Overview

The article underscores the pivotal role of property consultancy services in bolstering the effectiveness of investment fund managers engaged in real estate ventures. It highlights that these services, offered by reputable firms like Naismiths, furnish fund managers with vital insights essential for informed decision-making and robust risk management. Consequently, this leads to enhanced financial performance and strategic alignment with prevailing market trends.

Introduction

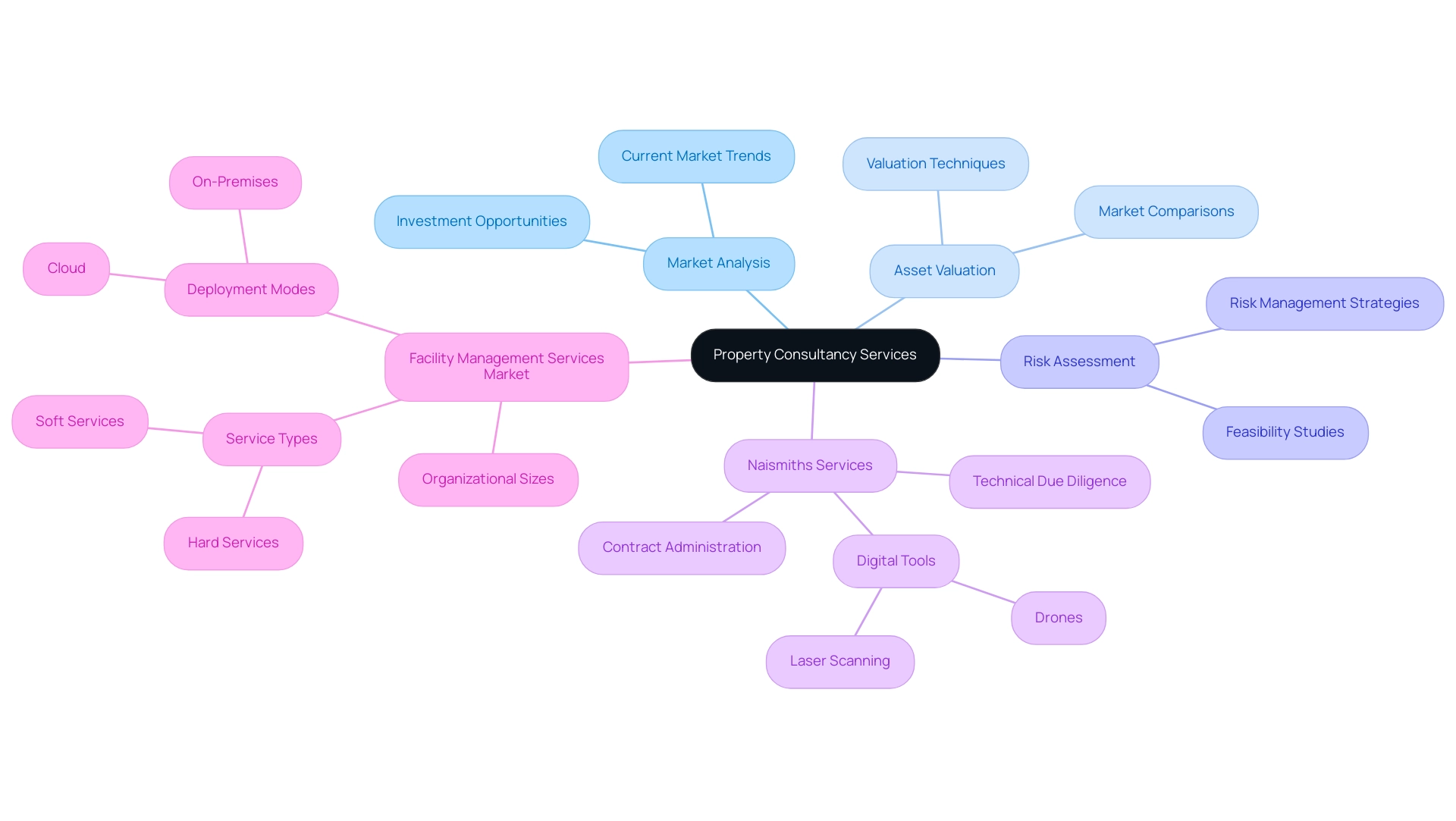

In the intricate realm of real estate investment, property consultancy services have become essential allies for investment fund managers. These services provide a vast array of expertise, encompassing:

- Market analysis

- Valuation

- Risk assessment

- Investment strategy formulation

As the landscape undergoes continual shifts, comprehending the nuances of these consultancy offerings is crucial for making informed decisions and optimising investment portfolios. Naismiths, a leader in consultancy services, exemplifies how customised project management and strategic insights can significantly enhance investment outcomes, especially in a market where investors have recently made noteworthy acquisitions.

With the property consultancy sector on the brink of expansion, it is imperative for fund managers to recognise the vital role that expert guidance plays in navigating challenges and capitalising on opportunities within the real estate market.

Understanding Property Consultancy Services

Property consultancy services play a crucial role in navigating the complex landscape of real estate ventures. These services encompass a variety of expert advisory roles, including market analysis, asset valuation, strategy formulation, and risk assessment. For fund supervisors, a comprehensive understanding of these services is imperative, as they equip professionals with the insights necessary for informed decision-making, portfolio optimisation, and the enhancement of overall project feasibility.

Naismiths delivers extensive management services that address every facet of consultancy, ranging from contract administration to risk management and technical due diligence. Their dedicated team of chartered building surveyors, quantity surveyors, and project managers ensures that clients receive tailored solutions that cater to their specific needs throughout the project lifecycle. This encompasses conducting feasibility studies to establish concept designs and cost budgeting, in addition to defect diagnosis for identifying and planning requisite corrective actions.

By partnering with Naismiths, fund managers can synchronise their financial strategies with prevailing market trends and client expectations, particularly in a dynamic market where investors are making acquisitions exceeding sales by over £7.5 billion, underscoring the growing demand for strategic guidance. The importance of real estate consultancy transcends mere advisory roles; it significantly impacts real estate returns. Effective consultancy, such as that provided by Naismiths, can yield improved financial outcomes and reduced risks, ensuring that assets are not only profitable but also sustainable in the long term.

Current trends indicate that the consultancy services market is poised for expansion in 2025, driven by an increasing reliance on professional advice to navigate intricate financial landscapes. Notably, high-performing agents achieve conversion rates surpassing 12%, while the average stands at merely 4.7%, highlighting how property consultancy services bolster investment success. Furthermore, successful property consultancy initiatives in real estate investment illustrate the tangible benefits of these services.

Naismiths prioritises risk management and collaboration, which can facilitate optimal outcomes while upholding high-quality standards throughout each endeavour. This collaborative ethos fosters robust relationships among stakeholders, ultimately enhancing project execution and success. Naismiths also employs advanced digital tools and data handling techniques, such as drones and 3D imagery, to ensure precision and compliance in their services.

In summary, Naismiths’ property consultancy services provide significant advantages for real estate ventures, equipping fund supervisors with the essential resources and insights to thrive in a competitive market. By comprehending and leveraging these services, fund managers can markedly enhance their decision-making processes and drive superior financial performance. Additionally, the facility management services market exemplifies the growing reliance on consultancy services, as organisations increasingly seek external providers to manage non-core business functions, thereby enhancing operational efficiency across various industry sectors.

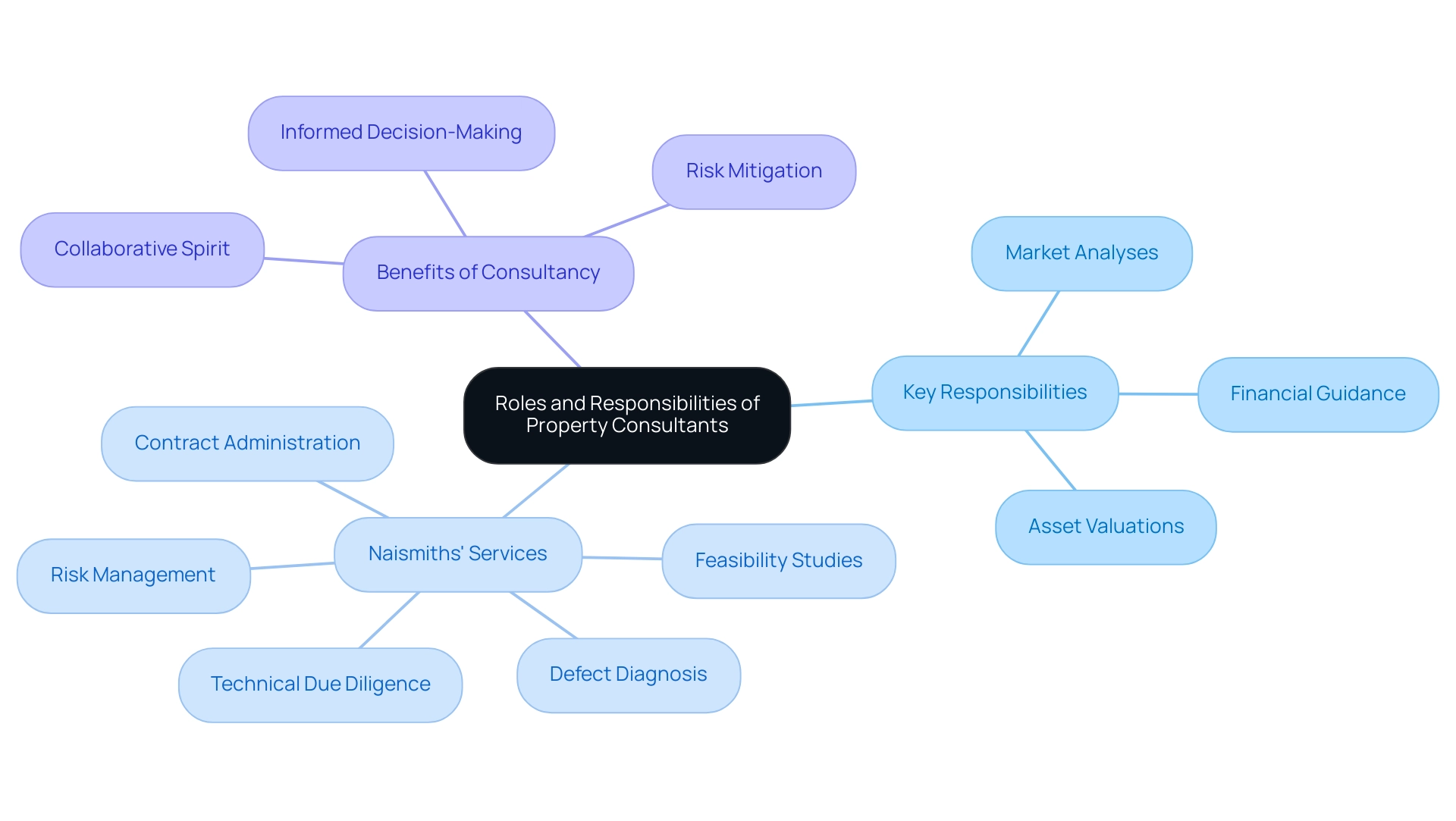

Roles and Responsibilities of Property Consultants

Property consultancy services are indispensable to the real estate sector, fulfilling a multifaceted role that encompasses a wide range of responsibilities. These experts conduct thorough market analyses, provide precise asset valuations, and offer strategic financial guidance, all while ensuring adherence to regulatory frameworks. Their expertise includes property consultancy services that facilitate negotiations and assist clients in navigating the complexities of intricate transactions, which can often be overwhelming for those lacking specialised knowledge.

For fund managers, the involvement of consultants such as Naismiths is not merely advantageous; it is crucial for informed decision-making. Naismiths provides comprehensive project management services, including:

- Contract administration

- Risk management

- Feasibility studies

- Defect diagnosis

- Technical due diligence

These services are essential for navigating the competitive real estate market. This collaboration can lead to enhanced financial strategies and improved outcomes.

Expert insights underscore that property consultancy services play a pivotal role in identifying lucrative opportunities and mitigating risks associated with real estate transactions. Naismiths’ capability to assess market trends and offer practical suggestions empowers fund overseers to make informed choices that align with their financial goals.

Effective partnerships between fund supervisors and real estate advisors frequently result in enhanced asset portfolios and higher returns. Industry leaders emphasise that the responsibilities of real estate advisors extend beyond mere advisory roles; they are partners in the funding process, committed to achieving the best possible outcomes for their clients.

In summary, understanding the specific roles and responsibilities of property consultancy services enables fund managers to leverage their expertise effectively. This partnership not only enhances the decision-making process but also fosters a collaborative atmosphere that prioritises risk management and high-quality standards throughout each endeavor.

If you seek to enhance your financial strategy, consider engaging with Naismiths for expert guidance and support.

Types of Property Consultancy Services Available

Investment fund managers have access to a diverse range of consultancy services related to real estate, meticulously tailored to meet their specific needs. Key service types include:

- Financial Advisory: This service provides strategic advice on real estate ventures, concentrating on market trends, financial analysis, and risk management. With 71.25% of industry professionals expecting positive changes and growth, advisory services are essential for navigating the evolving landscape.

- Market Research: A thorough examination of market conditions is crucial for informed financial choices. Current statistics indicate that the global real estate market is projected to reach £5,388.87 billion by 2026, growing at a CAGR of 9.6%. This growth underscores the importance of comprehensive market research in identifying lucrative opportunities, as highlighted in the case study on global real estate market growth projections.

- Property Valuation: Precise property evaluation is essential for ensuring appropriate pricing and financial assessments. This service assists fund supervisors in understanding the true value of their assets, facilitating improved investment strategies.

- Regulatory Compliance: Navigating the complex legal and regulatory landscape presents a significant challenge for fund managers. Consultancy services in this area assist clients in adhering to all necessary requirements, thus minimising risks associated with real estate transactions.

- Management: Effective oversight of property development initiatives is essential to meet timelines and budgets. Naismiths excels in this area, providing comprehensive management services that include contract administration, risk management, feasibility studies, and technical due diligence.

By understanding these service types, investment fund leaders can better align their needs with the appropriate consultancy support, ultimately enhancing their investment strategies and outcomes.

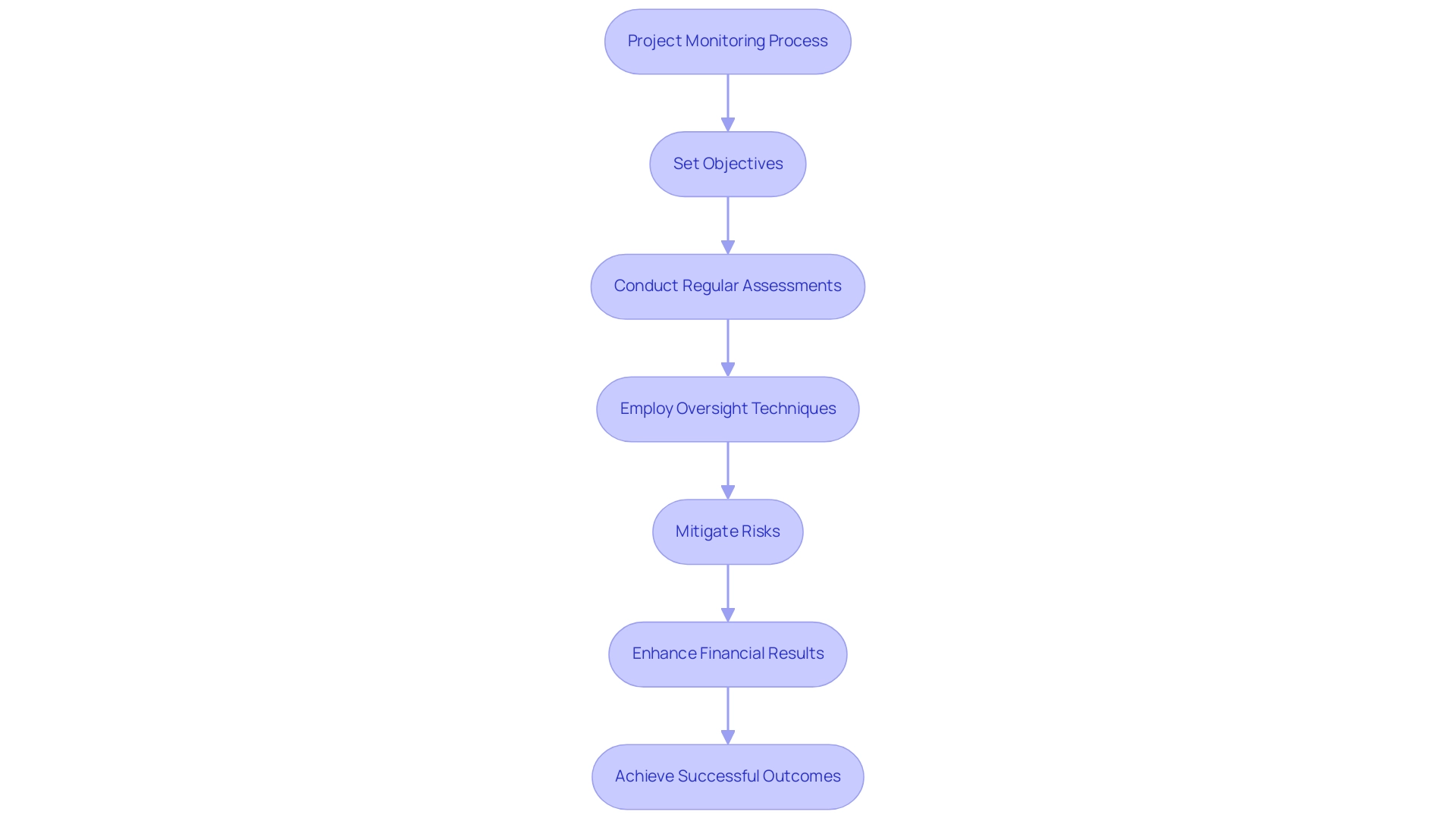

The Importance of Project Monitoring in Property Consultancy

Project monitoring serves as a cornerstone of property consultancy, particularly in real estate ventures. This process involves meticulous oversight of progress to ensure alignment with predefined objectives and quality standards. For fund supervisors, the significance of efficient monitoring cannot be overstated; it plays a crucial role in mitigating risks associated with delays, budget excesses, and quality inconsistencies.

Regular assessments of milestones, financial performance, and adherence to regulatory requirements are integral to this practice. By employing robust oversight techniques, fund managers can significantly enhance their financial results. Statistics reveal that delays and budget overruns are prevalent issues in the real estate sector, with studies indicating that nearly 70% of projects experience some form of delay, often leading to increased costs and diminished returns.

Successful monitoring examples in real estate investments underscore the importance of this practice. For instance, firms adopting structured methodologies, such as Agile frameworks, have reported improved delivery times and stakeholder satisfaction.

Naismiths’ monitoring surveyors play a pivotal role in overseeing developments, ensuring compliance and quality through regular site visits and reporting. These surveyors are responsible for overseeing progress, identifying potential hazards, and ensuring that all work meets the required standards and regulations.

In conclusion, the integration of thorough monitoring not only protects resources but also fosters a culture of accountability and transparency. By prioritising these practices, investment fund professionals can navigate the complexities of real estate ventures with confidence, ensuring timely completion and adherence to high-quality standards. Naismiths’ data-first, commercially focused approach to asset management further enhances their ability to deliver successful project outcomes.

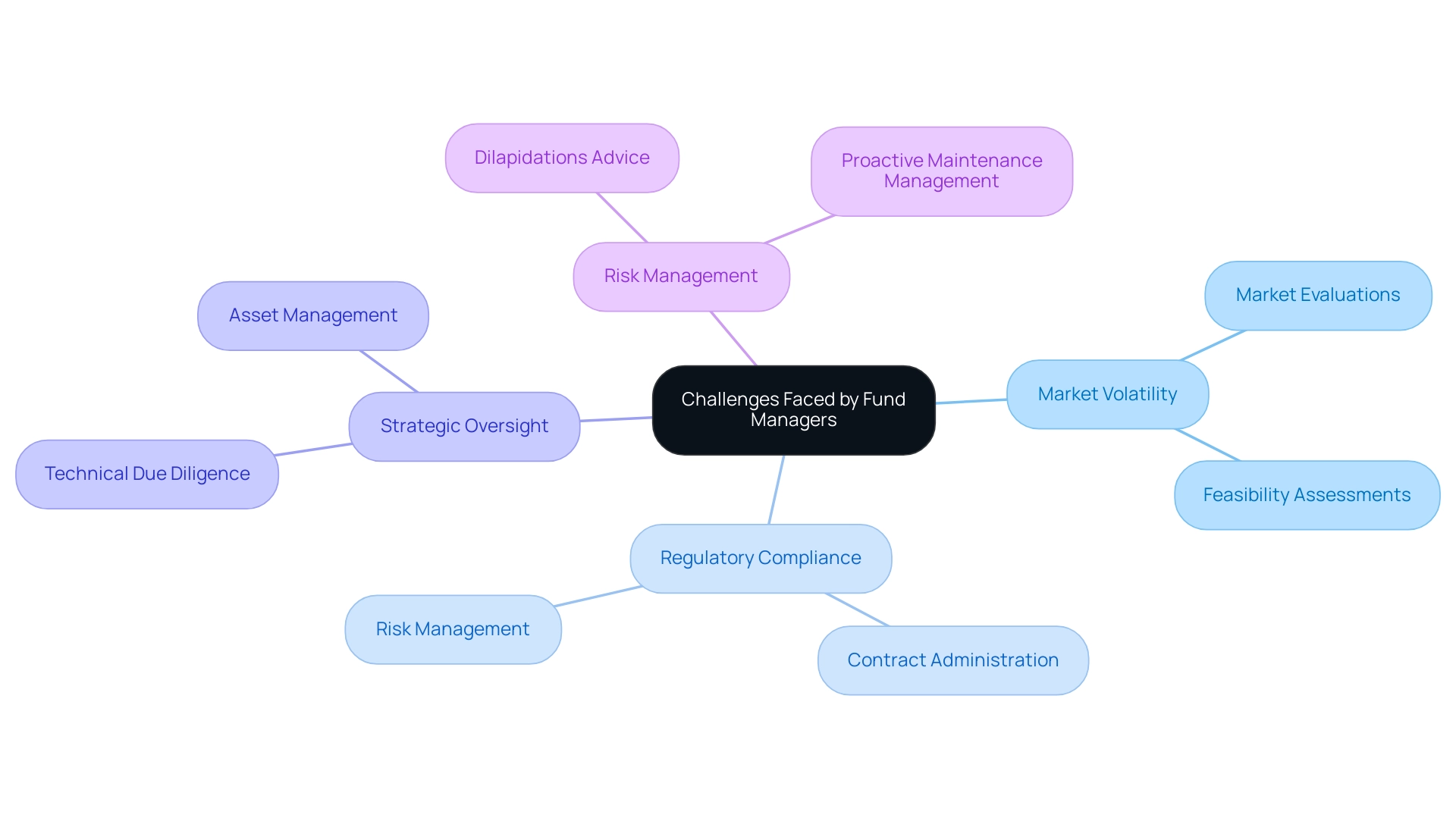

Navigating Challenges: How Consultancy Services Support Fund Managers

Investment fund supervisors face numerous challenges in today’s dynamic landscape, marked by market volatility, regulatory compliance, and economic uncertainties.

Property consultancy services are essential in equipping fund leaders with the insights and strategies necessary to navigate these complexities. Property consultants, such as Naismiths, conduct thorough market evaluations and feasibility assessments that reveal emerging trends and potential risks, enabling fund leaders to make informed decisions.

Furthermore, property consultancy services play a critical role in ensuring compliance with regulatory requirements, thereby mitigating the risk of legal complications. By offering tailored guidance on contract administration, quantity surveying, and risk management, Naismiths aids fund supervisors in adhering to evolving regulations, an essential aspect of maintaining operational integrity and investor confidence.

The expertise provided by property consultancy services not only enhances adaptability to changing market conditions but also fosters a competitive edge. Naismiths’ technical due diligence services, which include defect diagnosis, reinstatement cost assessments, and pre-acquisition surveys, ensure comprehensive asset assessment and proactive maintenance management, crucial components for effective asset management. Additionally, their dilapidations advice assists in negotiating the costs of restoring properties, further supporting both landlords and tenants.

As noted by industry experts, a customer-centric approach that emphasises risk management and collaboration is key to achieving optimal outcomes. This is particularly relevant in real estate, where the landscape is fraught with challenges that require nuanced comprehension and strategic foresight.

In summary, leveraging property consultancy services like those offered by Naismiths empowers fund supervisors to adeptly navigate market fluctuations, positioning them to seize opportunities while managing inherent risks.

Tailored Solutions: Customising Consultancy for Optimal Results

Customised property consultancy services are paramount for fund managers striving to achieve optimal outcomes in real estate investments. By tailoring these services to meet specific needs and financial goals, Naismiths delivers insights and strategies that are directly relevant to each unique situation. This customisation encompasses comprehensive management services, including:

- Contract administration

- Risk management

- Technical due diligence

- Dilapidations advice

- Defect diagnosis

- Measured surveys

This ensures meticulous oversight of every aspect of a project from inception to completion.

Engaging property consultancy services that emphasise tailored solutions can significantly enhance decision-making processes, improve performance, and ultimately yield greater financial returns. The impact of customisation is evident; firms that implement personalised property consultancy services frequently experience measurable improvements in investment performance. For instance, organisations that adopt customised recommendations for supply chain management have reported notable cost savings and increased productivity.

Moreover, the focus on personalisation in property consultancy services resonates with broader industry trends, where businesses that prioritise tailored interactions reap substantial benefits, including heightened customer engagement and improved sales. In fact, personalised calls to action convert 202% better than standard calls to action, highlighting the effectiveness of customisation.

As fund supervisors navigate the complexities of real estate ventures, the significance of property consultancy services cannot be overstated; they are essential for achieving success in a competitive landscape.

Effective Communication and Reporting in Property Consultancy

Effective communication and reporting serve as essential pillars of successful property consultancy, particularly for investment fund leaders. Establishing and maintaining open lines of communication with consultants is crucial to ensure alignment on objectives, timelines, and expectations. Regular reporting on initiative progress, financial performance, and compliance issues not only fosters transparency but also builds trust between fund overseers and consultants.

By implementing structured communication protocols and utilising concise reporting formats, fund managers can significantly enhance collaboration, ensuring that potential issues are identified and addressed promptly.

Successful reporting practises are linked to improved outcomes. For instance, consistent reporting frequency has been shown to correlate with higher success rates, reinforcing the need for diligence in this area. Expert opinions highlight that effective communication in property consultancy transcends the mere sharing of information; it is about creating a collaborative environment where all parties can thrive.

As pointed out by industry experts, prioritising risk management and encouraging a collaborative spirit are essential to achieving optimal results while maintaining high-quality standards throughout each project.

Naismiths emphasises the significance of asset management in construction, overseeing and monitoring all elements, from workforce and machinery to cost assessments. Their data-first, commercially focused strategy ensures that initiatives are planned and controlled to the highest industry standards. This comprehensive oversight includes setting project goals, reviewing budgets, advising on procurement, and ensuring compliance with statutory procedures.

Naismiths employs specific methodologies such as regular site visits and detailed reporting to ensure compliance and address any issues proactively. Case studies reveal that effective communication strategies can lead to more successful partnerships.

Global trends underscore the importance of adapting communication strategies to meet the demands of an evolving market landscape. By leveraging technology and maintaining transparent communication, fund administrators can ensure that their consultancy partnerships are not only productive but also resilient in the face of these changes.

Moreover, the increasing significance of social media as a communication channel in 2024 reinforces the need for consultants to engage with clients through various platforms, thereby enhancing overall consumer interaction.

Future Trends in Property Consultancy: What Fund Managers Should Know

The real estate landscape is undergoing rapid transformation, necessitating that investment fund supervisors remain vigilant about emerging trends in property consultancy services. A pivotal trend is the increasing integration of technology and data analytics into decision-making processes. This shift not only enhances the accuracy of forecasts but also streamlines operations, allowing fund managers to make informed choices based on real-time data.

For instance, firms utilising advanced analytics have reported a significant improvement in project outcomes, with some noting a 25% increase in productivity when leveraging technology-driven solutions, such as partnering with transaction coordinators. Sustainability and environmental considerations are also gaining traction, as stakeholders increasingly prioritise eco-friendly practices. This trend is highlighted by the increasing need for real estate that meets rigorous sustainability criteria, reflecting a wider societal movement towards responsible financing. Furthermore, the rise of remote collaboration tools has transformed communication among stakeholders, facilitating seamless interactions and decision-making processes.

Investment fund managers should also remain aware of regulatory changes that could affect real estate investments. Adapting to these shifts is crucial for capitalising on new opportunities while effectively navigating potential challenges. For instance, the recent increase in remote work has changed housing demand, with buyers looking for homes that support work-from-home lifestyles.

This shift has led to a notable increase in interest for rural areas, prompting agents to highlight features such as high-speed internet and dedicated office spaces. A case study on shifts in housing demand due to remote work illustrates this trend, showing how the popularity of suburban areas has surged as people prioritise larger living spaces.

Additionally, investing in industrial properties offers growth opportunities as businesses prioritise fast and efficient delivery.

By staying informed about these trends, fund managers can strategically position themselves to leverage new opportunities and address the evolving needs of the market, ensuring they remain competitive in a dynamic environment.

Conclusion

Property consultancy services are essential for investment fund managers navigating the complexities of the real estate market. By offering critical expertise in market analysis, property valuation, risk assessment, and investment strategy formulation, these services enable fund managers to make informed decisions that optimise their investment portfolios. Naismiths exemplifies this value through its comprehensive project management offerings, which not only enhance financial outcomes but also contribute to the sustainability of investments in a rapidly evolving landscape.

As the demand for strategic investment guidance continues to grow, the necessity of engaging knowledgeable property consultants cannot be overstated. Their capability to identify lucrative opportunities and mitigate risks is crucial for fund managers striving to maintain a competitive edge. Furthermore, as property consultancy services evolve, the integration of technology and customised solutions will further enhance the effectiveness of these partnerships, driving superior investment performance.

In conclusion, the future of property consultancy is promising, with trends indicating substantial growth and increased reliance on expert guidance. Investment fund managers who leverage these services will be better positioned to navigate challenges, capitalise on opportunities, and achieve their investment objectives. Embracing tailored consultancy solutions fosters collaboration and accountability, ensuring that fund managers can thrive in a dynamic market landscape, ultimately leading to enhanced returns and sustainable success.