Overview

Investors can leverage construction market data to make informed investment decisions by comprehensively understanding the industry’s landscape. By utilising data analytics for predictive insights and closely monitoring key economic indicators and trends, investors are better equipped to navigate the complexities of the market. Furthermore, integrating comprehensive market data, including financial metrics and regulatory changes, enables investors to effectively assess risks and identify opportunities. Ultimately, this strategic approach leads to informed and deliberate investment choices.

Introduction

In the rapidly evolving construction market, understanding the intricate dynamics that drive investment decisions is crucial for success. As the industry grapples with challenges such as labour shortages, regulatory changes, and market volatility, investors must adopt a data-driven approach to navigate these complexities.

Key insights into market trends, technological advancements, and sustainability practices are essential for making informed choices. Furthermore, by leveraging comprehensive data analytics and fostering collaboration among stakeholders, investors can uncover lucrative opportunities and mitigate risks.

Consequently, this positions them for growth in this competitive landscape. This article delves into the essential strategies and considerations for optimising investments in the construction sector, ensuring that stakeholders are well-equipped to thrive in an ever-changing environment.

Understanding the Construction Market Landscape

To effectively utilise construction market data, investors must first understand the complex environment of the industry. This entails identifying key participants, market segments, and economic indicators that greatly affect building activities. Key aspects to consider include:

- Market Size and Growth: The UK construction market is projected to reach approximately £200 billion in 2025, reflecting a steady growth rate of around 3.5% annually. This growth is driven by increased government investment in infrastructure and housing, particularly in response to new housing policies aimed at expediting development through enhanced funding and fast-tracked planning permissions. Notably, the response rate for November 2024 was 76.0%, indicating strong engagement and interest in the market.

- Key Players: Identifying major building companies, subcontractors, and suppliers is crucial for understanding the competitive landscape. Collaboration between all parties exemplifies the strategic alliances that are becoming increasingly important in the industry, aligning with Naismiths’ emphasis on risk management and collaboration.

- Economic Indicators: Investors should closely monitor economic indicators such as interest rates, inflation, and employment rates. For example, a rise in interest rates can lead to higher borrowing expenses, potentially reducing demand for building. Conversely, a robust employment rate often correlates with higher demand for residential and commercial properties, thus influencing investment viability.

- Regulatory Environment: Familiarity with local and national regulations is essential for navigating the construction landscape. Zoning laws, building codes, and environmental regulations can significantly affect feasibility and timelines of the project. Understanding these regulations helps investors anticipate potential hurdles and streamline project execution.

- Current Trends: The building market is increasingly focusing on sustainability and eco-friendly practices, driven by both consumer demand and regulatory pressures. This trend is reflected in the increasing funding for green building technologies and materials, which are anticipated to dominate the market in the coming years.

By integrating these components and utilising Naismiths’ data-driven, commercially oriented consultancy, which encompasses customised project monitoring, risk evaluation methodologies, and insights from construction market data, investors can make informed choices that align with the changing dynamics of the UK building sector. Naismiths’ 60-year legacy of providing high-quality service and extensive market knowledge further strengthens their capacity to assist clients in optimising their financial strategies.

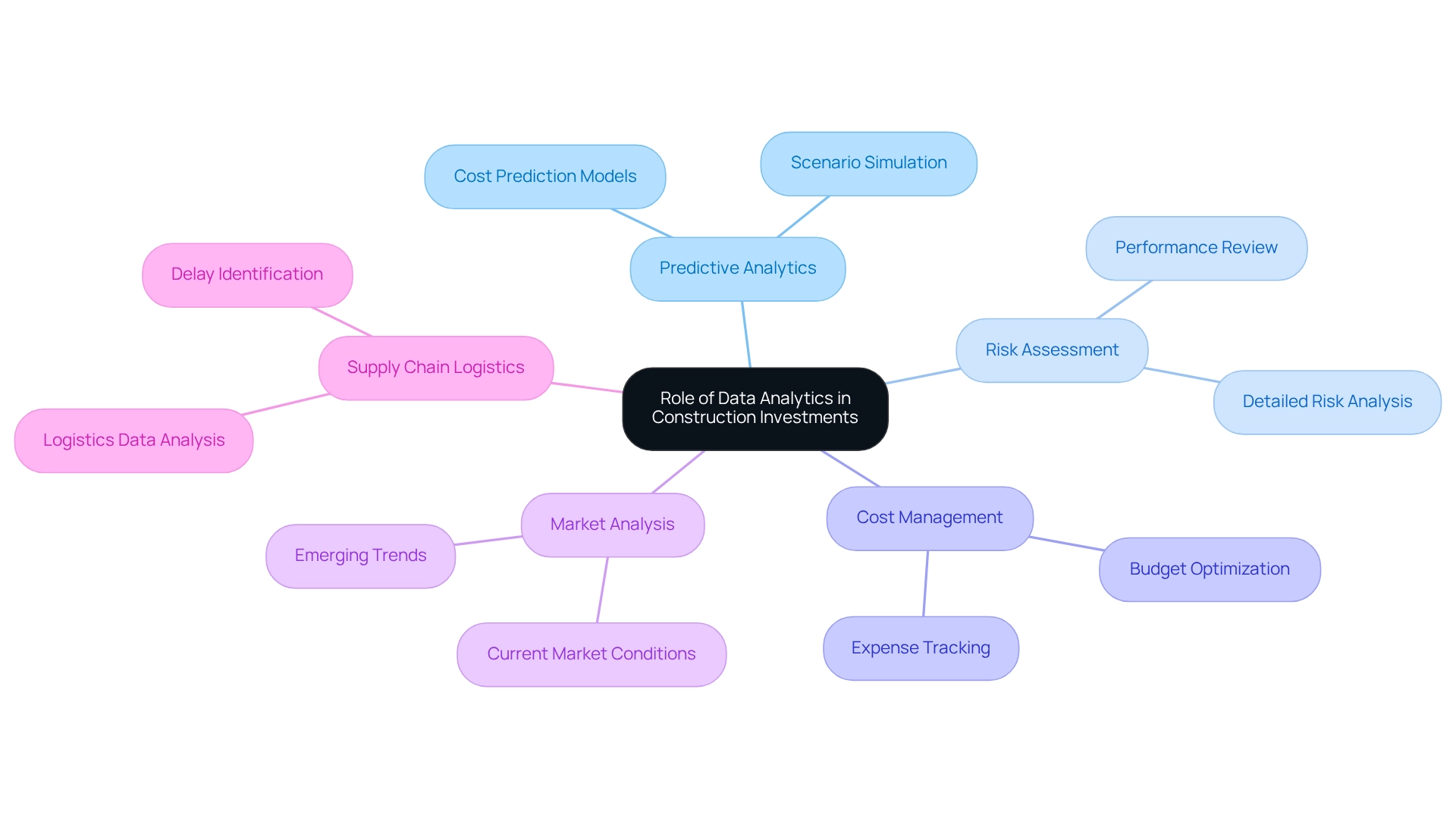

The Role of Data Analytics in Construction Investments

Data analytics is essential in shaping contemporary building investments by leveraging construction market data, empowering investors to make informed, data-driven decisions. Here are several key strategies for effectively leveraging analytics in this sector:

- Predictive Analytics: By harnessing historical information, investors can forecast future trends in construction expenses, timelines, and market demand. Naismiths Analytics enhances this proactive strategy by providing precise cost prediction models based on real-time and historical construction market data. This allows investors to foresee potential challenges and seize emerging opportunities, ultimately strengthening their strategic positioning in the market. The platform also enables users to simulate different scenarios and stress-test essential variables, providing an extensive perspective on possible risks through construction market data.

- Risk Assessment: Utilising advanced data analytics tools, such as Naismiths’ platform, facilitates a detailed assessment of potential risks associated with specific initiatives. By examining previous task performances, investors can pinpoint essential elements that led to overruns or delays, thus enhancing their risk management strategies and improving task outcomes. The platform’s ability to quantify technical risks associated with projects further enhances this capability.

- Cost Management: Data analytics serves as a powerful tool for tracking expenses and optimising budgets. Naismiths Analytics provides bespoke reports and interactive dashboards that allow investors to scrutinise spending patterns, pinpoint areas ripe for cost reduction, and ultimately lead to improved financial performance and more efficient resource allocation. The secure database guarantees that all information is stored securely and can be accessed effortlessly for standardised reporting and analysis.

- Market Analysis: Utilising construction market data and analytics to evaluate current market conditions and identify emerging trends is essential for informed investment strategies. This entails examining demographic information, economic indicators, and competitor performance, which together guide decision-making processes and improve competitive advantage. Naismiths Analytics assists investors in modifying their strategies accordingly by supplying real-time construction market data and insights that illustrate these shifts in the market.

- Case Study – Enhancing Supply Chain Logistics with Analytical Insights: Construction companies frequently face difficulties in monitoring supply chain logistics, including materials deliveries and inventory levels. By employing construction market data analytics, including the capabilities of Naismiths Analytics, these companies can analyse logistics data to identify potential delays. The result of this method has been substantial, as it aids in sustaining a consistent supply of materials to building sites, reducing interruptions and guaranteeing prompt project completion.

As the industry advances, the incorporation of predictive analytics into construction market data will become more crucial. In 2025, the focus on data-informed decision-making will likely grow stronger, with an emphasis on utilising construction market data to manage the complexities of building financial commitments. This shift is emphasised by the fact that building productivity has enhanced by only 1% each year over the past twenty years, in contrast to the global economy’s average growth of 2.8%.

Thus, the function of analytics in building projects is not merely significant; it is essential for attaining sustainable growth and optimising returns through the use of construction market data. Additionally, Naismiths’ project management tools streamline approvals and enhance coordination across teams, further supporting effective investment strategies.

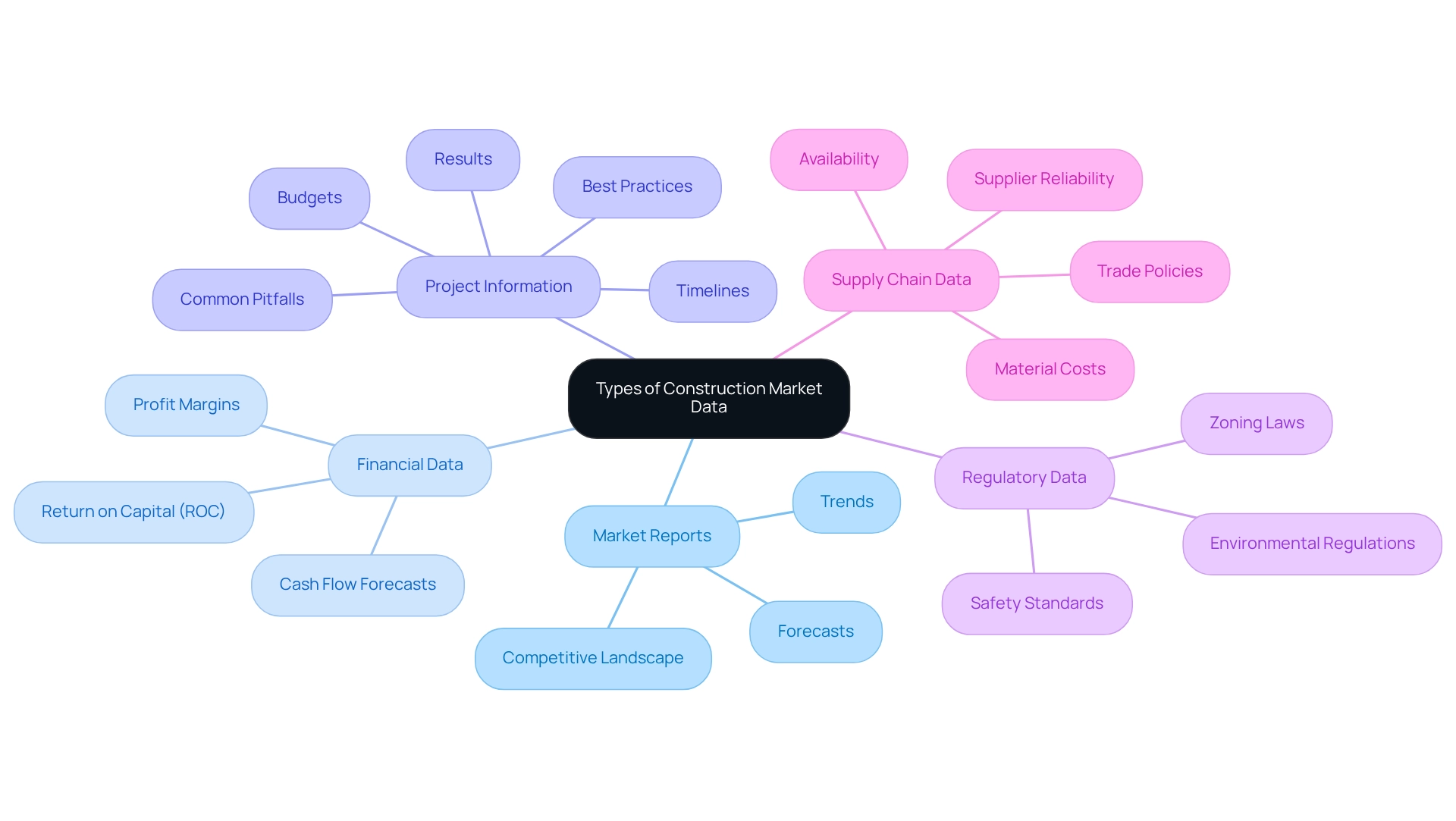

Types of Construction Market Data to Consider

Investors must consider several critical types of construction market data to make informed decisions:

- Market Reports: Comprehensive reports from industry analysts are essential, covering market trends, forecasts, and competitive landscapes. These insights assist investors in assessing the overall vitality of the building industry and recognising emerging opportunities.

- Financial Data: Examining financial indicators like profit margins, return on capital (ROC), and cash flow forecasts is crucial for evaluating the feasibility of construction projects. Understanding these metrics enables investors to assess potential gains and risks linked to their assets.

- Project Information: Analysing information on completed and ongoing initiatives, including timelines, budgets, and results, provides valuable insights into project viability and success factors. This data can highlight best practices and common pitfalls, guiding future investment decisions. Naismiths Analytics enhances this process by offering precise cost forecasting models and tailored reports that clarify intricate data, enabling a clearer understanding of performance outcomes. Additionally, Naismiths’ platform allows users to simulate scenarios and stress-test key variables, providing a comprehensive view of potential risks.

- Regulatory Data: Staying informed about changes in regulations and compliance requirements is vital, as these can significantly influence construction projects. Key areas to monitor include zoning laws, environmental regulations, and safety standards, which can impact timelines and costs.

- Supply Chain Data: Understanding supply chain dynamics is essential, particularly concerning material costs, availability, and supplier reliability. With HVAC orders reaching record levels and nearly 36% of demand in 2024 being satisfied by imports, fluctuations in supply chain conditions can directly affect costs and delivery timelines. Naismiths’ platform enables users to monitor key parties within the supply chain and receive real-time updates, ensuring informed decision-making.

Given recent changes, including increased tariff rates on essential materials, investors must closely observe trade policies that could impact construction expenses and schedules. The 2025 U.K. Construction Outlook report emphasises the importance of sustainability and advanced technologies, highlighting the need for resilient strategies to navigate evolving market dynamics. Furthermore, private equity firms are progressively allocating funds to building technologies and sustainable energy initiatives, underscoring the importance of market information in recognising strategic opportunities.

By leveraging these various types of construction market data, including the comprehensive solutions offered by Naismiths Analytics, investors can enhance their decision-making processes and position themselves for success in a competitive landscape.

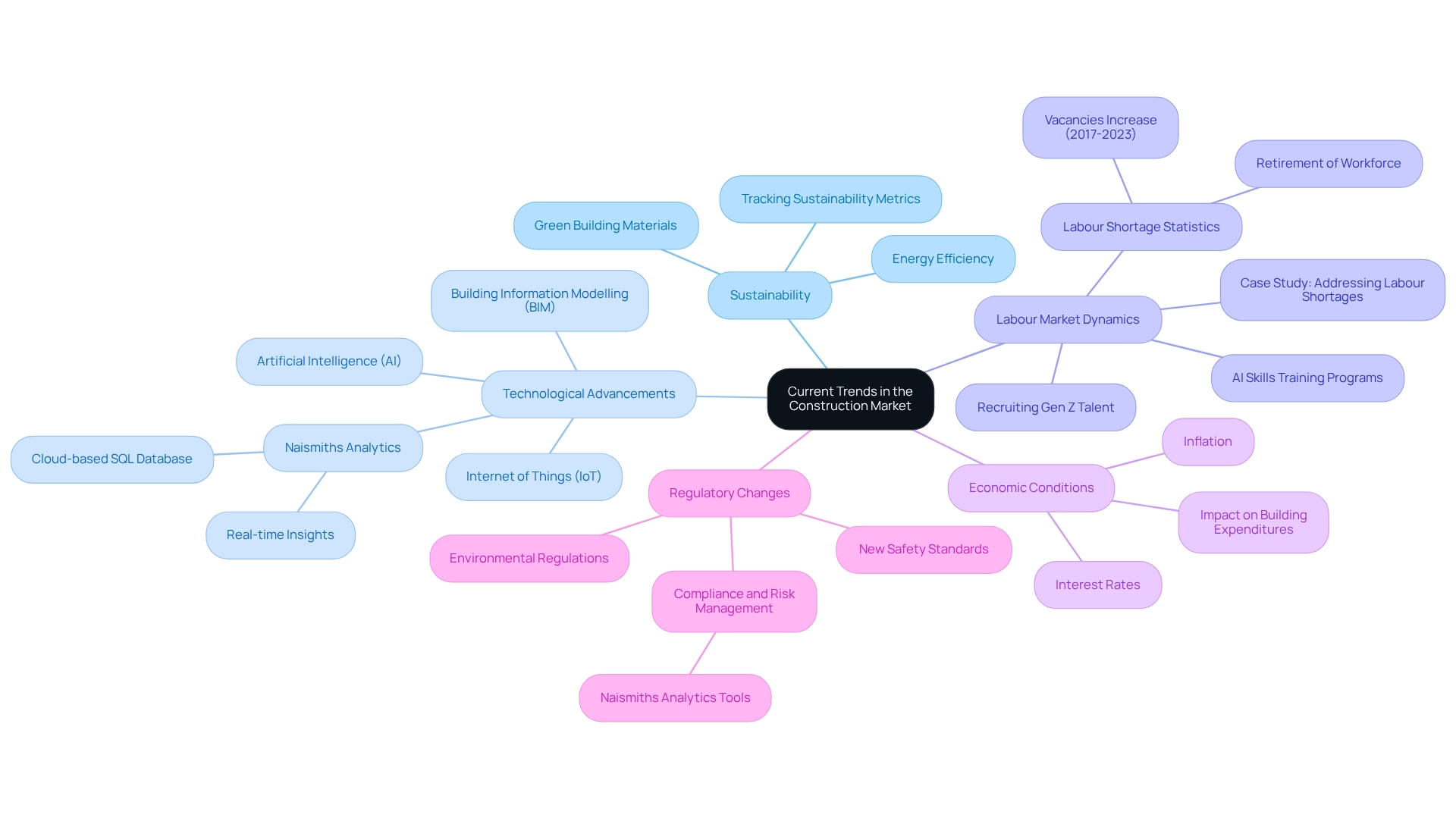

Analysing Current Trends in the Construction Market

To make informed investment decisions, investors must analyse current trends in the construction market:

- Sustainability: The construction landscape is increasingly shaped by the demand for sustainable building practices. Projects that prioritise green building materials and energy-efficient designs are not only appealing to environmentally conscious consumers but also align with regulatory trends aimed at reducing carbon footprints. Tracking sustainability metrics is essential for companies aiming to complete more green projects at scale, ensuring compliance and enhancing marketability.

- Technological Advancements: The integration of technologies such as Building Information Modelling (BIM), artificial intelligence (AI), and the Internet of Things (IoT) is transforming building processes. They simplify management of initiatives, improve precision in cost prediction, and enhance collaboration among stakeholders. Understanding these technologies can provide investors with a competitive edge, as firms that adopt them are better positioned to meet the demands of modern construction. Naismiths Analytics exemplifies this trend, providing a comprehensive solution for precise cost information and project performance evaluation, enabling investors to make trustworthy decisions based on real-time insights. The platform features a secure cloud-based SQL database and utilises APIs to integrate data from external sources, enhancing reporting capabilities.

- Labour Market Dynamics: The building sector is facing a major labour shortage. As a substantial portion of the workforce approaches retirement, it is crucial for investors to monitor labour market trends, including workforce availability and skill shortages. Companies are encouraged to recruit Gen Z talent and implement training programmes focused on AI skills to build a sustainable workforce, thereby mitigating potential productivity losses by 2040.

- Economic Conditions: Investors should stay alert about macroeconomic elements like interest rates and inflation, which can greatly affect building expenditures and funding potential. A thorough understanding of these economic indicators can help investors anticipate market shifts and adjust their strategies accordingly.

- Regulatory Changes: Staying informed about regulatory changes is vital for navigating the construction landscape. New safety standards and environmental regulations can affect timelines and costs, making it essential for investors to stay informed about these developments to ensure compliance and enhance investment results. Leveraging tools like Naismiths Analytics can provide investors with the necessary data to assess risks associated with regulatory changes, ensuring informed decision-making. The platform’s interactive dashboards and bespoke reports further support this process, allowing for a comprehensive view of project performance and risk management.

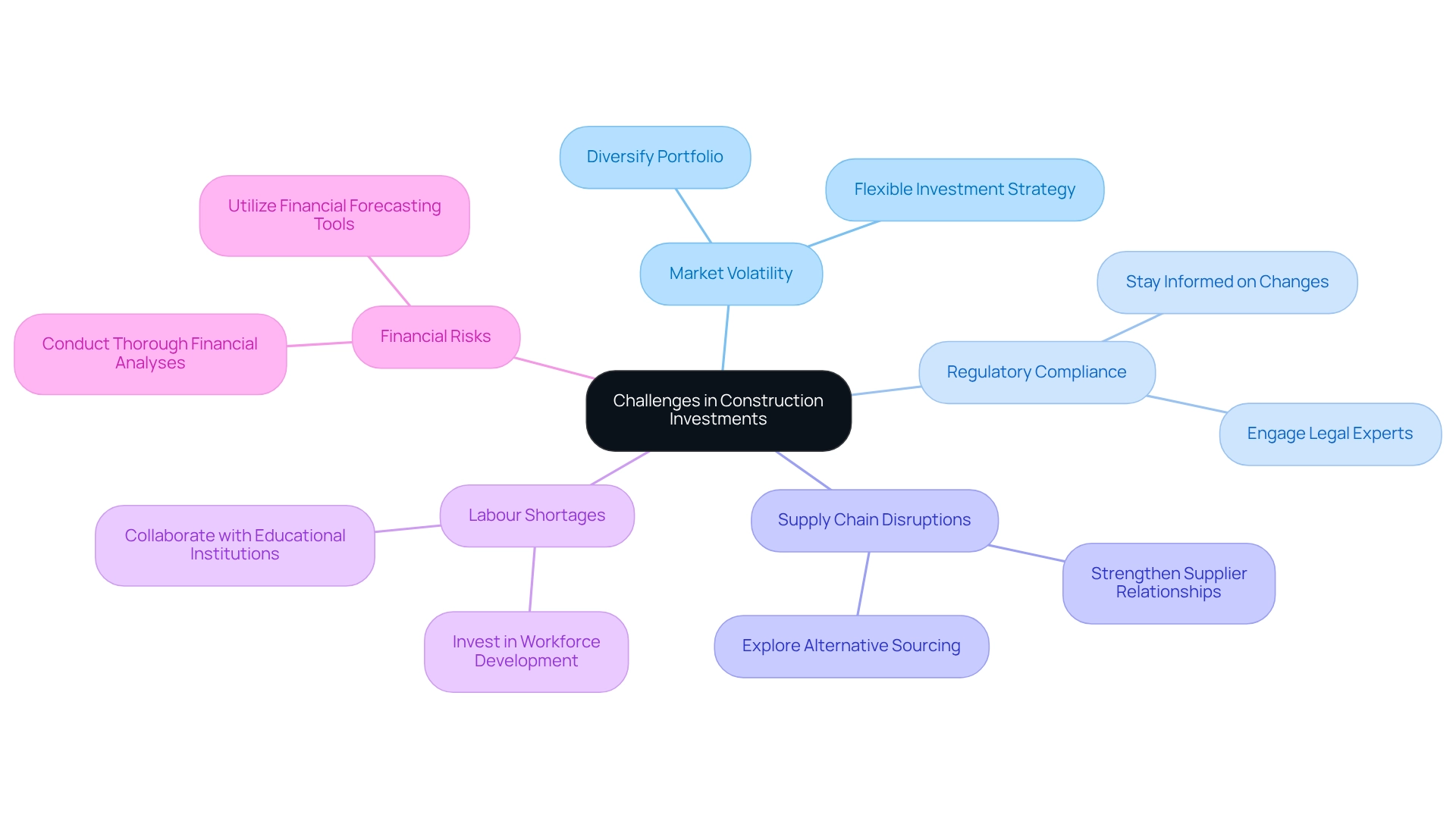

Navigating Challenges in Construction Investments

Investors in the construction industry face a myriad of challenges that can significantly impact their strategies based on construction market data. To effectively navigate these obstacles, consider the following key strategies:

- Market Volatility: Establish a flexible investment strategy capable of swiftly adapting to fluctuating market conditions. This may involve diversifying your portfolio across various sectors or geographic regions to mitigate risks associated with economic shifts. The fixed income universe comprises at least 20 distinct asset classes and over 70,000 securities, underscoring the critical role of diversification in managing financial risks.

- Regulatory Compliance: Adherence to local regulations is essential to avoid costly delays and penalties. Engaging legal and compliance experts is vital to remain informed about regulatory changes, particularly in 2025, when compliance challenges are anticipated to intensify.

- Supply Chain Disruptions: Strengthening relationships with suppliers can significantly mitigate risks related to material shortages or price fluctuations. Exploring alternative sourcing strategies will also help ensure continuity amidst supply chain uncertainties.

- Labour Shortages: Investing in workforce development initiatives is crucial for attracting and retaining skilled labour. Collaborating with educational institutions to create targeted training programmes can effectively address skill gaps within the industry.

- Financial Risks: Conducting thorough financial analyses prior to committing to funding is vital. Utilising sophisticated financial forecasting tools can assist in evaluating potential returns and recognising risks linked to specific initiatives, thereby facilitating informed decision-making.

By implementing these strategies and leveraging construction market data, investors can better navigate the complexities of the building market, ensuring that their investments are resilient and poised for success. Naismiths’ customer-centric approach emphasizes risk management and collaboration, ensuring high-quality outcomes for all parties involved.

Making Informed Investment Decisions with Market Data

- Information Gathering: Begin by collecting pertinent market information from reputable sources, such as industry reports, financial statements, and project performance metrics. This foundational step ensures that your analysis is grounded in precise and comprehensive data from the construction market, which is vital for effective asset management in construction projects.

- Information Analysis: After gathering the information, employ analytical techniques to uncover trends, patterns, and anomalies. Utilising data visualisation tools enhances the clarity of your findings, facilitating the communication of insights to stakeholders. Naismiths data-first strategy ensures that every aspect of the property lifecycle is meticulously organised and managed, in accordance with industry standards.

- Phases Overview: A comprehensive overview of the phases is essential. This includes establishing the initiative’s objectives, examining the budget and cost implications, providing guidance on procurement, and ensuring compliance with statutory processes. Understanding these stages is crucial for effective asset management.

- Scenario Planning: Develop various funding scenarios based on your analysis. Consider best-case, worst-case, and most likely outcomes to prepare for a spectrum of market conditions. This proactive approach fosters improved risk management and strategic flexibility, which are essential for ensuring project success.

- Consultation: Collaborate with construction consultants and industry experts to validate your findings and deepen your understanding. Their insights can provide critical context, aiding in the refinement of your analysis and guiding your financial strategy.

- Decision-Making: Leverage the knowledge gained from your data analysis and expert consultations to make informed financial decisions. Ensure that these choices align with your overarching financial goals and risk appetite, fostering a balanced approach to growth and stability.

In 2025, construction market data indicates that the building market is poised for significant evolution, with contractors increasingly adopting technology solutions to enhance operational efficiency. Most contractors are utilising tech solutions to manage their operations effectively. Key metrics such as asset utilisation and cost management will be pivotal for sustaining profitability and delivering quality work.

Naismiths expertise in project oversight and consulting services empowers them to assist clients in managing these metrics effectively.

As the building landscape continues to evolve, mastering these data analysis methods and best practices will be essential for making prudent financial decisions in the field.

The Value of Collaboration in Construction Investments

Cooperation is crucial for successful building investments. To cultivate effective partnerships, consider the following strategies:

- Open Communication: Establishing clear lines of communication among all stakeholders, including investors, contractors, and consultants, is vital. Regular updates and feedback loops can significantly reduce misunderstandings and delays, fostering a more efficient work environment.

- Shared Goals: Aligning objectives across all parties ensures that everyone is working towards common aims. This alignment enhances cohesion and increases the likelihood of success for the initiative.

- Joint Risk Management: Collaborating on risk assessment and management strategies allows stakeholders to pool their resources and expertise. This collective approach improves recognition and reduction of potential risks, ultimately protecting resources. Naismiths comprehensive services, including contract administration and feasibility studies, further enhance this collaborative effort.

- Leveraging Expertise: Engaging construction consultants like Naismiths can provide invaluable insights that guide financial choices. Their specialised expertise in areas such as technical due diligence and defect diagnosis assists investors in navigating the complexities of dynamics and market conditions, resulting in more informed choices.

- Continuous Improvement: Cultivating a culture of continuous improvement is crucial. Frequently assessing results and procedures can enhance efficiency and produce better investment returns. This practice not only addresses current challenges but also prepares stakeholders for future opportunities.

As the building sector evolves, particularly in 2025, the significance of collaboration cannot be overstated. By prioritising collaborative efforts and effective communication strategies, stakeholders can ensure high-quality standards and successful results, ultimately positioning themselves for growth in a competitive market.

Future Opportunities in the Construction Market

As the building market continues to evolve, numerous promising opportunities are emerging for astute investors.

- Sustainable Development: The increasing focus on sustainability is opening doors for investments in eco-friendly building initiatives and technologies aimed at minimising environmental impact. This trend not only aligns with regulatory pressures but also satisfies the rising consumer demand for sustainable solutions.

- Technological Innovations: The swift advancement of construction technologies, such as automation, artificial intelligence (AI), and the Internet of Things (IoT), is creating fresh investment opportunities. Projects that integrate these innovations can greatly enhance operational efficiency and yield significant cost savings, making them appealing to forward-thinking investors. For instance, companies implementing AI-driven solutions can increase productivity, elevate safety standards, and adhere to timelines and budgets, thereby securing a competitive advantage in a rapidly changing industry. Naismiths Analytics exemplifies this by offering an advanced cost forecasting tool that utilises live and historical data, facilitating accurate cost predictions and informed decision-making. This tool empowers users to simulate scenarios and stress-test key variables, providing a thorough understanding of potential risks and outcomes.

- Urban Development: With urbanisation on the rise, there is an intensified demand for both residential and commercial developments. Investors should actively seek opportunities in urban redevelopment and mixed-use developments, which promise robust returns as cities expand and evolve.

- Infrastructure Funding: Government initiatives focused on infrastructure enhancement present lucrative prospects. By monitoring public expenditure in this domain and pursuing collaborations with governmental bodies, investors can uncover beneficial opportunities in infrastructure projects. Utilising Naismiths’ extensive property development platform can aid in assessing project performance and managing risks associated with these ventures. The platform’s secure database ensures reliable data storage and standardised reporting, thereby improving the overall decision-making process.

- Healthcare and Education Facilities: The ongoing demand for healthcare and educational facilities provides a stable investment landscape. Projects in these sectors typically benefit from strong funding sources and exhibit long-term sustainability, making them a reliable choice for investors seeking security and growth.

Furthermore, enhancing the digital customer experience in the building sector is crucial, as it can improve organisational performance and attract knowledgeable investors. The platform’s capacity to deliver bespoke reports and real-time monitoring solutions further empowers investors to navigate opportunities effectively within the construction market data, ensuring they stay ahead in a competitive landscape.

Conclusion

Understanding the current dynamics of the construction market is essential for investors aiming to optimise their investment strategies. A comprehensive grasp of market trends, economic indicators, and regulatory environments provides a solid foundation for making informed decisions. The construction sector is poised for growth, driven by increased government investment, a focus on sustainability, and technological advancements.

Leveraging data analytics is a key strategy for navigating the complexities of construction investments. By utilising predictive analytics and risk assessment tools, investors can enhance their decision-making processes, ultimately leading to improved project outcomes. The importance of collecting and analysing various types of market data cannot be overstated, as it informs both short-term actions and long-term strategies.

Collaboration stands out as a critical component in the construction investment landscape. Effective communication among stakeholders fosters a shared vision and enhances project execution. As the industry evolves, embracing a culture of collaboration and continuous improvement will be vital for achieving success in an increasingly competitive environment.

Looking ahead, opportunities abound in sustainable construction, technological innovations, and urban development. By strategically targeting these areas and utilising advanced tools like Naismiths Analytics, investors can position themselves to capitalise on market shifts and ensure sustainable growth. The construction industry is not just about building structures; it is about building a future that is resilient, innovative, and aligned with the needs of society.