Overview

Project management firms play a pivotal role for investment fund managers, providing essential oversight and specialised expertise that significantly enhance project execution, risk management, and stakeholder communication. This ultimately leads to improved financial outcomes.

The article illustrates how firms like Naismiths leverage structured methodologies and advanced tools to effectively tackle the challenges faced by fund managers. By ensuring that projects align with strategic goals, these firms maximise returns on investment, demonstrating the substantial benefits of engaging their services.

Introduction

In the intricate world of investment fund management, the seamless execution of projects can mean the difference between success and failure. As organisations navigate an ever-evolving landscape filled with regulatory challenges, fluctuating interest rates, and the pressing need for timely decision-making, the role of project management firms becomes increasingly vital.

By offering specialised expertise in risk management, efficient resource allocation, and effective communication, firms like Naismiths empower fund managers to optimise their investments and achieve their strategic objectives.

This article delves into the essential contributions of project management firms to investment fund success, highlighting the benefits of collaboration, the importance of robust project oversight, and the transformative impact of innovative management practices.

The Essential Role of Project Management Firms in Investment Fund Management

Firm operators are essential to the success of fund oversight, guaranteeing that initiatives are executed with both efficiency and effectiveness. The company provides crucial oversight that assists fund managers in navigating the intricacies of execution, from initial planning to final completion. By leveraging specialised expertise and established methodologies, including contract administration, risk assessment, and technical due diligence, Naismiths enhances feasibility, significantly increasing the likelihood that funding will yield the anticipated returns.

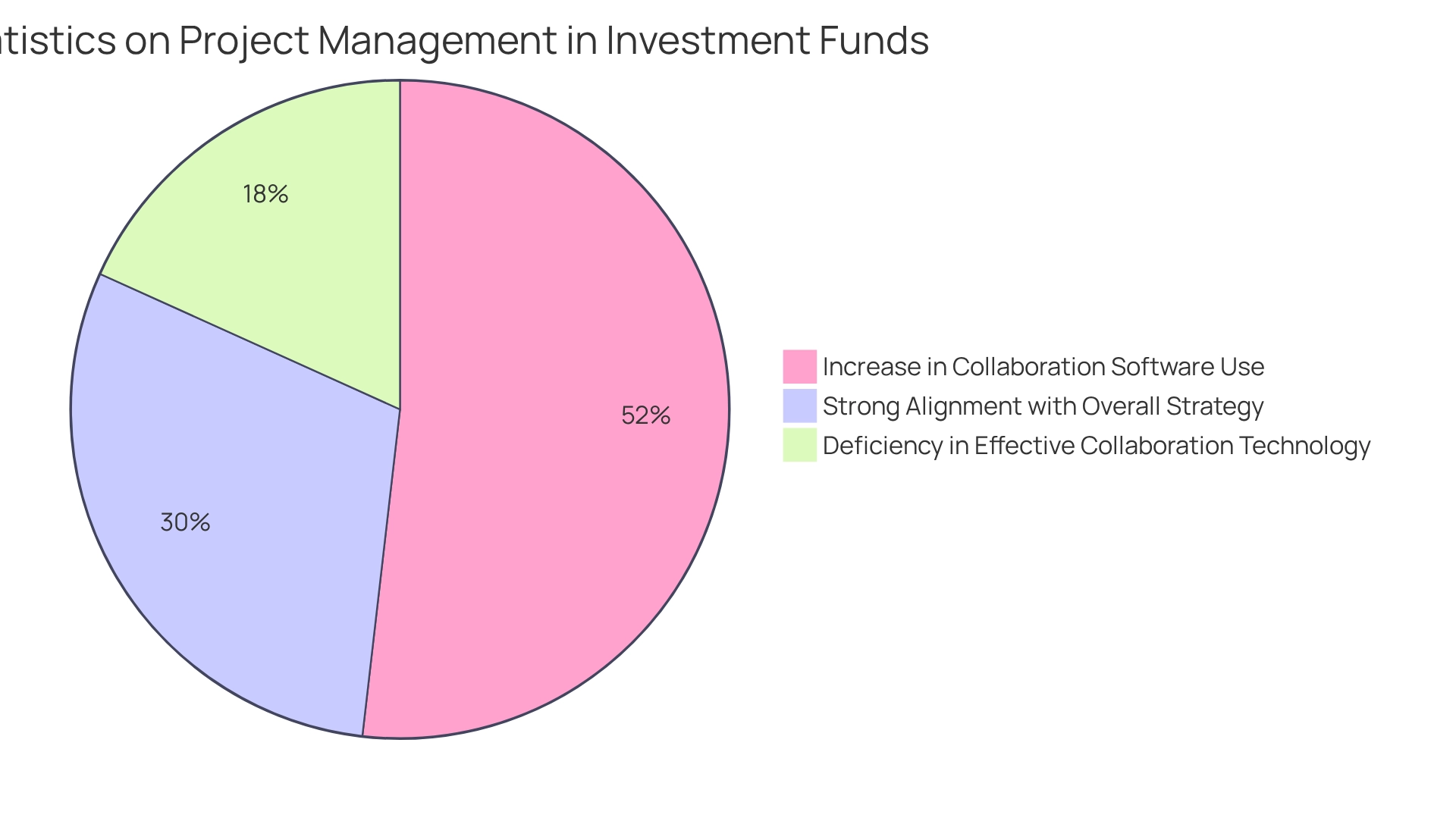

The impact of overseeing initiatives on investment yields is particularly pronounced in 2025, as the environment continues to evolve. A recent survey revealed that 71% of professionals in oversight roles noted an increase in the use of collaboration software within their organisations over the past year, highlighting a growing emphasis on effective communication and teamwork. However, 25% of professionals in the field still report a deficiency in effective collaboration technology, underscoring the necessity for firms to adopt robust tools that facilitate seamless interaction among stakeholders.

Furthermore, consulting companies play a pivotal role in aligning objectives with the strategic aims of investment funds. This alignment is crucial for maximising financial success, as it ensures that all efforts are directed toward shared goals.

However, only 41% of organisations with a well-structured Project Management Office (PMO) report strong alignment with their overall strategy, indicating that there remains significant room for improvement in the integration of initiatives into broader organisational frameworks.

The significance of project management firms transcends mere execution; they facilitate the integration of various stakeholders, ensuring that communication flows seamlessly and that all parties remain coordinated. This collaborative approach is vital for achieving optimal results. As fund managers increasingly recognise the importance of these collaborations, the role of project management firms in enhancing execution and overall financial viability will continue to expand.

Moreover, the dynamic role of initiative leaders necessitates a diverse skill set to guide projects from conception to completion, further emphasising the importance of collaboration with project management firms like Naismiths. Their expertise in programme oversight and consultancy services, coupled with features such as secure data storage, interactive dashboards, and precise benchmarking, positions them as a vital partner in the fund management landscape.

Challenges Faced by Investment Fund Managers and How Project Management Firms Can Help

Fund managers encounter a myriad of challenges that significantly impact their operations and financial outcomes. Among the key issues are:

- Resource allocation

- Regulatory compliance

- The pressing need for timely decision-making

These challenges often result in delays, budget overruns, and, ultimately, reduced returns on investment.

In 2025, the landscape becomes even more complex due to fluctuating interest rates, particularly following the Bank of England’s decision to lower interest rates for the first time in over four years on August 1, 2024, alongside evolving regulatory frameworks. This scenario necessitates a proactive approach to managing initiatives. Naismiths plays a pivotal role in addressing these challenges by providing comprehensive services designed to enhance efficiency and accountability. Their expert team ensures that contract administration is meticulous, maintaining the ‘golden thread’ of information thoroughly documented alongside the contract.

They implement structured processes, including technical due diligence and pre-acquisition surveys, which facilitate the development of robust plans that consider potential risks and uncertainties, incorporating risk management strategies and feasibility studies. This strategic foresight empowers fund managers to make informed decisions that align with their financial objectives. Furthermore, Naismiths offers continuous monitoring and reporting, ensuring that fund managers remain updated on progress.

This real-time oversight allows for timely adjustments, minimising the risk of delays that could adversely affect returns. For instance, as institutional investors increasingly allocate resources to hedge strategies, focusing on systematic and multi-strategy funds, the need for precise oversight becomes crucial to navigate the complexities of these financial ventures. Statistics indicate that effective oversight can lead to a significant reduction in delays, directly correlating with improved financial performance.

Additionally, the rising focus on ESG investing introduces regulatory and reporting challenges that further complicate the landscape for hedge funds. By tackling resource distribution challenges and ensuring compliance with regulatory standards, the company not only enhances operational efficiency but also fortifies the overall success of financial strategies.

As the financial landscape continues to evolve, the collaboration between fund managers and consulting experts will be essential in overcoming these challenges and achieving optimal results.

Key Benefits of Engaging Project Management Firms for Investment Fund Managers

Engaging project management firms presents a multitude of advantages for investment fund managers. Notably, organisations that prioritise training for initiatives experience a marked performance difference; 83% of high-performing organisations invest in such education, compared to merely 34% of those that underperform. This statistic underscores the critical importance of investing in programme oversight capabilities to drive organisational success.

Moreover, Naismiths provides specialised knowledge in risk oversight, enabling fund managers to identify potential challenges early in the process and formulate effective strategies to address them.

Furthermore, project management firms facilitate enhanced communication among stakeholders, ensuring that all parties remain informed and aligned throughout the initiative’s lifecycle. This collaborative method not only fosters trust but also greatly enhances the likelihood of success. By leveraging advanced task coordination tools and analytics, including real-time oversight and precise cost benchmarking, the company provides valuable insights that inform strategic decision-making, empowering fund managers to adapt to evolving investor preferences and regulatory changes effectively.

The interactive dashboards and customised reports further enrich the user experience, delivering tailored insights that are crucial for performance evaluation. The 2025 Industry Outlook for Asset Oversight emphasises the importance of innovation in product offerings and distribution strategies, reinforcing the necessity for fund supervisors to collaborate with firms like Naismiths.

In conclusion, the benefits of engaging project management firms for fund managers are diverse, encompassing efficiency enhancements, improved risk oversight, superior stakeholder communication, and invaluable analytics, all of which contribute to achieving optimal outcomes.

The Importance of Communication and Collaboration in Project Management

Efficient communication and cooperation are paramount for successful project oversight, especially in fund administration. Project management firms play a pivotal role in cultivating an environment that encourages open dialogue, ensuring all stakeholders feel valued and engaged. This is achieved through regular meetings, clearly defined reporting structures, and the implementation of collaborative tools that facilitate seamless information sharing.

Naismiths’ customer-centric approach underscores the significance of risk management and collaboration in achieving optimal outcomes, which is essential for investment fund managers. Their monitoring surveyors, operating independently, guarantee full compliance and high-quality construction through regular site visits and comprehensive reporting. This proactive approach allows for the early identification and resolution of potential issues, significantly reducing misunderstandings and enabling project management firms to work together effectively towards shared objectives.

Statistics indicate that while emails are the most frequently utilised communication channel (92%), their effectiveness stands at only 89%. In contrast, all-employee live events achieve an impressive 97% effectiveness, underscoring the importance of interactive communication methods in fostering engagement and clarity. The company leverages its extensive property development platform, equipped with secure data storage, real-time monitoring solutions, and application programme interfaces (APIs) to aggregate information from external data sources, thereby enhancing communication and performance evaluation.

Moreover, project management firms bolster problem-solving capabilities by integrating diverse perspectives to address challenges effectively.

Ultimately, effective communication and teamwork not only lead to improved outcomes but also enhance stakeholder satisfaction. By applying these strategies, fund managers can ensure that their initiatives.

Enhancing Risk Management Strategies Through Project Management Expertise

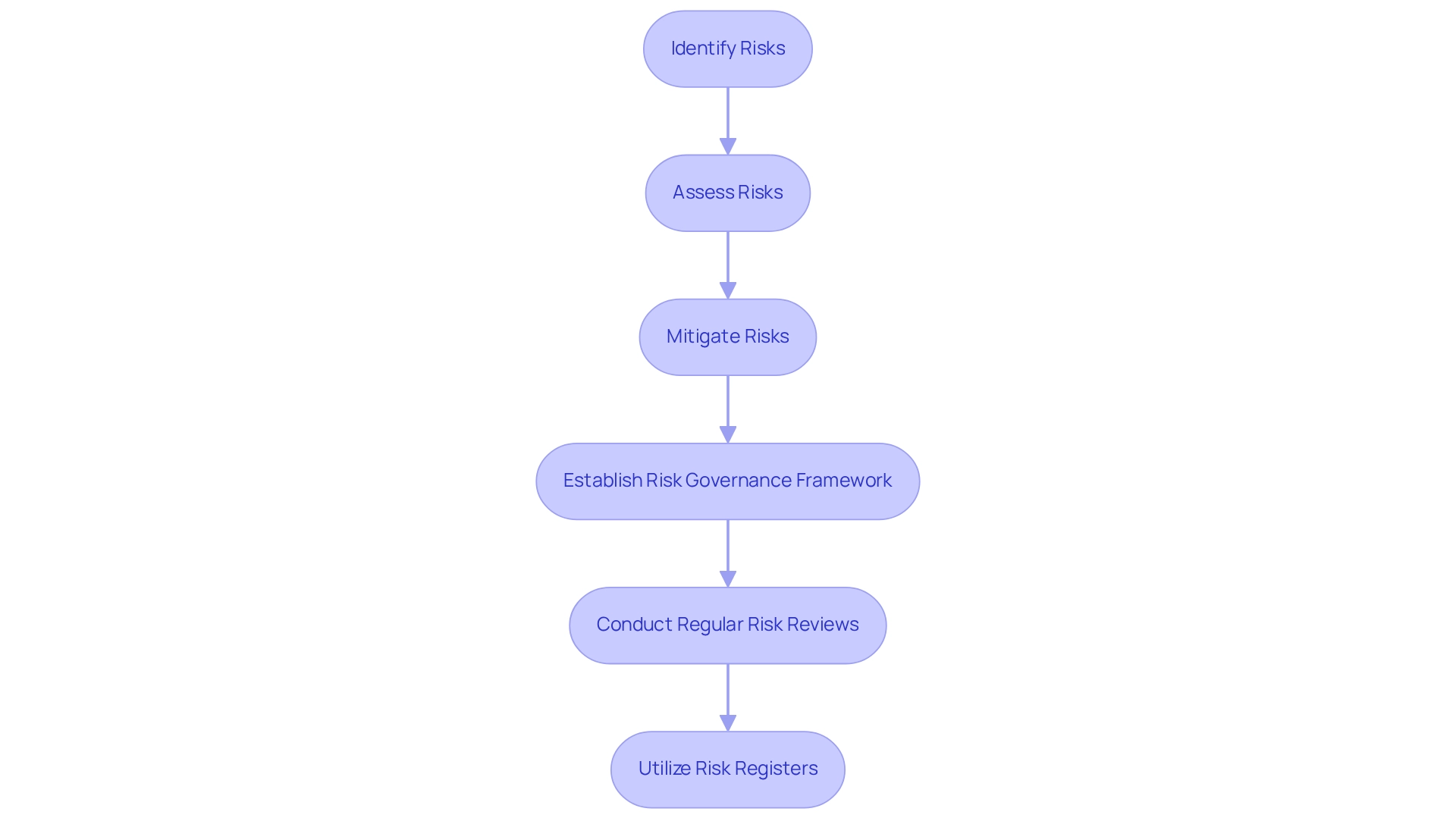

Project management firms play a crucial role in enhancing risk management strategies for investment fund managers by employing systematic methods to effectively identify, assess, and mitigate risks. By utilising tools such as risk registers and qualitative assessments, these firms evaluate potential threats to success, ensuring that all aspects of risk are thoroughly considered. For instance, our organisation distinguishes itself through director-led instruction and a steadfast commitment to prioritising clients’ commercial interests.

By establishing robust risk governance frameworks, Naismiths empowers fund managers to address challenges before they escalate, significantly reducing the likelihood of failure. Regular risk reviews and updates are integral to this process, facilitating the continuous refinement of risk strategies. This proactive approach not only protects investments but also instills confidence among stakeholders, who can be assured that risks are managed with diligence and expertise.

Notably, statistics indicate that 33% of initiatives fail due to insufficient engagement from senior leadership, underscoring the critical importance of thorough risk management practices.

Moreover, the effectiveness of risk registers in management cannot be overstated; they serve as essential instruments for systematically monitoring and addressing risks. The surveyors from the firm meticulously oversee the development process, ensuring compliance and high-quality delivery through regular site visits and detailed reporting. The platform’s customised reports and interactive dashboards further enhance the ability to monitor performance and make informed decisions.

By employing these strategies, project management firms like Naismiths not only enhance risk management but also contribute to the overall success of financial ventures, ensuring that objectives align with business aims and stakeholder expectations are met. The dynamic nature of project coordination, characterised by shifting client and stakeholder expectations during execution, further underscores the necessity for ongoing risk evaluation and adjustment.

The Impact of Project Management Firms on Investment Fund Success

The impact of consulting companies on the achievements of fund managers is significant and complex. With 91% of experts overseeing tasks reporting difficulties in their area, the knowledge of firms like Naismiths becomes indispensable in navigating intricate situations with assurance.

As the financial landscape evolves, the partnership between fund managers and development firms is not merely beneficial; it is crucial for attaining long-term success. Companies that effectively combine task oversight techniques are poised to surpass their competitors, especially as the worldwide task oversight software market is projected to reach $8.82 billion in 2024, expanding at a CAGR of 15.7% through 2030. This growth underscores the increasing reliance on advanced solution techniques to foster financial success.

Case studies illustrate the tangible benefits of this collaboration. For instance, the incorporation of advanced monitoring techniques in the hotel development project demonstrates how firms embracing these innovations can navigate the steep risk/reward curve more effectively, resulting in superior outcomes.

Moreover, consultancy firms such as Naismiths significantly enhance returns on capital by ensuring that initiatives are executed effectively and to elevated standards. Their thorough, jargon-free reporting and commitment to open communication foster strong connections between stakeholders, ultimately leading to improved outcomes. As investment fund managers face mounting pressures to deliver results, the role of project management firms will remain a cornerstone of strategic success in the industry.

Conclusion

The contributions of project management firms, such as Naismiths, to investment fund management are not merely significant; they are essential for navigating the complexities of today’s financial landscape. By offering specialised expertise in critical areas such as risk management, resource allocation, and communication, these firms empower fund managers to streamline project execution and align their objectives with overarching financial goals. The evidence presented in the article clearly illustrates that effective project management can lead to reduced delays, improved investment performance, and enhanced stakeholder satisfaction.

Furthermore, the importance of collaboration and communication in project management cannot be overstated. As highlighted, fostering an environment where all stakeholders are engaged and informed facilitates better decision-making and strengthens partnerships. The statistics indicating the effectiveness of diverse communication methods further reinforce the notion that successful project outcomes are intrinsically linked to robust collaboration strategies.

Consequently, the growing reliance on project management firms signifies a paradigm shift in investment fund management. As the industry continues to evolve, embracing innovative management practices and leveraging advanced technologies will be crucial for achieving optimal results. Engaging with firms like Naismiths not only mitigates risks but also enhances the overall success of investment strategies, ensuring that fund managers can navigate challenges with confidence and drive long-term value for their stakeholders.