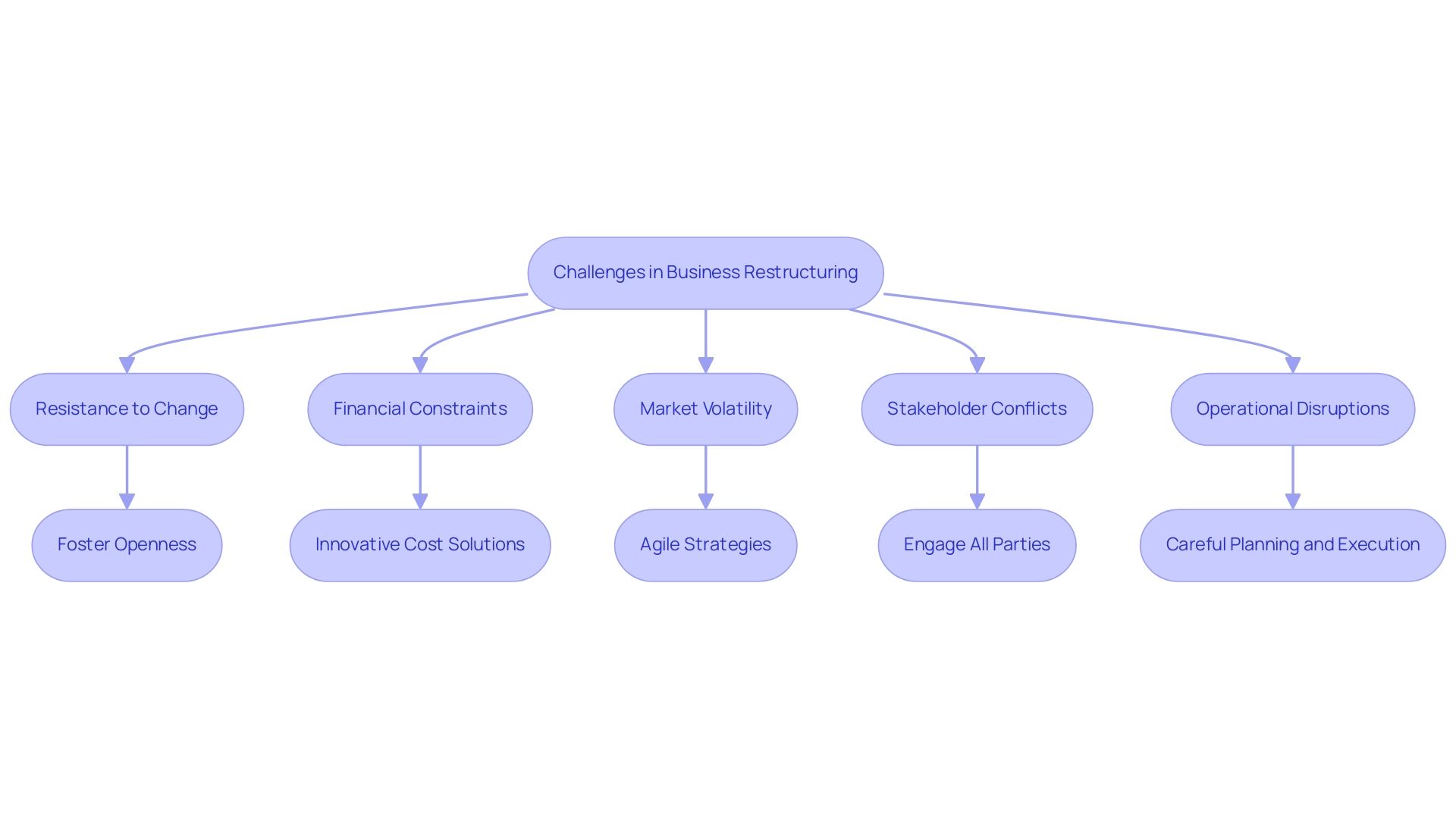

Navigating Challenges in Business Restructuring

Business reorganisation often presents a myriad of challenges, underscoring the necessity of seeking restructuring advisory to navigate issues that can significantly impact an organisation’s success. Key issues include:

- Resistance to Change: Employees and management frequently exhibit resistance to change, driven by fear of the unknown. To mitigate this, fostering a culture of openness and communication is crucial. Engaging employees early in the process can help alleviate concerns and encourage buy-in. Naismiths’ customer-centric approach emphasises risk management and a collaborative spirit, ensuring that all parties achieve the best possible outcomes while maintaining high-quality standards throughout each project.

- Financial Constraints: Limited financial resources pose a significant barrier to implementing necessary changes. Organisations must explore innovative solutions to optimise costs while ensuring that their restructuring advisory efforts remain effective. For instance, structured recognition programmes have been shown to enhance employee retention, which can ultimately reduce costs associated with turnover. In 2025, 57% of CEOs recognised keeping and involving employees as a top business priority, emphasising the significance of tackling resistance to change.

- Market Volatility: The unpredictable nature of market conditions can complicate organisational initiatives. Businesses need to adopt agile strategies that allow them to pivot quickly in response to external pressures, ensuring that they remain competitive and resilient.

- Stakeholder Conflicts: Conflicting interests among stakeholders can lead to significant challenges during organisational changes. It is essential to engage all parties in the decision-making process to foster collaboration and align objectives, thereby minimising friction and enhancing overall project outcomes.

- Operational Disruptions: Restructuring efforts can disrupt daily operations, impacting productivity. Careful planning and execution in the context of restructuring advisory are necessary to minimise these disruptions, ensuring that the entity continues to function effectively during the transition.

Furthermore, 28% of medium-sized entities reported maintaining a culture of change management, underscoring the need for effective strategies to navigate these challenges. By utilising expert knowledge and case studies, entities can create strong frameworks to overcome resistance and promote successful transformation initiatives.

Strategic Approaches to Effective Restructuring Advisory

Effective restructuring advisory encompasses several strategic approaches that are crucial for navigating the complexities of organisational change, particularly in the evolving landscape of 2025.

- Comprehensive Assessment: A thorough evaluation of the organisation’s current state is essential. This involves identifying strengths, weaknesses, and opportunities for improvement, laying the groundwork for informed decision-making. Recent statistics suggest that entities performing thorough evaluations are 30% more likely to attain successful transformation results. Naismiths’ platform supports this by providing accurate cost data and benchmarking, enabling entities to make informed assessments through its intuitive interface.

- Stakeholder Collaboration: Involving stakeholders early in the reorganisation process is vital for ensuring alignment and securing buy-in for the proposed changes. Effective collaboration can significantly enhance the success rates of organisational change initiatives, with studies showing that organisations with strong stakeholder engagement experience a 25% higher success rate in their efforts.

- Clear Communication: Establishing transparent communication channels is critical to keeping all parties informed and engaged throughout the transition journey. This not only fosters trust but also reduces resistance to change, which is often a significant obstacle in transformation scenarios.

- Data-Driven Decision Making: Leveraging data analytics to inform decisions and track progress is increasingly important. By utilising solid evidence, organisations can make informed choices that enhance the effectiveness of their reorganisation strategies. The integration of advanced analytics tools, such as those offered by Naismiths, has been shown to improve decision-making efficiency by up to 40%, particularly through the platform’s ability to quantify technical risks, draw on historical data, and pull in information from external data sources to support reporting.

- Continuous Monitoring and Adjustment: Regularly reviewing the effectiveness of the reorganisation plan and making necessary adjustments is key to staying on track. This iterative method enables companies to respond proactively to challenges and seize emerging opportunities, ensuring that reform efforts remain aligned with overall business objectives.

In light of the anticipated regulatory changes and the evolving economic landscape, organisations must adopt these strategic approaches to successfully navigate the complexities of restructuring advisory. As highlighted in recent case studies, the future of reorganisation and M&A is set for transformation, with potential relief for distressed companies enabling out-of-court reorganisations. However, many companies may still face challenges that hinder their ability to fully benefit from these changes in the near term.

Thus, a focus on stakeholder collaboration and comprehensive assessments, supported by Naismiths’ comprehensive property development platform, will be paramount in achieving sustainable success. Moreover, banks face pressure to control operating expenses, with many pledging to enhance cost discipline as they approach 2025, underscoring the wider economic environment influencing their strategies.

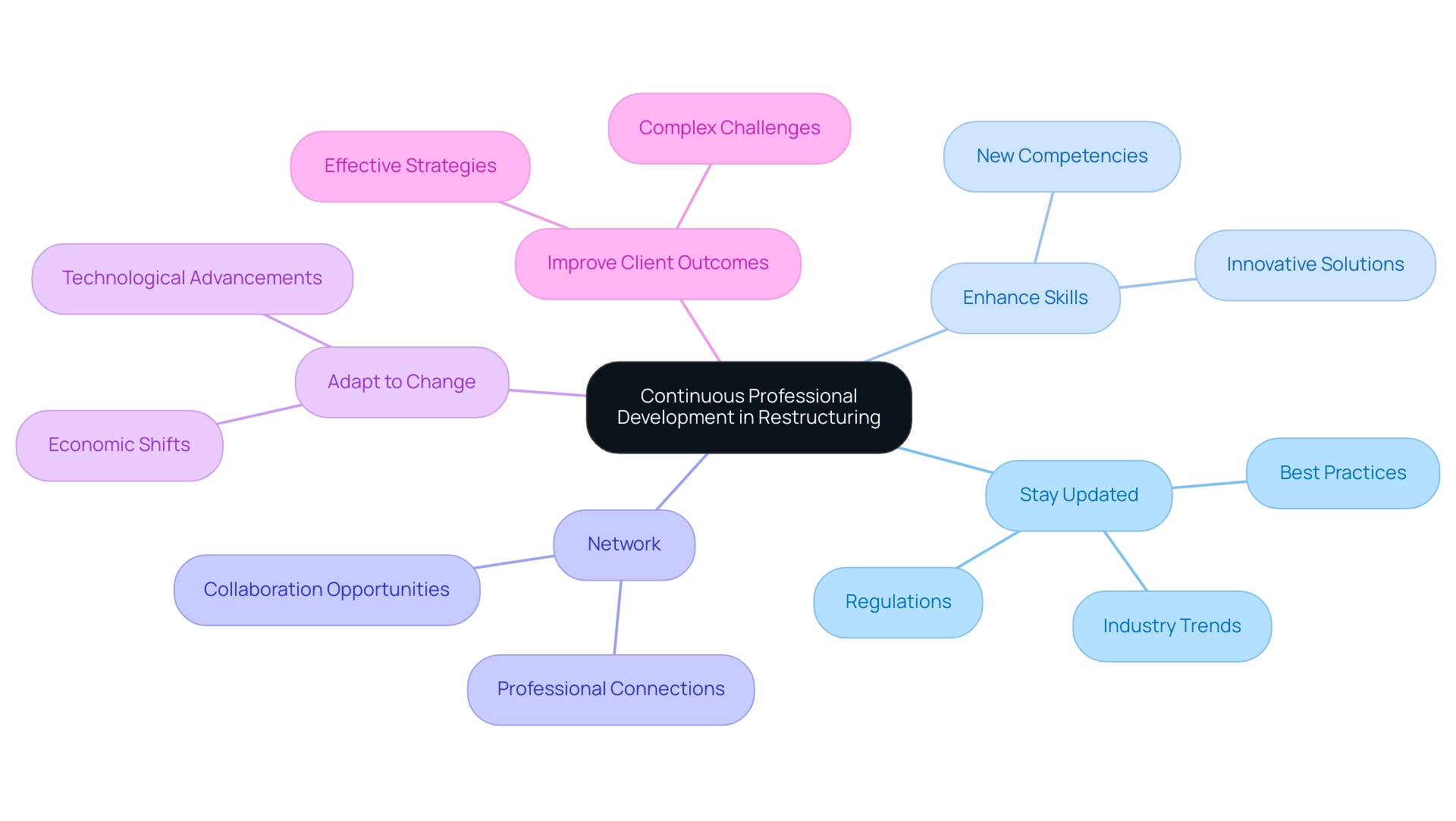

The Role of Continuous Professional Development in Restructuring

Continuous professional development (CPD) is essential for restructuring professionals for several key reasons:

- Stay Updated: In a rapidly changing business environment, it is crucial for professionals to remain informed about the latest industry trends, regulations, and best practices that directly influence restructuring efforts. This knowledge enables them to provide clients with timely and relevant restructuring advisory.

- Enhance Skills: CPD enables individuals to acquire new skills and competencies, significantly improving the effectiveness of their advisory services. As organisational changes progress, the ability to adapt and implement innovative solutions becomes increasingly important.

- Network: Engaging in CPD activities facilitates the building of connections with other professionals in the field. This networking promotes collaboration and knowledge exchange, resulting in improved problem-solving skills and creative strategies for overcoming challenges.

- Adapt to Change: The business restructuring landscape is continually evolving, driven by economic shifts and technological advancements. CPD provides individuals with the tools and insights necessary to offer restructuring advisory and navigate these changes effectively, ensuring they can provide relevant and timely advice to their clients.

- Improve Client Outcomes: Ultimately, ongoing education within restructuring advisory translates into better outcomes for clients. Professionals who invest in their development are better prepared to tackle complex challenges, leading to more effective strategies and solutions that meet client needs.

Statistics underscore the importance of CPD in this field; for instance, organisations that prioritise employee development see a significant reduction in absenteeism, with studies indicating a decrease of up to 81%. Furthermore, individuals who participate in CPD are 40% more likely to be acknowledged by their managers, correlating with higher levels of employee engagement and satisfaction.

When employees have the freedom to choose their development path, they invest in meaningful opportunities that align with their career goals. This emphasises the significance of enabling development specialists to engage in CPD that aligns with their goals.

Case studies highlight the effectiveness of CPD initiatives. For example, organisations that implement development accounts with annual stipends encourage employees to pursue meaningful learning opportunities that align with their career goals. This method not only promotes a culture of ongoing education but also improves the overall efficiency of industry experts.

Expert opinions further reinforce the value of CPD. Industry leaders stress that investing in professional development is not only advantageous but essential for professionals to stay competitive and effective in their roles. As the demand for skilled advisors in restructuring advisory continues to rise, those who commit to lifelong learning will undoubtedly lead in delivering exceptional services.

By integrating CPD into their practices, firms like Naismiths can enhance their monitoring and advisory capabilities, ultimately benefiting their clients and stakeholders.

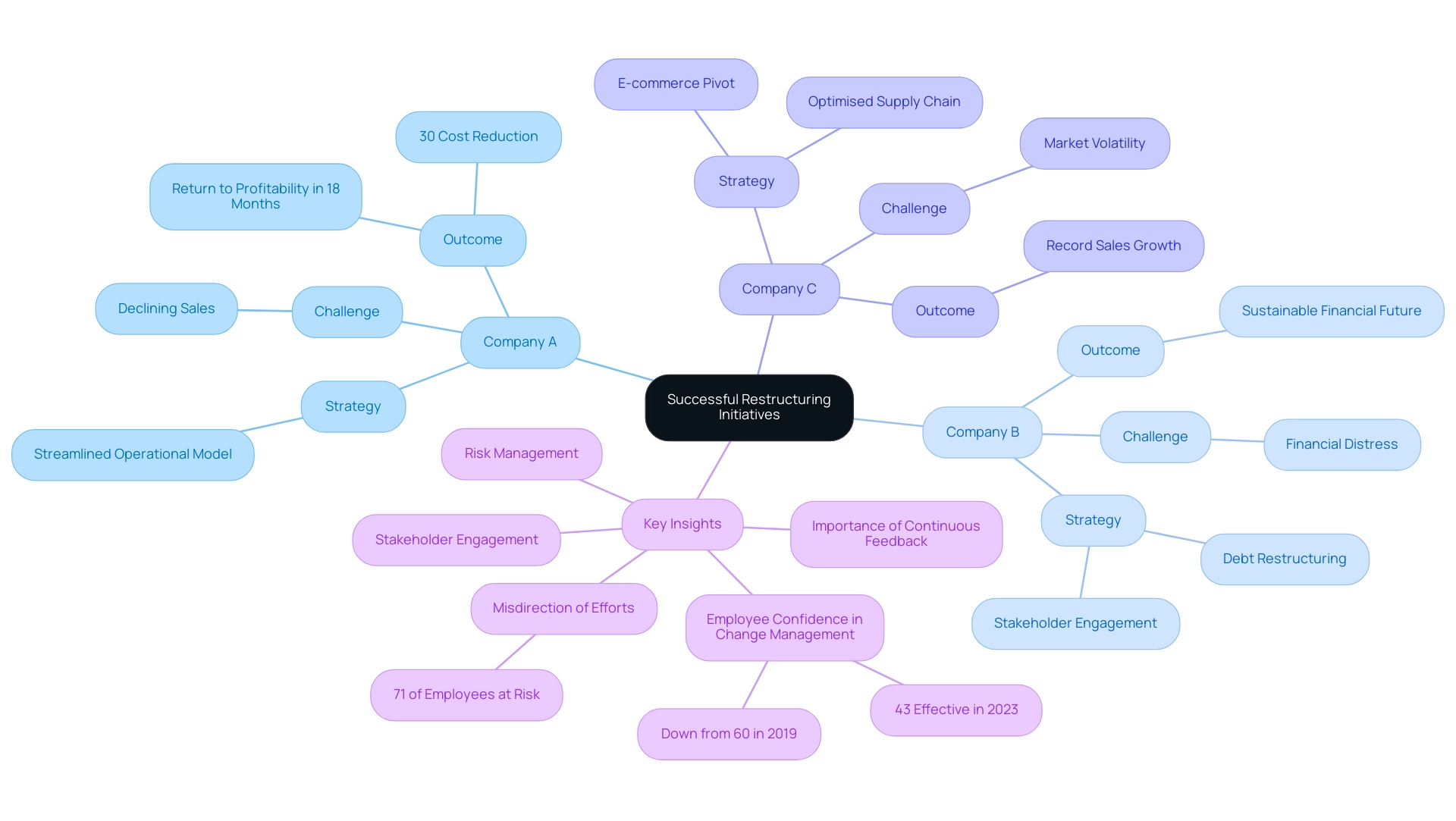

Case Studies: Successful Restructuring Initiatives

Examining successful transformation initiatives reveals critical insights into effective strategies that can drive organisational recovery and growth. For instance, Company A confronted with declining sales, sought the expertise of our restructuring advisors to evaluate its operations. A thorough analysis uncovered inefficiencies, leading to the implementation of a streamlined operational model. This strategic shift resulted in a remarkable 30% reduction in costs and a return to profitability within just 18 months.

Company B faced significant financial distress and collaborated with specialists to renegotiate its debt obligations. By engaging stakeholders early and fostering transparent communication, they successfully restructured their debt, paving the way for a more sustainable financial future.

Company C, grappling with market volatility, leveraged data-driven decision-making to pivot its business model. By embracing e-commerce and optimising its supply chain, the company not only survived but thrived, achieving record sales growth post-restructuring.

These examples underscore the necessity of continuous feedback and iterative improvements in change management, especially in a competitive landscape where 71% of employees risk misdirecting their efforts due to irrelevant leader-created plans. In fact, a concerning statistic from 2023/24 indicates that only 43% of employees believe their organisation is effective at managing change, down from nearly 60% in 2019. This highlights the critical need for effective restructuring advisory initiatives.

The insights gained from these case studies highlight the importance of a customer-centric approach, as illustrated by a particular example emphasising risk management and collaboration to ensure high-quality standards and optimal outcomes for all parties involved. The organisation employs methodologies such as regular stakeholder engagement, risk assessments, and performance metrics to ensure project success.

As noted by Phillip Gould of Avamore Capital, “Naismiths emphasises risk management and a collaborative spirit, ensuring that all parties achieve the best possible outcomes while maintaining high-quality standards throughout each project.” This reinforces the idea that effective restructuring advisory hinges on maintaining open lines of communication and prioritising commercial interests, ultimately leading to successful transformations. Additionally, the hotel will feature supplementary facilities, including workspace and meeting facilities, as well as a proposed rooftop restaurant offering diners unrestricted views towards the Cathedral, further enhancing the project’s value.

Conclusion

In an era marked by unprecedented challenges, the significance of restructuring advisory services cannot be overstated. These services offer essential guidance for organizations grappling with financial difficulties and operational inefficiencies. By implementing effective restructuring strategies, businesses can adeptly navigate market volatility and liquidity constraints, ultimately positioning themselves for sustainable growth and recovery.

The role of restructuring professionals is pivotal. Their responsibilities encompass:

- Assessing financial health

- Engaging stakeholders

- Implementing tailored strategies

- Continuously monitoring progress

By cultivating essential skills such as analytical thinking, communication, negotiation, and adaptability, these professionals can effectively lead organizations through transformative change. Furthermore, the integration of technology and data analytics enhances decision-making processes, allowing for timely interventions that can significantly improve outcomes.

Successful case studies illustrate the tangible benefits of expert-led restructuring initiatives. Companies that embrace comprehensive assessments, stakeholder collaboration, and clear communication are more likely to achieve their restructuring goals. The emphasis on continuous professional development underscores the need for restructuring professionals to stay informed about industry trends and enhance their skill sets, ultimately leading to improved client outcomes.

As the business landscape evolves, organizations must prioritize restructuring advisory services as a fundamental component of their strategic planning. By doing so, they not only enhance their resilience against future challenges but also pave the way for long-term success in an ever-changing environment. The message is clear: effective restructuring is not merely about survival; it is about thriving in the face of adversity. With the right guidance, businesses can transform challenges into opportunities for growth.