Overview

Insolvency and restructuring best practices for expert success hinge on:

- Proactive financial management

- Early identification of distress signals

- Formulation of comprehensive restructuring plans

In the current market landscape, organisations face increasing financial pressures that necessitate a strategic approach. The challenges of navigating financial distress are significant; however, employing experienced advisors and fostering transparent communication can markedly enhance recovery prospects. This approach not only strengthens client relationships but also leads to more favorable outcomes during periods of financial turmoil.

Consequently, engaging with seasoned professionals is essential for organisations aiming to mitigate risks and ensure sustainable recovery.

Introduction

Insolvency and restructuring are increasingly pertinent in today’s volatile economic landscape, where organisations encounter mounting financial pressures and evolving market dynamics. As the UK faces escalating insolvency rates, grasping the nuances of these financial concepts is essential for stakeholders aiming to navigate potential crises.

Recognising early signs of distress and implementing robust restructuring strategies are critical; the capacity to adapt and respond proactively can distinguish recovery from failure.

This article explores the key principles of insolvency, best practices for effective management, and the vital role of monitoring, providing valuable insights for businesses striving to emerge stronger from financial challenges.

Understanding Insolvency and Restructuring: Key Concepts

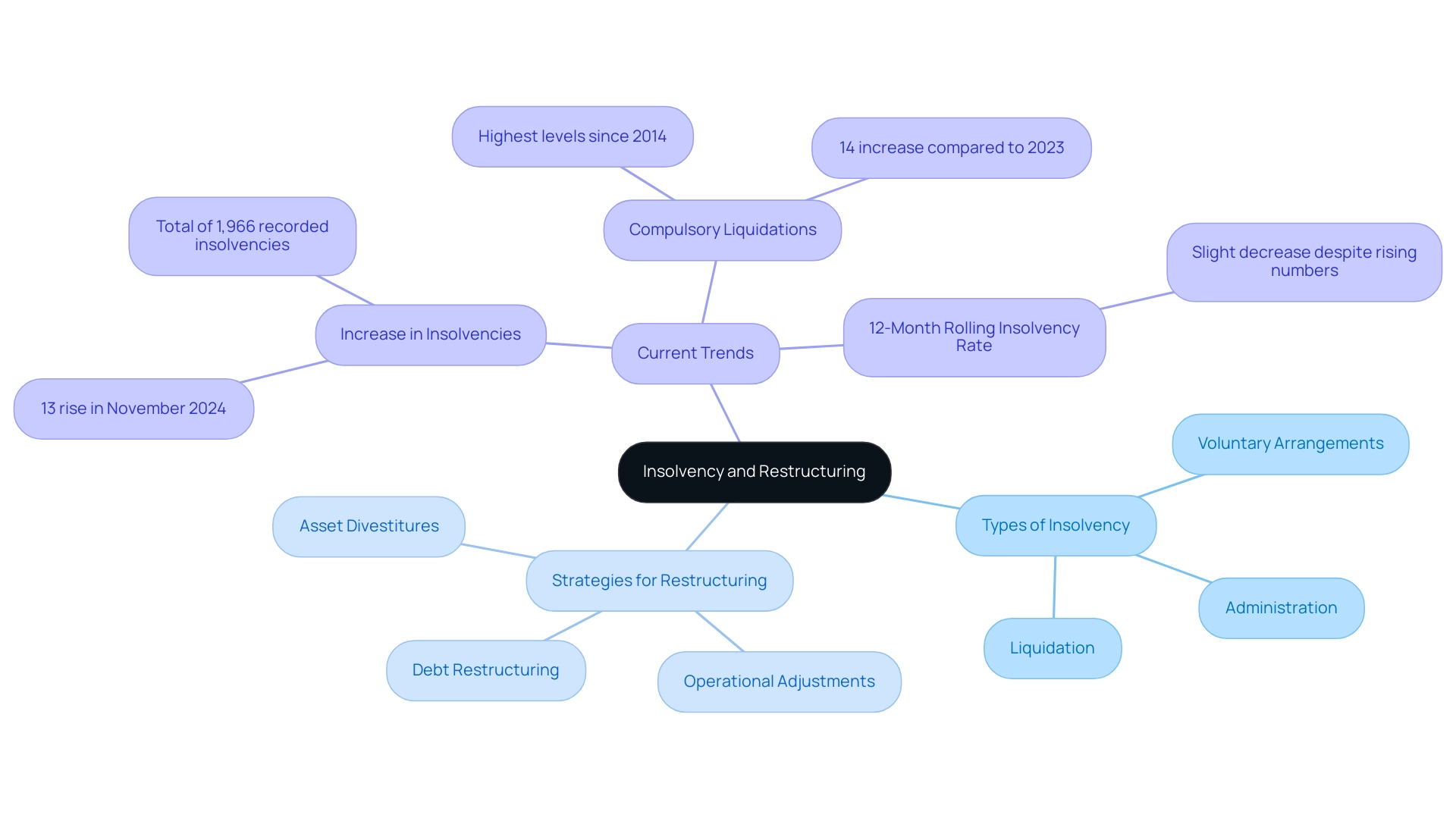

Insolvency represents a critical financial condition characterised by an individual or organisation’s inability to fulfil its debt obligations as they become due. This situation manifests in several forms, notably cash flow insolvency, where immediate liabilities exceed available cash, and balance sheet insolvency, occurring when total liabilities surpass total assets. Understanding these distinctions is essential for stakeholders, particularly in light of the rising rates of insolvency and restructuring in the UK, which experienced a 13% increase in November 2024 compared to the previous month, culminating in 1,966 recorded insolvencies.

Furthermore, the number of compulsory liquidations reached its highest levels since 2014, increasing by 14% compared to 2023. This trend underscores the significance of proactive financial management and the necessity for efficient strategies in insolvency and restructuring, where the platform can play a crucial role.

In the context of insolvency and restructuring, a comprehensive reorganisation of a company’s structure, operations, or finances aims to enhance its viability and restore profitability. This process may encompass various strategies, including:

- Debt restructuring

- Operational adjustments

- Asset divestitures

As the economic landscape continues to evolve, particularly with the challenges faced in 2024, understanding insolvency and restructuring becomes increasingly vital for navigating financial distress.

Current trends indicate that many companies are reassessing their performance before making liquidation decisions, underscoring the relevance of insolvency and restructuring. This is evidenced by the slight decrease in the 12-month rolling insolvency rate despite the uptick in actual insolvency numbers. Such a trend suggests a cautious approach among businesses as they seek to stabilise their operations amidst ongoing financial challenges.

In the UK, the types of insolvency include:

- Voluntary arrangements

- Administration

- Liquidation

Each serving distinct purposes and processes. Familiarity with these types is crucial for stakeholders involved in insolvency and restructuring, as it allows for informed decision-making and strategic planning. By understanding the nuances of insolvency and restructuring definitions and types, stakeholders can better position themselves to implement effective recovery strategies and enhance their financial oversight efforts.

Best Practices in Managing Insolvency and Restructuring

Efficient oversight of insolvency and restructuring necessitates a proactive and strategic approach. Key best practices include:

- Early Identification of Financial Distress Signals: Recognising the early signs of financial distress—such as declining cash flow, increased debt levels, or changes in market conditions—enables timely intervention. Statistics indicate that companies that identify distress early can significantly improve their chances of recovery. In the current financial landscape, cautious rate reductions from the second half of 2024 may not suffice to rescue troubled balance sheets, making early identification even more critical.

- Engaging Experienced Advisors: Collaborating with seasoned financial advisors is crucial. These professionals provide strategic insights and facilitate negotiations with creditors, ensuring that the company navigates the complexities of insolvency and restructuring with expertise.

- Developing a Comprehensive Restructuring Plan: A well-structured plan should outline clear objectives, timelines, and responsibilities. This roadmap is essential for guiding the organisation through the reorganisation process and aligning all stakeholders towards common goals. Recent case studies highlight that companies adopting best practices can recover from financial distress, demonstrating that insolvency and restructuring do not necessarily signify the end of a business. Maintaining Transparent Communication: Open lines of communication with all stakeholders foster trust and collaboration. Regular updates and discussions can mitigate uncertainty and enhance stakeholder confidence during challenging times.

- Regular Monitoring of Progress: Continuous assessment of the reorganisation plan’s implementation is vital. This allows for timely adjustments and ensures that the organisation remains on track to achieve its objectives. Furthermore, management teams are employing assertive liability management strategies to benefit certain lenders, possibly postponing the requirement for court supervision. These practices not only aid in effectively navigating through the reorganisation process but also play a crucial role in restoring stakeholder confidence. Moreover, the demand for office space is anticipated to stay low compared to pre-COVID-19 levels, with some owners contemplating transforming underused office assets into residential properties, which may influence reorganisation strategies. By adopting these best practices, companies can emerge stronger from financial distress.

The Importance of Monitoring in Restructuring

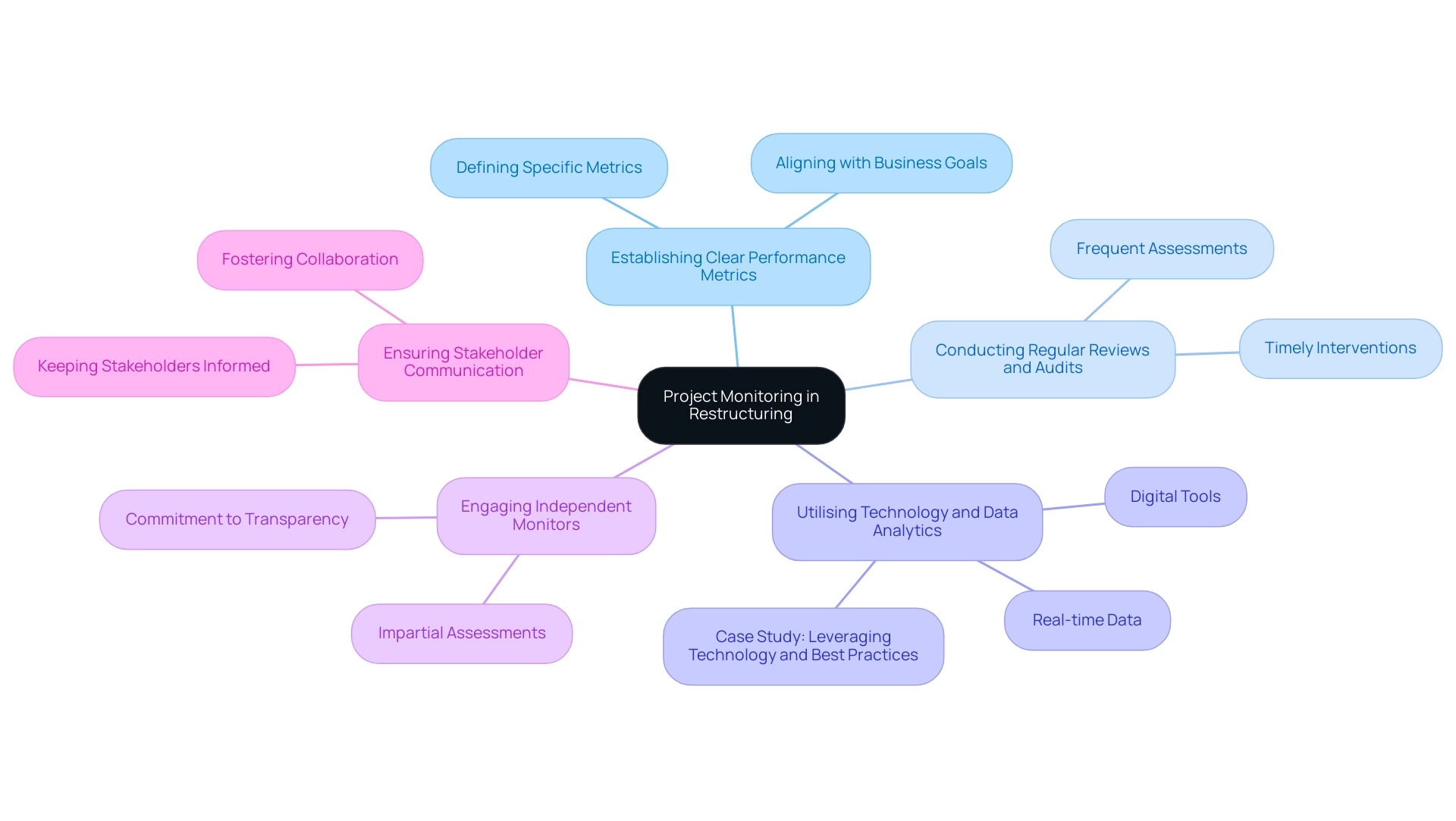

Monitoring plays a pivotal role during insolvency and restructuring, serving as a structured approach to track progress and ensure adherence to the restructuring plan.

- Establishing Clear Performance Metrics: Defining specific metrics aligned with business goals is crucial. This focus aids in avoiding distractions and guarantees that value delivery stays at the forefront of the endeavour.

- Conducting Regular Reviews and Audits: Frequent assessments allow organisations to identify potential issues early, facilitating timely interventions that can mitigate risks and enhance outcomes. Naismiths’ proactive approach exemplifies this practice, ensuring that any challenges are addressed promptly.

- Utilising Technology and Data Analytics: Leveraging advanced digital tools and analytics provides enhanced visibility into status, enabling stakeholders to make informed decisions based on real time data. Organisations can overcome management challenges by integrating digital tools and methodologies, positioning themselves for success in an increasingly competitive environment.

- Engaging Independent Service providers: Unbiased evaluations provide impartial assessments of progress, ensuring that all elements of the reorganisation are examined without conflicts of interest.

- Ensuring Stakeholder Communication: Keeping all stakeholders informed about progress and challenges fosters transparency and collaboration, which are essential for navigating the complexities of organisational change.

By implementing these robust monitoring practices, organisations can effectively manage the intricacies of insolvency and restructuring, ultimately achieving their desired outcomes. Significantly, 83% of high-performance organisations emphasise ongoing investment in training for projects, highlighting the significance of continuous enhancement in this field.

This cooperative attitude, as shown by the team in the hotel endeavour, guarantees that all parties attain the most favourable results while addressing the challenges of reorganisation.

Challenges for Investment Fund Managers in Restructuring Scenarios

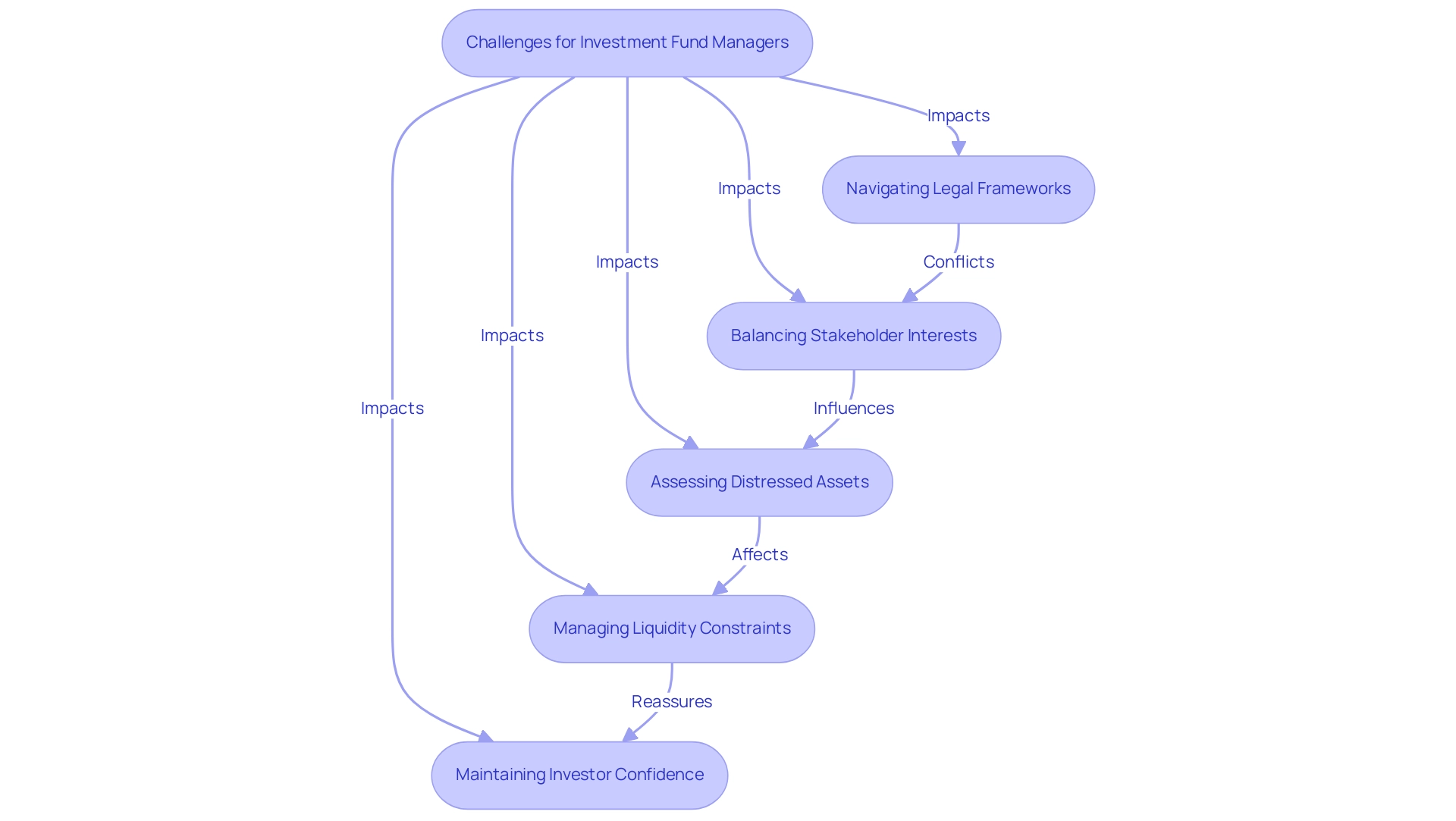

Investment fund managers encounter a multitude of challenges during insolvency and restructuring scenarios, which can significantly impact the effectiveness of their strategies. Key challenges include:

- Navigating complex legal and regulatory frameworks in the context of insolvency and restructuring is intricate and constantly evolving. Fund managers must stay informed about changes in legislation and regulatory requirements that can directly influence the outcomes of insolvency and restructuring. In 2025, the legal environment remains particularly challenging, with increased scrutiny on compliance and governance issues.

- Balancing stakeholder interests is crucial. Fund managers must adeptly navigate the often conflicting interests of various stakeholders, including creditors, equity holders, and management teams. This balancing act is essential for achieving consensus and ensuring that all parties are aligned towards a common goal, which can be particularly difficult in distressed scenarios.

- Assessing distressed assets is a critical component of the reorganisation process. Evaluating the viability of these assets requires fund managers to develop robust recovery strategies that take into account market conditions and asset performance. The commercial real estate sector, for instance, has been significantly impacted by the COVID-19 pandemic, resulting in high vacancy rates and fluctuating property valuations, which accounted for 35% of total filings in 2024. Additionally, the weak demand for office space has prompted some owners to consider converting underutilised office properties into residential spaces, complicating asset assessments in terms of insolvency and restructuring.

- Managing liquidity constraints poses significant risks during the reorganisation process. Fund managers must implement strategies to manage cash flow effectively, ensuring that operations can continue while navigating these challenges.

- Maintaining investor confidence is paramount amidst uncertainty. Fund managers must communicate transparently about the reorganisation process and its implications for investment performance. This is particularly important as 57% of industry respondents believe that integrating advanced technologies, such as AI, can enhance productivity and drive revenue growth.

By recognising and proactively addressing these challenges, investment fund managers can formulate more effective strategies that not only protect their investments but also facilitate successful insolvency and restructuring outcomes. The ongoing evolution of the market and regulatory landscape necessitates a dynamic approach to these processes, ensuring that fund managers remain agile and responsive to emerging challenges.

Building Strong Client Relationships for Successful Restructuring

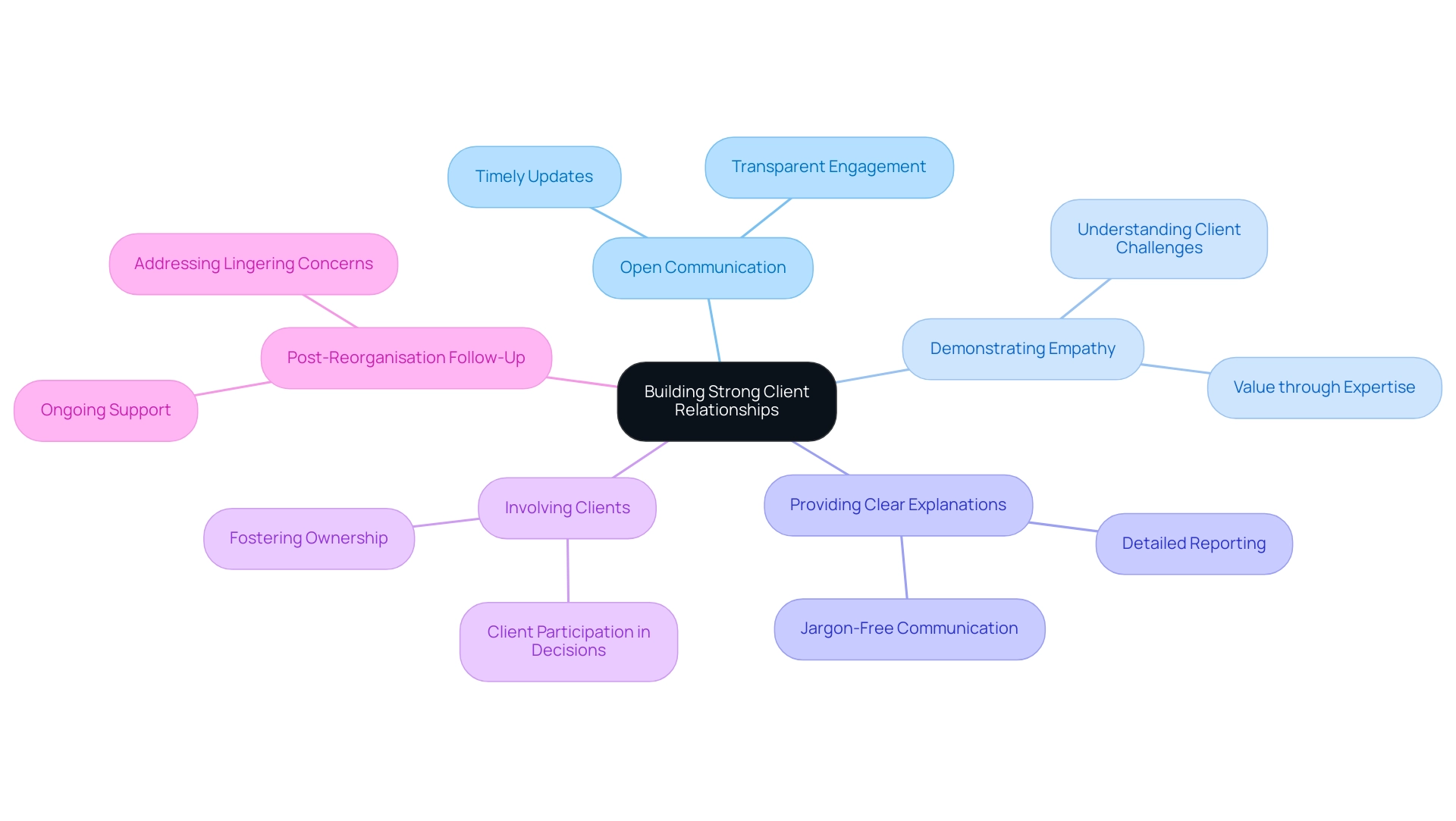

Establishing strong client connections is crucial during the reorganisation process. Effective strategies to achieve this include:

- Establishing Open Communication: Maintaining transparent lines of communication is essential. Clients should be kept informed and engaged throughout the insolvency and restructuring journey, fostering trust and confidence. Notably, the consistent and diligent approach of this organisation supports this, ensuring clients receive timely updates and thorough reporting.

- Demonstrating Empathy: Understanding the unique challenges and concerns of clients is vital. Acknowledging their emotional and financial stakes can significantly enhance the relationship. Naismiths’ exemplifies this by taking the time to understand funding dynamics, particularly in the context of insolvency and restructuring, and adding value through their expertise.

- Providing Clear Explanations: Complex reorganising concepts can be daunting. Offering clear, jargon-free explanations helps demystify the process and empowers clients to make informed decisions. The detailed reports and our extensive knowledge of the housebuilding industry clarify these complexities for their clients.

- Involving Clients in Decision-Making: Encouraging client participation in key decisions during the insolvency and restructuring process fosters a sense of ownership and commitment to the reorganisation plan, which can lead to more favourable outcomes. The team’s collaborative approach ensures that clients feel like an integral part of the process.

- Post-Reorganisation Follow-Up: Ongoing support after the reorganisation is critical. Following up to address any lingering concerns in the context of insolvency and restructuring reinforces the relationship and demonstrates a commitment to the client’s long-term success. Naismiths’ dedication to maintaining strong relationships with clients, as evidenced by their ongoing support and communication, exemplifies this commitment.

By prioritising these strategies, firms can enhance collaboration and significantly increase the likelihood of successful insolvency and restructuring efforts. The significance of robust client relationships in attaining these goals cannot be overstated, as they are often the cornerstone of effective insolvency and restructuring efforts. The customer-centric approach of the company, which emphasises risk management, insolvency and restructuring, and collaboration, further reinforces these strategies, ensuring that all parties achieve the best possible outcomes.

Can We Help? Get in Touch: Naismiths is a preferred team, and we look forward to assisting you in your journey of insolvency and restructuring.

Conclusion

In today’s complex economic environment, understanding insolvency and restructuring is more crucial than ever for businesses grappling with financial challenges. The distinctions between various types of insolvency, such as cash flow and balance sheet insolvency, underscore the necessity for stakeholders to remain vigilant and proactive in their financial management strategies. As UK insolvency rates continue to rise, recognising early signs of distress and engaging experienced advisors can significantly enhance recovery prospects.

Implementing best practices in managing insolvency—such as developing comprehensive restructuring plans and maintaining transparent communication—fosters trust and collaboration among all parties involved. Regular monitoring of project progress, supported by technology and data analytics, ensures that organisations stay aligned with their goals and can adeptly adapt to emerging challenges. This structured approach is vital for successfully navigating the intricacies of restructuring.

Investment fund managers encounter their own set of challenges, including navigating complex legal frameworks and balancing diverse stakeholder interests. By addressing these challenges head-on and maintaining open lines of communication, fund managers can bolster investor confidence and safeguard their investments during turbulent times.

Ultimately, building strong client relationships is paramount for successful restructuring. By establishing clear communication, demonstrating empathy, and involving clients in decision-making, firms can foster collaboration and increase the likelihood of favourable outcomes. Naismiths’ commitment to high-quality standards and customer-centric approaches exemplifies how organisations can emerge stronger from financial distress, transforming challenges into opportunities for growth and stability.