Overview

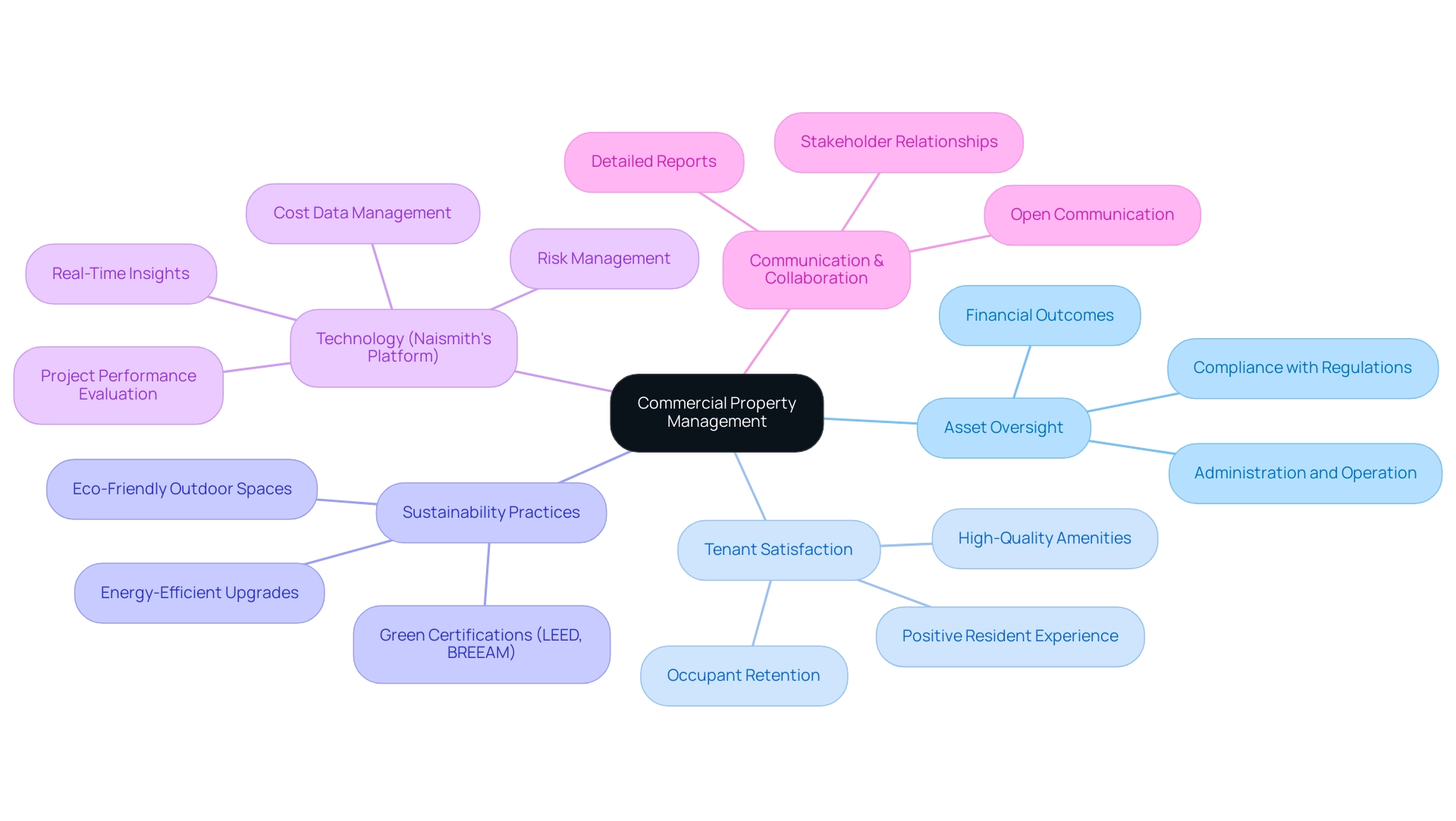

Commercial property management encompasses the comprehensive administration and oversight of non-residential properties, aimed at maximising asset value and ensuring tenant satisfaction through strategic practices. Effective management is crucial in enhancing financial outcomes, tenant retention, and compliance with legal regulations. Professional oversight plays a critical role in navigating the evolving commercial real estate landscape, illustrating the necessity of engaging expert services to achieve optimal results.

Introduction

In the dynamic world of commercial real estate, effective property management stands as a cornerstone for success. As businesses adapt to shifting market demands and evolving tenant expectations, the role of commercial property managers becomes increasingly vital. These professionals navigate a complex landscape filled with unique challenges and opportunities, from maximising property value to ensuring tenant satisfaction.

Furthermore, with the rise of technology and a growing emphasis on sustainability, understanding the intricacies of commercial property management is essential for landlords and investors alike. This article delves into the multifaceted realm of commercial property management, exploring its definition, key responsibilities, and the myriad benefits of engaging professional management services in today’s competitive environment.

Understanding Commercial Property Management

Commercial asset oversight encompasses the administration, operation, and supervision of non-residential spaces, including office buildings, retail areas, and industrial facilities. This multifaceted field involves a range of duties aimed at maximising asset value and ensuring resident satisfaction. In 2025, efficient business asset oversight is more crucial than ever, directly influencing financial outcomes, resident retention, and compliance with legal regulations.

Recent statistics underscore the importance of business asset oversight, with digital economy locations ranking second this year for investment prospects, trailing only industrial and manufacturing resources. This trend highlights the need for real estate administrators to adapt to evolving market demands and resident expectations, particularly in an environment where effective oversight practices can lead to improved financial results.

The impact of efficient commercial real estate oversight on renter retention is significant. Properties that prioritise occupant satisfaction through diligent operational practices and high-quality amenities typically experience elevated retention rates. Case studies reveal that embracing sustainability trends—such as green certifications (LEED and BREEAM) and energy-efficient upgrades—not only enhances tenant satisfaction but also reduces operational costs, rendering assets more competitive in the marketplace.

These practices align with Naismith’s method, which emphasises the importance of sustainability in asset oversight.

Naismith’s N3 platform further strengthens commercial real estate management by offering comprehensive solutions for precise cost data, project performance evaluation, and risk management. The platform’s ability to aggregate information from external sources allows for accurate cost benchmarking, while its integrated technical library provides initial guidance on design features, aiding managers in making informed decisions that meet occupant needs.

Current trends in commercial property management indicate an increasing focus on sustainability and resident engagement. Property managers are progressively adopting eco-friendly practices and creating inviting outdoor spaces, contributing to a positive resident experience. This shift is essential in a landscape where tenant expectations are changing, and satisfaction is vital for long-term success.

Moreover, the significance of effective commercial asset oversight prompts the question of what constitutes commercial property management, as professionals highlight the necessity for risk control and a collaborative approach. By fostering open communication and delivering comprehensive, clear reporting, managers can build strong relationships with residents and stakeholders, ensuring that all parties attain optimal results while upholding high-quality standards throughout each project.

In conclusion, as the commercial real estate market continues to evolve, the role of managers becomes increasingly vital in navigating challenges and optimising performance, ultimately leading to enhanced tenant satisfaction and improved financial outcomes.

Types of Commercial Properties: A Comprehensive Overview

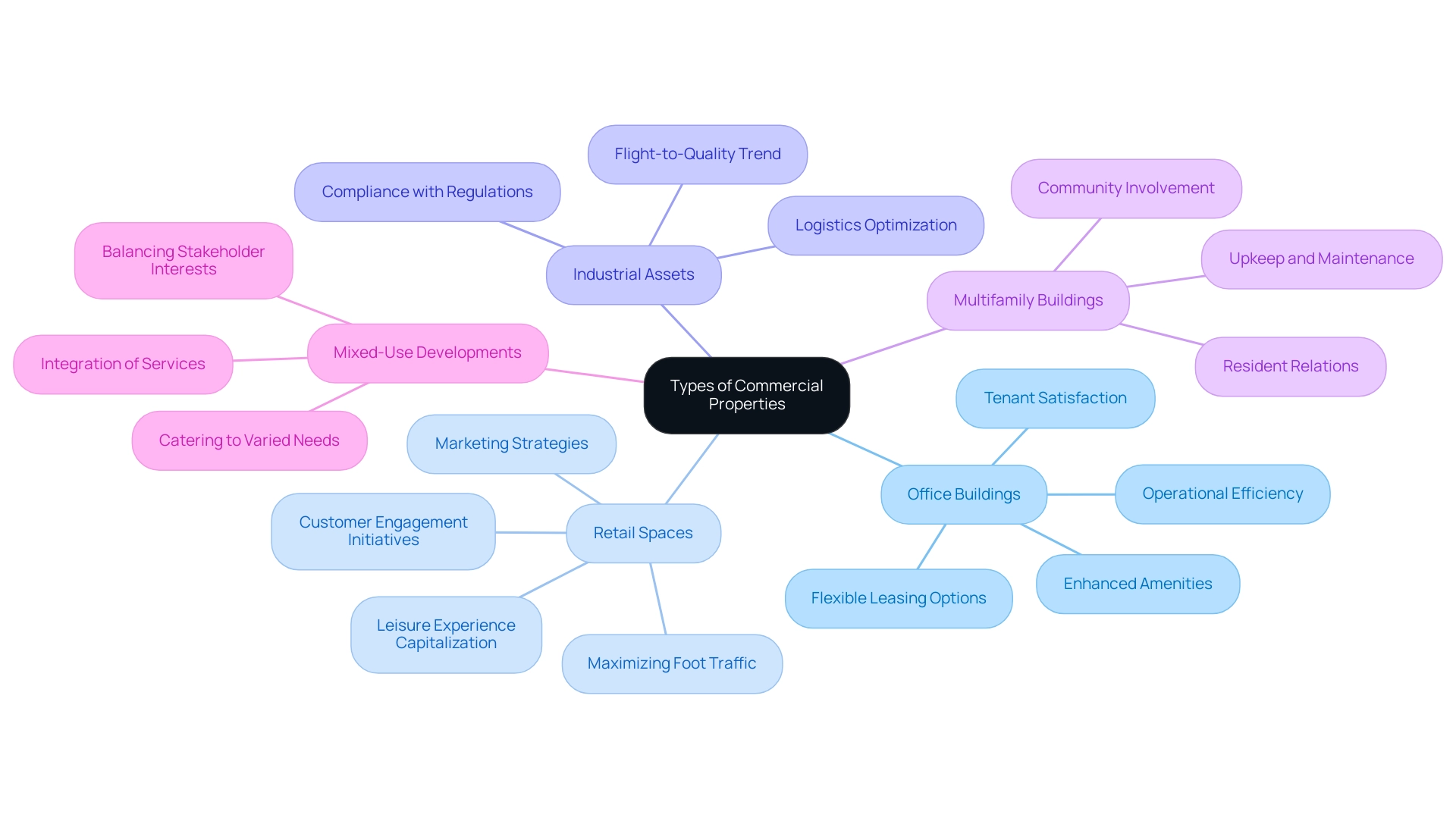

Understanding commercial property management requires recognising that commercial real estate can be categorised into distinct categories, each necessitating specific oversight strategies tailored to their unique features and operational needs. The primary categories include:

- Office Buildings: Designed for business operations, these properties range from single-tenant buildings to expansive multi-tenant complexes. Effective oversight strategies focus on optimising tenant satisfaction and ensuring operational efficiency. As the market evolves, clarity in organisational strategies becomes crucial, particularly with the anticipated increase in demand for high-quality office spaces in the UK.

- Retail Spaces: This category includes shopping centres, malls, and standalone stores, emphasising consumer interaction and sales performance. Management approaches often involve marketing strategies and customer engagement initiatives to enhance foot traffic and sales.

- Industrial Assets: Comprising warehouses, manufacturing sites, and distribution hubs, these assets frequently require specialised oversight due to their operational intricacies. Strategies may involve logistics optimisation and compliance with industry regulations to ensure smooth operations. The ‘flight-to-quality’ trend is influencing investment decisions in this area, particularly in urban settings.

- HMO Buildings: While primarily residential, these structures are overseen similarly to business spaces, with a significant focus on resident relations, upkeep, and community involvement to cultivate a positive living atmosphere.

- Mixed-Use Developments: Integrating residential, retail, and occasionally industrial spaces, these properties necessitate a thorough oversight approach that caters to the varied needs of occupants and enterprises. This involves balancing the interests of different stakeholders and ensuring the smooth integration of services.

As the business real estate market develops, particularly by 2025, clarity in operational strategies will be essential for understanding commercial property management. Statistics indicate that clarity in the commercial real estate market may emerge in the next 12 to 18 months, underscoring the necessity of effective oversight practices.

Successful oversight approaches reveal that effective strategies for office buildings often include flexible leasing options and enhanced amenities, while retail spaces benefit from innovative marketing campaigns and community-focused events.

Roles and Responsibilities of Commercial Property Managers

To grasp the essence of commercial property management, one must acknowledge the vital role that administrators play in ensuring the efficient operation and oversight of properties. This encompasses a diverse array of responsibilities crucial for maintaining property value and resident satisfaction. Key responsibilities include:

- Resident Management: This involves leasing activities, fostering positive resident relations, and swiftly addressing resident concerns to enhance satisfaction and retention rates. Effective management strategies for renters are indispensable, particularly in 2025, as they directly influence renter loyalty and overall satisfaction, which significantly impacts occupancy rates. Statistics indicate that properties managed by experts boast resident satisfaction rates exceeding 85%, underscoring the effectiveness of these strategies.

- Financial Management: Asset managers oversee budgeting, rent collection, and financial reporting, ensuring the asset remains profitable and financially viable—an increasingly critical factor in a competitive market.

- Maintenance Coordination: They are tasked with scheduling regular maintenance, managing repairs, and ensuring compliance with safety regulations. This proactive approach not only preserves the condition of the premises but also enhances resident satisfaction, as prompt upkeep is a key element in resident retention.

- Marketing and Leasing: Implementing effective marketing strategies is essential for attracting residents. This includes advertising vacancies, conducting viewings, and leveraging digital platforms to reach potential tenants. In 2025, integrating technology into marketing efforts has become vital for maximising visibility and engagement.

- Legal Compliance: Property managers must ensure that all operations comply with local, regional, and national regulations and safety standards. This responsibility is paramount in mitigating legal risks and maintaining the asset’s reputation.

The effectiveness of these roles is underscored by statistics showing that spaces managed by professionals experience higher resident satisfaction rates. For instance, recent data reveals that effectively managed business facilities report satisfaction levels exceeding 85%. Case studies highlight the substantial impact of property managers on resident relations and overall property performance.

A customer-centric focus not only enhances tenant experiences but also contributes to the long-term success of business establishments. Investment fund managers aiming to maximise their real estate investments are encouraged to engage with Naismiths for expert services.

Benefits of Professional Commercial Property Management

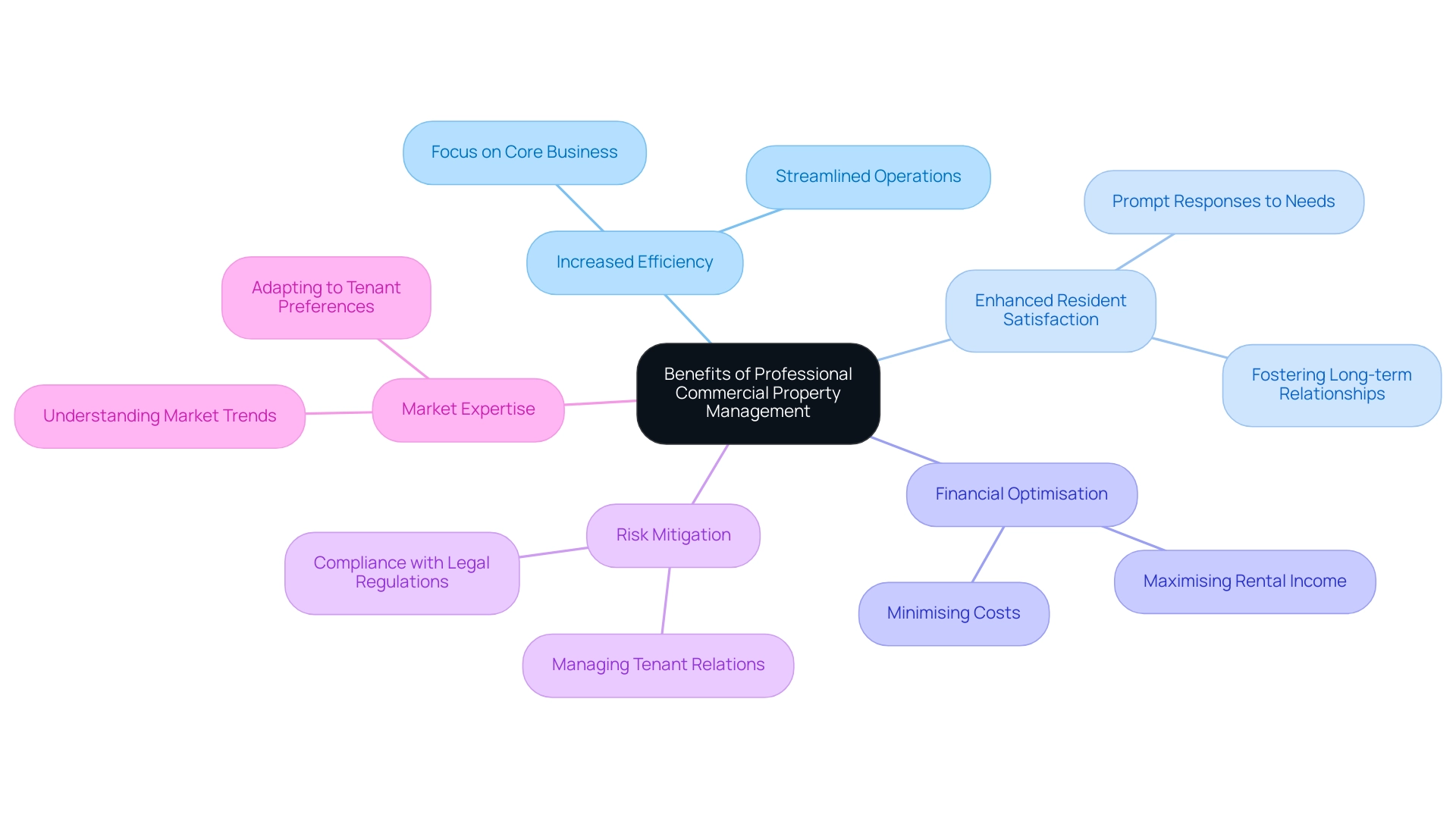

Engaging a professional commercial property management company offers a multitude of benefits that are crucial for success in 2025, including:

- Increased Efficiency: Experienced property managers streamline operations, allowing owners to concentrate on other critical aspects of their business. This efficiency is essential in a landscape where companies are increasingly choosing short-term leases ranging from 1 to 24 months, necessitating flexible practices that can adjust to these changing demands.

- Enhanced Resident Satisfaction: Professional management ensures prompt responses to resident needs, fostering long-term relationships and retention. By prioritising resident communication and addressing concerns swiftly, managers create an environment where residents feel valued and supported.

- Financial Optimisation: Property managers implement effective financial strategies that maximise rental income while minimising costs through efficient maintenance and operations, illustrating commercial property management. This financial expertise is crucial as businesses adjust to evolving economic circumstances, ensuring that assets stay profitable.

- Risk Mitigation: Commercial property management involves ensuring compliance with legal regulations and effectively managing tenant relations, which helps reduce the risk of legal issues and financial losses. Their expertise in navigating complex regulatory environments safeguards landowners from potential pitfalls.

- Market Expertise: Professional managers who understand commercial property management possess in-depth knowledge of market trends, enabling them to make informed decisions that enhance property value.

These advantages emphasise the essential role of professional oversight in attaining optimal asset performance, especially in a dynamic market where adaptability, technology, and data-informed decision-making are crucial. “Staying updated on real estate statistics is crucial for making strategic choices in a dynamic sector.” This highlights the significance of incorporating data into real estate practices.

As highlighted by industry specialists, staying updated on real estate statistics is essential for making strategic choices in this constantly evolving environment.

Financial Management in Commercial Property: Costs and Strategies

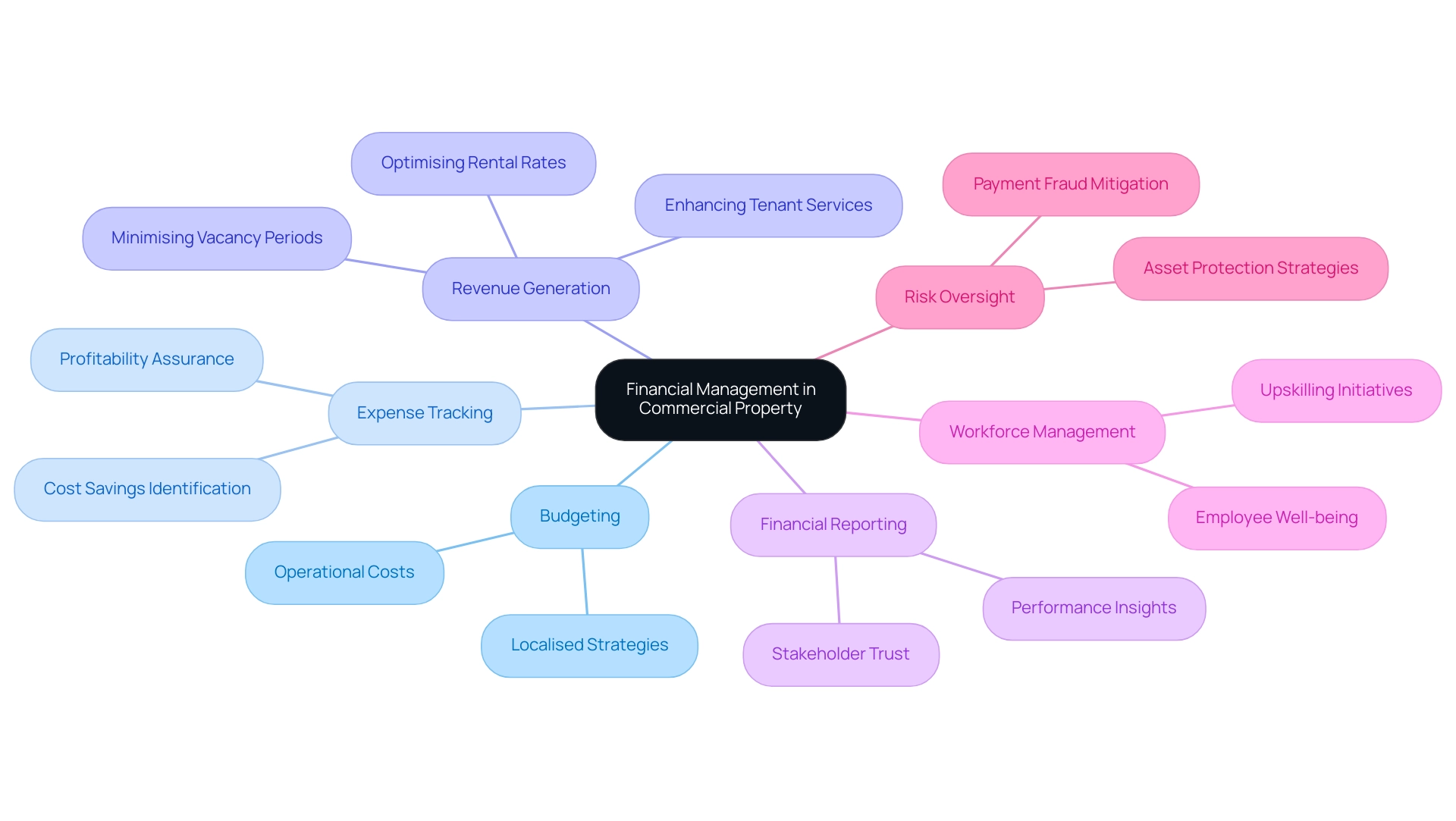

Financial oversight in business real estate is a critical domain that necessitates meticulous planning and execution of budgets, vigilant expense monitoring, and innovative revenue generation strategies. Key considerations include:

- Budgeting: Establishing a comprehensive budget is paramount, as it must encompass all operational costs, including maintenance, utilities, and management fees. In 2025, the average operational costs for commercial real estate in the UK are projected to reflect the evolving market dynamics, necessitating a proactive approach to financial planning. Notably, Bristol has the lowest average rent for retail space at £85 per square foot per year, underscoring the importance of localised budgeting strategies.

- Expense Tracking: Regular monitoring of expenses is essential for identifying potential cost savings and ensuring asset profitability. Successful budgeting and expense tracking practices have demonstrated their efficacy in enhancing financial performance, with organisations prioritising these strategies being better positioned to navigate economic fluctuations.

- Revenue Generation: Implementing effective revenue generation strategies—such as optimising rental rates, minimising vacancy periods, and enhancing tenant services—can significantly augment overall revenue.

- Financial Reporting: Clear financial reporting is indispensable, providing real estate owners with valuable insights into performance and facilitating informed decision-making. This practice not only fosters trust with stakeholders but also supports strategic adjustments to enhance profitability.

- Workforce Management: As the real estate sector grapples with considerable workforce challenges, organisations that invest in upskilling initiatives and prioritise employee well-being are better equipped to sustain a robust talent pipeline. This investment is crucial for underpinning their financial strategies and ensuring long-term profitability.

- Risk Oversight: In light of escalating threats, such as payment fraud—reported to affect 80% of organisations in 2023—financial oversight strategies must also incorporate robust risk evaluation and mitigation plans to safeguard assets and revenue streams.

Effective financial oversight is vital for preserving asset value and ensuring sustained profitability.

Legal Compliance in Commercial Property Management: Key Considerations

Legal compliance in commercial property management is a multifaceted area that managers must adeptly navigate to ensure the smooth operation of their assets. Key considerations include:

- Local Laws: A thorough understanding of local regulations is essential for managers of real estate. These laws dictate how properties can be utilised, impacting everything from the types of businesses that can operate within a space to the density of development. Successful navigation of laws can lead to innovative uses of commercial spaces, as seen in recent projects that repurposed underutilised buildings into vibrant mixed-use developments.

- Safety Regulations: Compliance with safety standards, including fire codes and health regulations, is paramount. These regulations are designed to protect occupants and visitors, and failure to adhere can result in significant legal liabilities. In 2025, a notable percentage of property supervisors reported that safety compliance was a top priority, reflecting a growing awareness of the significance of resident safety in maintaining real estate value and reputation.

- Lease Agreements: Managers must ensure that lease agreements are not only compliant with local laws but also clearly delineate the responsibilities of both residents and landlords. This clarity helps prevent disputes and fosters a positive landlord-tenant relationship. Expert opinions suggest that well-structured lease agreements can significantly reduce legal challenges and enhance tenant satisfaction.

By prioritising legal compliance, managers not only mitigate risks but also safeguard owners from potential legal issues. The effect of local laws, especially, can greatly affect asset oversight approaches, making it essential for supervisors to remain aware of important regulations and their consequences. As the environment of business real estate evolves, understanding commercial property management and these legal frameworks will be vital for success.

Considering present market circumstances, with 33.67% of individuals thinking that the housing sector is deteriorating in 2025, asset supervisors must be especially attentive in their compliance initiatives. Furthermore, the increasing focus on sustainability in real estate oversight is highlighted by the push for deep energy retrofits in the industry, propelled by regulatory demands and the necessity for energy efficiency.

This trend emphasises the connection between sustainable investment and financial returns, rendering legal compliance not only a regulatory requirement but also a strategic benefit in the changing business environment.

The Role of Technology in Commercial Property Management

Technology is transforming commercial property management by significantly increasing operational efficiency and enhancing resident satisfaction. At the forefront of this transformation are several key advancements:

- Property Management Software: These sophisticated platforms streamline various operations, including resident communication, maintenance requests, and financial tracking. By automating routine tasks, real estate managers can concentrate on strategic initiatives, resulting in enhanced overall efficiency.

- Data Analytics: Utilising data analytics enables real estate managers to make informed decisions by examining resident behaviour and market trends. This insight facilitates proactive strategies that align with resident needs and market demands.

- Smart Building Technologies: The integration of Technological devices optimises energy consumption, enhances security measures, and elevates resident experiences. These technologies not only lower operational expenses but also support sustainability objectives, which are increasingly significant in today’s market.

- Virtual Tours and Online Leasing: These innovative tools enhance renter engagement by enabling prospective occupants to explore properties remotely. This streamlined leasing process not only saves time but also increases the likelihood of securing tenants quickly.

Understanding commercial property management involves embracing these technological advancements, which are essential for managers aiming to enhance operational efficiency and deliver exceptional service to tenants. The ongoing integration of technology is anticipated to yield significant enhancements in the sector, especially as clarity in the real estate market develops over the next 12 to 18 months.

Choosing the Right Commercial Property Management Company

Choosing the appropriate firm for commercial property management is crucial for efficient administration and enhancing the value of your investment. To navigate this decision effectively, consider the following key factors:

- Experience and Expertise: Prioritise companies with a solid track record in managing assets similar to yours.

- Comprehensive Services: Ensure the company provides a broad array of services customised to your specific real estate supervision needs. This encompasses everything from tenant relations to maintenance and financial reporting.

- Reputation and References: Examine the company’s reputation within the industry. Seek references from current or past clients to assess their performance and reliability. Positive testimonials can provide insight into their operational effectiveness.

- Communication and Transparency: A trustworthy overseeing company should prioritise open communication and offer clear reporting on asset performance. This fosters trust and ensures you remain informed about your investment.

- Fee Structure: Understand the fee structure in detail. Ensure it aligns with your budget while delivering value for the services provided. Average charges for commercial asset oversight services in the UK can vary, making it essential to compare alternatives to find the best match.

By thoroughly assessing these elements, asset owners can make informed choices when selecting a supervising firm that not only fulfils their requirements but also enhances their understanding of commercial property management and improves the overall performance of their estate. The real estate sector is projected to expand considerably, highlighting the importance of selecting a competent ally in this evolving landscape. Furthermore, insights from Deloitte’s annual global real estate outlook survey can provide valuable information for strategic planning when choosing a service company.

Conclusion

In the rapidly evolving landscape of commercial real estate, effective property management has emerged as a critical component for success. This article has explored various facets of commercial property management, highlighting its definition, the diverse types of properties, and the multifaceted roles and responsibilities of property managers. Engaging professional management services not only enhances tenant satisfaction but also optimises financial performance, ultimately leading to improved property value.

The benefits of professional commercial property management are various, from increased operational efficiency and enhanced tenant relations to effective financial management and risk mitigation, these services are indispensable in navigating the complexities of today’s market. Moreover, the integration of technology into property management practices has revolutionised the industry, enabling data-driven decision-making and improved tenant engagement.

As the commercial real estate market continues to grow and adapt, the importance of choosing the right management company cannot be overstated. Property owners must prioritise experience, comprehensive services, and transparent communication when selecting a partner. By doing so, they can ensure their investments are well-managed and positioned for long-term success.

In conclusion, the role of commercial property managers is more vital than ever. Their expertise not only addresses the unique challenges of various property types but also aligns with the evolving expectations of tenants and investors alike. As the industry progresses, embracing these management practices will be essential for achieving optimal property performance in a competitive environment.