Overview

Investment managers must master restructuring and insolvency law to effectively navigate distressed investments and enhance financial stability. Understanding these legal frameworks is not just beneficial; it is essential in today’s volatile market. The complexities and challenges associated with restructuring processes require a proactive approach to risk management.

Furthermore, fostering collaboration with legal advisors can significantly improve outcomes in these intricate situations. By addressing these critical aspects, fund managers can position themselves to successfully tackle the difficulties inherent in distressed investments, ultimately leading to enhanced financial stability.

Introduction

In the intricate world of corporate finance, the realms of restructuring and insolvency law play a pivotal role, particularly for investment managers navigating the complexities of distressed assets. As companies grapple with financial distress, understanding the legal frameworks governing debt reorganisation and asset liquidation becomes essential. Key concepts such as insolvency, restructuring, and bankruptcy not only shape the strategies employed by fund managers but also influence the broader economic landscape.

Furthermore, recent trends indicate fluctuations in insolvency rates and a growing emphasis on risk management, underscoring the heightened stakes in this arena. This article delves into the fundamental principles of restructuring and insolvency law, the challenges faced by fund managers, and the strategies that can lead to successful outcomes in these turbulent times.

Understanding Restructuring and Insolvency Law Fundamentals

The legal frameworks governing the reorganisation of debts or liquidation of assets for financially distressed companies are defined by restructuring and insolvency law. For investment fund leaders, a thorough understanding of these frameworks is essential as they navigate the complexities of distressed investments. Key concepts include:

- Insolvency: A situation where a company cannot meet its financial obligations as they become due, indicating potential financial distress.

- Restructuring: This process entails reorganising a company’s debt and operational structure to enhance financial stability, often aimed at avoiding insolvency.

- Bankruptcy: A legal proceeding that occurs when an individual or business cannot repay outstanding debts, resulting in a court-managed process for asset liquidation or debt reorganisation.

As of February 2025, total insolvency rates were recorded at 35.1 per 10,000 companies, reflecting a slight increase from the previous year. Notably, 21 company insolvencies were reported in the same month, marking a 19% decrease from February 2024. This total comprised compulsory liquidations, creditors’ voluntary liquidations, administrations, and company voluntary arrangements.

This decline suggests a potential stabilisation in the business environment, a critical consideration for investment fund administrators when assessing the uncertainty associated with their portfolios.

Investment managers must remain vigilant about current trends in restructuring and insolvency law. The increasing emphasis on risk management and collaboration is paramount, Naismiths emphasises risk management and a collaborative spirit, ensuring that all parties achieve the best possible outcomes while maintaining high-quality standards throughout each project. A customer-focused strategy can yield optimal outcomes while upholding high-quality standards during the transformation process.

Understanding these legal fundamentals not only aids in evaluating the feasibility of investments but also equips leaders for potential interventions in troubled assets, ensuring they can adeptly navigate the intricacies of restructuring and insolvency law.

Challenges Faced by Investment Managers in Restructuring

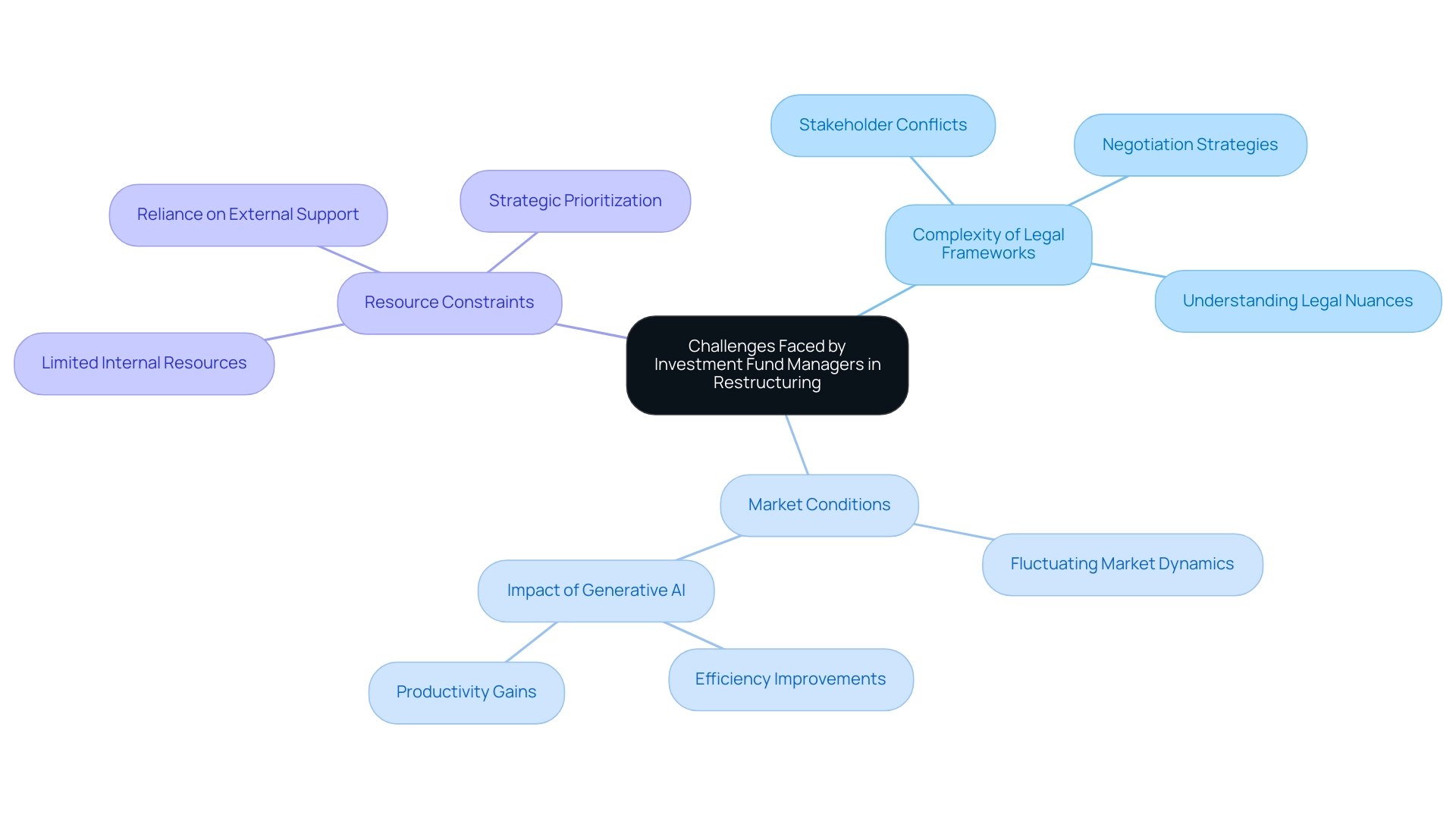

Investment fund supervisors encounter a multitude of obstacles during the reorganisation process, significantly affecting the effectiveness of their strategies. Key challenges include:

- Complexity of Legal Frameworks: The legal landscape governing organisational changes is often intricate, particularly when multiple jurisdictions are involved. Understanding the nuances of various legal requirements—especially restructuring and insolvency law—is essential for effective navigation and compliance. Conflicts among stakeholders can arise from the necessity to balance the interests of diverse parties, including creditors, shareholders, and management. Such disagreements complicate the reorganisation process, making it imperative for administrators to employ effective negotiation and communication strategies to align interests.

- Market Conditions: Fluctuating market conditions present additional challenges, as they can directly influence the viability of recovery plans. Investment fund leaders must remain adaptable and responsive to market dynamics to ensure their strategies remain viable and effective. Notably, 57% of surveyed investment management firms anticipate that generative AI will enhance efficiency and productivity, potentially aiding in overcoming these market challenges.

- Resource Constraints: Limited resources can impede the execution of effective restructuring plans, particularly for smaller funds. This limitation necessitates a strategic prioritisation of initiatives and a focus on maximising the impact of available resources. As noted, capacity constraints among the largest firms will lead to continued reliance on external resources, underscoring the critical role of external support in surmounting these challenges.

To effectively tackle these challenges, a proactive approach is essential. Fund supervisors must cultivate a profound understanding of both the legal and financial landscapes, particularly concerning restructuring and insolvency law. This knowledge enables them to anticipate potential issues and devise comprehensive plans that mitigate risks and foster successful outcomes.

Exploring Restructuring Options: Strategies for Fund Managers

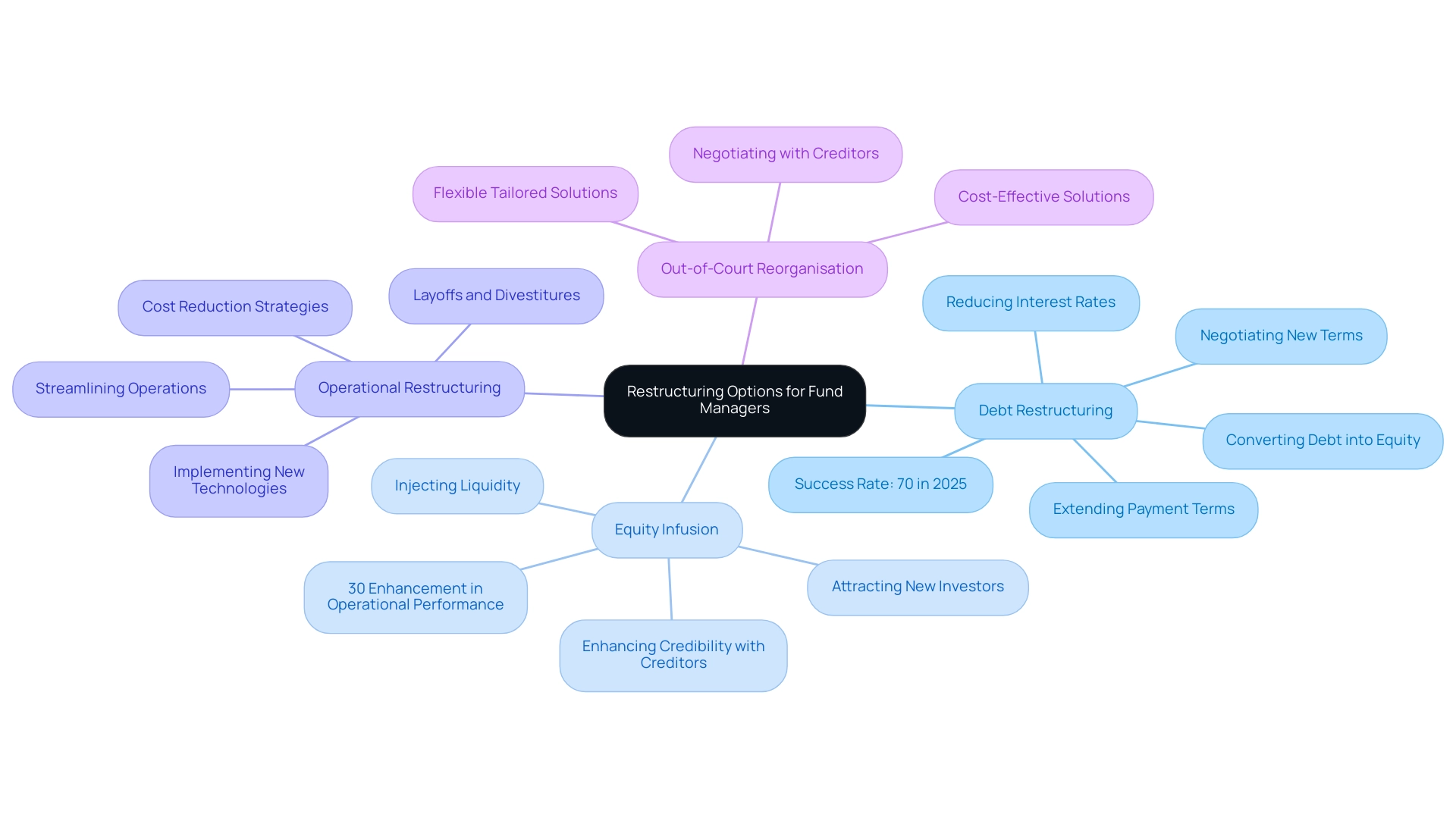

Fund managers have a range of options available under restructuring and insolvency law to effectively navigate financial distress. These approaches include:

- Debt Restructuring: This involves negotiating new terms with creditors to alleviate debt burdens. Common strategies include extending payment terms, reducing interest rates, or converting debt into equity. Such measures can significantly enhance cash flow and provide the necessary breathing space for recovery.

- Equity Infusion: Attracting new equity investors can supply essential capital to stabilise a company’s financial position. This strategy not only injects liquidity but also enhances the company’s credibility with existing creditors, fostering a more favourable negotiation environment.

- Operational Restructuring: Streamlining operations is crucial for reducing costs and improving efficiency. This may involve difficult decisions such as layoffs, divestitures, or implementing new technologies. Successful operational reorganisation can lead to a leaner, more agile organisation, better positioned to respond to market demands.

- Out-of-Court Reorganisation: Engaging in negotiations with creditors outside of formal bankruptcy proceedings can be a strategic move. This approach, often considered under restructuring and insolvency law, is usually less costly and time-consuming, allowing for flexible solutions tailored to the specific needs of the distressed entity.

Each of these options carries its own set of advantages and disadvantages, and the optimal choice will depend on the unique circumstances surrounding the distressed entity. Recent statistics show that debt reorganisation approaches have achieved a success rate of around 70% in 2024, emphasising their effectiveness when implemented correctly. Additionally, case studies indicate that firms that executed equity infusions during restructuring saw a 30% enhancement in operational performance within the first year after restructuring.

As investment fund leaders consider these approaches, it is crucial to thoughtfully assess the potential effects and align them with the overall objectives of the fund and its stakeholders.

Navigating Legal Frameworks: Insolvency Processes Explained

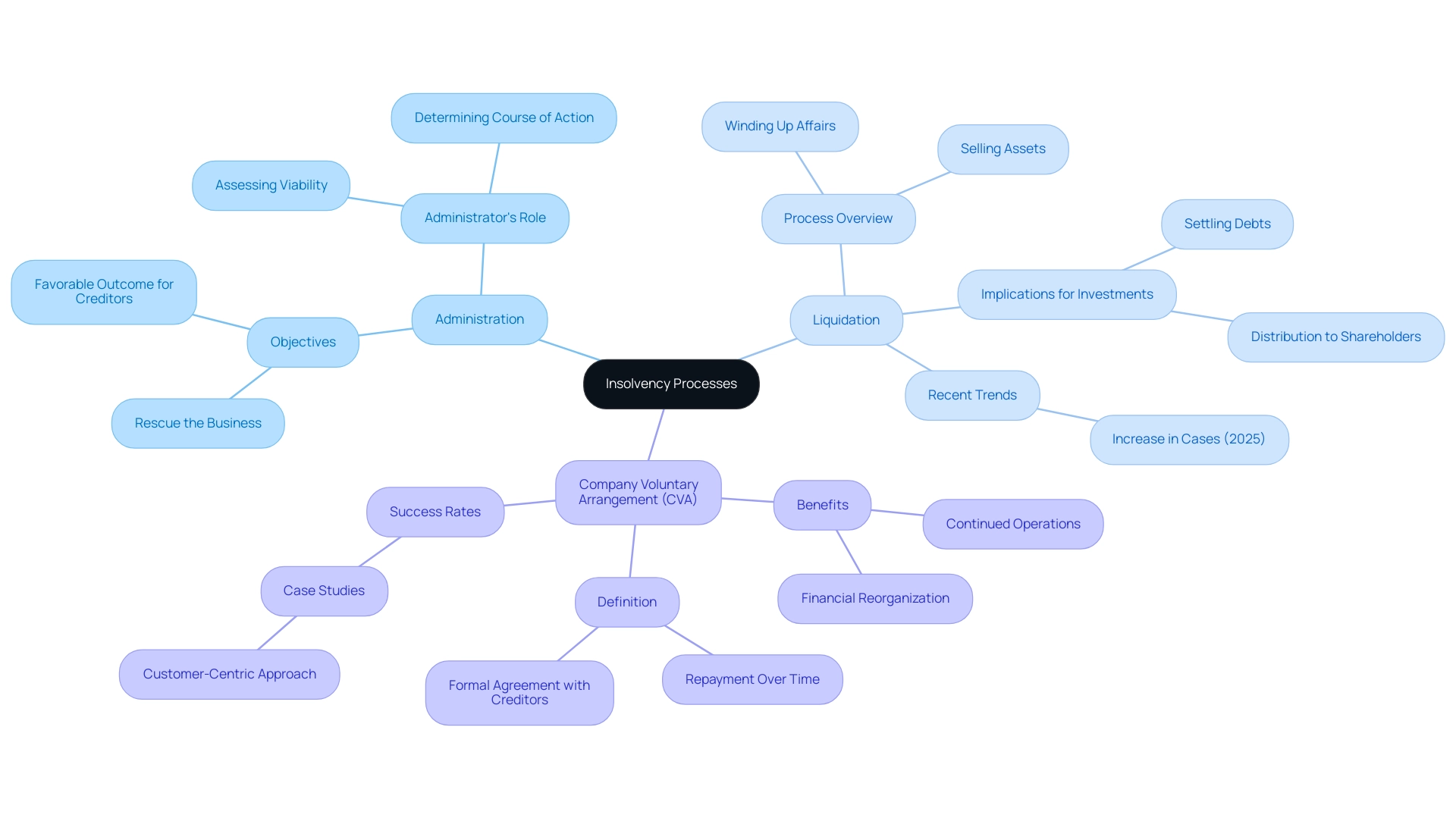

Understanding the legal frameworks surrounding restructuring and insolvency law is essential for fund managers, as these processes significantly impact investment strategies and risk management. The primary processes include:

- Administration: This process involves appointing an administrator to oversee the company’s affairs, with the dual objectives of rescuing the business or achieving a more favourable outcome for creditors. The administrator’s role is critical in assessing the company’s viability and determining the best course of action.

- Liquidation: Liquidation entails winding up a company’s affairs, which includes selling off assets to settle debts with creditors. This process culminates in the distribution of any remaining funds to shareholders, making it vital for fund administrators to understand the implications for their investments. Notably, in 2025, the UK witnessed a significant increase in liquidation cases, reflecting broader economic challenges.

- Company Voluntary Arrangement (CVA): A CVA is a formal agreement between a company and its creditors, allowing the company to repay its debts over time while continuing operations. This arrangement can offer a lifeline for struggling businesses, allowing them to reorganise their finances without resorting to liquidation.

Each of these processes under restructuring and insolvency law carries specific legal implications and requirements that those overseeing funds must navigate with care. Understanding the statistics surrounding these processes, such as the rise in administration cases and the success rates of CVAs, is crucial for informed decision-making. Recent data indicates that the volume of changes in circumstances to existing claims typically surges at the end of the financial year.

Case studies highlighting successful CVAs demonstrate the potential for recovery and growth even in challenging circumstances under this legal framework. By examining these examples, fund managers can gain valuable insights into effective reorganisation strategies and the importance of a collaborative approach in achieving favourable outcomes for all stakeholders involved.

Moreover, the ONS’s dedication to providing quarterly updates on their progress in developing population and migration statistics underscores the importance of timely information in the context of insolvency and reorganisation.

The Role of Communication in Restructuring and Insolvency

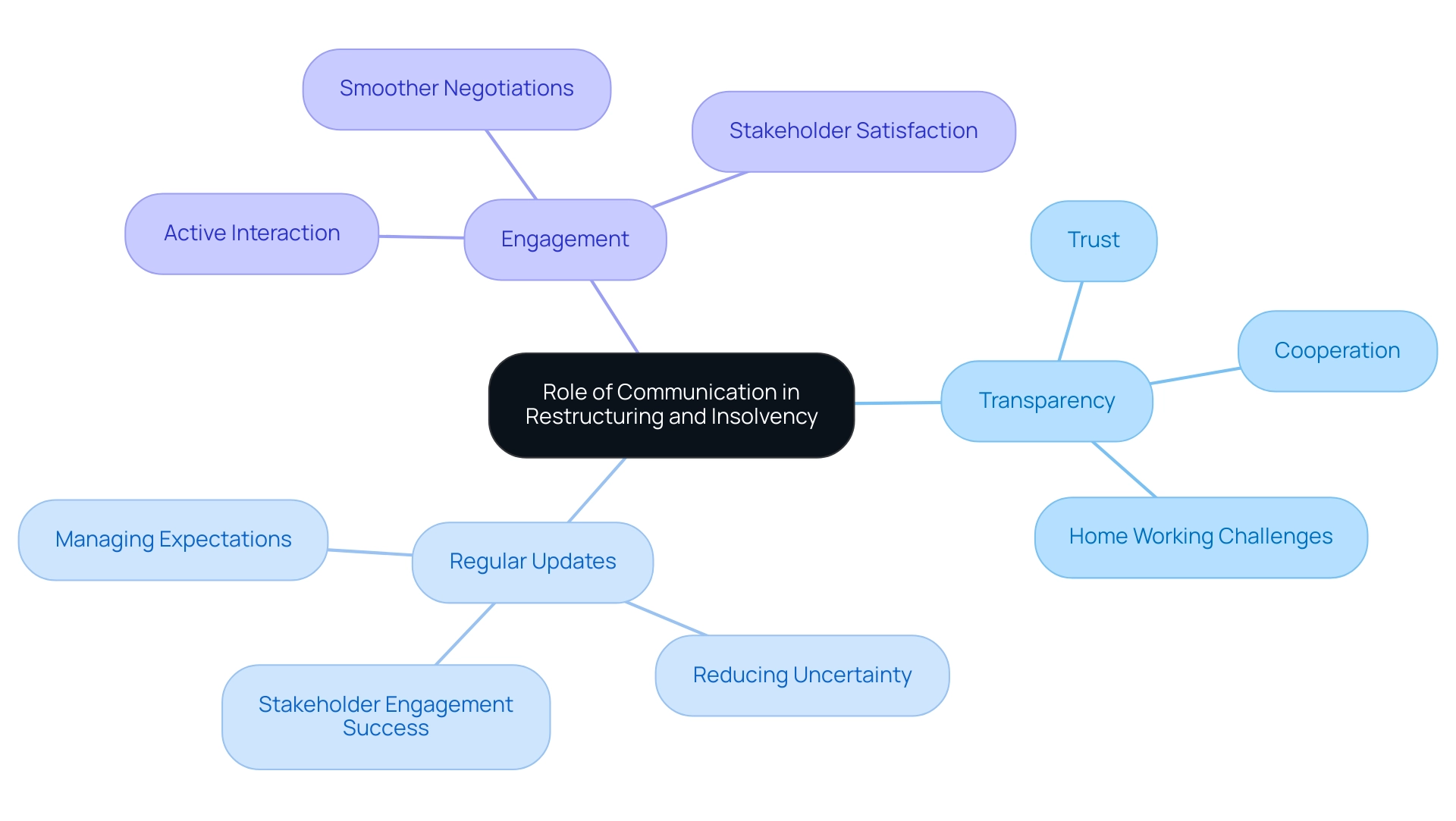

Effective communication is essential during organisational changes and in the context of restructuring and insolvency law processes, serving as a cornerstone for successful outcomes. Key elements include:

- Transparency: Keeping stakeholders informed about the restructuring process and its implications fosters trust and cooperation. This transparency is crucial, especially in an environment where 42% of workers are still operating from home, highlighting the need for clear communication channels.

- Regular Updates: Consistent updates to stakeholders help manage expectations and reduce uncertainty. In 2025, organisations that prioritise regular communication have experienced significantly enhanced stakeholder engagement success rates, essential for navigating complex organisational changes.

- Engagement: Actively interacting with stakeholders, including creditors and employees, facilitates smoother negotiations and enhances support for plans of reorganisation. Successful instances from recent case studies show that organisations utilising effective communication approaches have attained greater levels of stakeholder satisfaction and commitment during organisational changes.

Establishing a strong communication plan not only reduces uncertainties but also increases the chances of a successful reorganisation in accordance with restructuring and insolvency law. Naismiths’ customer-focused strategy highlights management of uncertainties and a collaborative spirit, ensuring that all parties attain the best possible results while upholding high-quality standards throughout each project. This highlights the essential requirement for investment fund leaders to prioritise communication in their reorganisation practices.

Implementing Risk Management Strategies in Restructuring

Applying efficient approaches to managing uncertainties during organisational changes is essential for investment leaders aiming to protect their assets and achieve favourable results. Key strategies include:

- Risk Assessment: This involves a thorough identification of potential risks associated with the restructuring process. Fund managers should assess financial, operational, and market uncertainties to create a comprehensive profile that informs decision-making. Naismiths’ N3 platform improves this process by enabling the team to quantify technical uncertainties linked to projects, utilising historical data from thousands of projects to identify ‘abnormal’ features that may affect cost, uncertainty, and programme duration.

- Contingency Planning: Developing robust contingency plans is essential to address potential setbacks or challenges that may arise during the process governed by restructuring and insolvency law. Successful examples from recent case studies in 2024 highlight how proactive contingency planning has enabled firms to navigate unexpected hurdles effectively, ensuring continuity and stability.

- Monitoring and Reporting: Establishing rigorous monitoring and reporting mechanisms enables fund administrators to track progress and identify emerging challenges in real-time. This approach not only enhances transparency but also facilitates timely interventions when necessary.

Data from 2025 suggest that firms utilising comprehensive management strategies during restructuring and insolvency law processes have experienced a significant rise in successful outcomes, emphasising the importance of these practices in today’s dynamic market environment. Moreover, the financial strain of escalating insurance expenses continues to be an issue, as the occurrence and intensity of challenges grow, making efficient management of uncertainties even more essential.

Additionally, insights from the case study titled “Real Estate Developer Market Insights” reveal that while residential development is strong, commercial projects face pressures. Developers are advised to stay informed about emerging trends and coverage intricacies to effectively manage risks, illustrating the practical application of the strategies discussed in this section.

Collaborating with Legal Advisors: Best Practices for Fund Managers

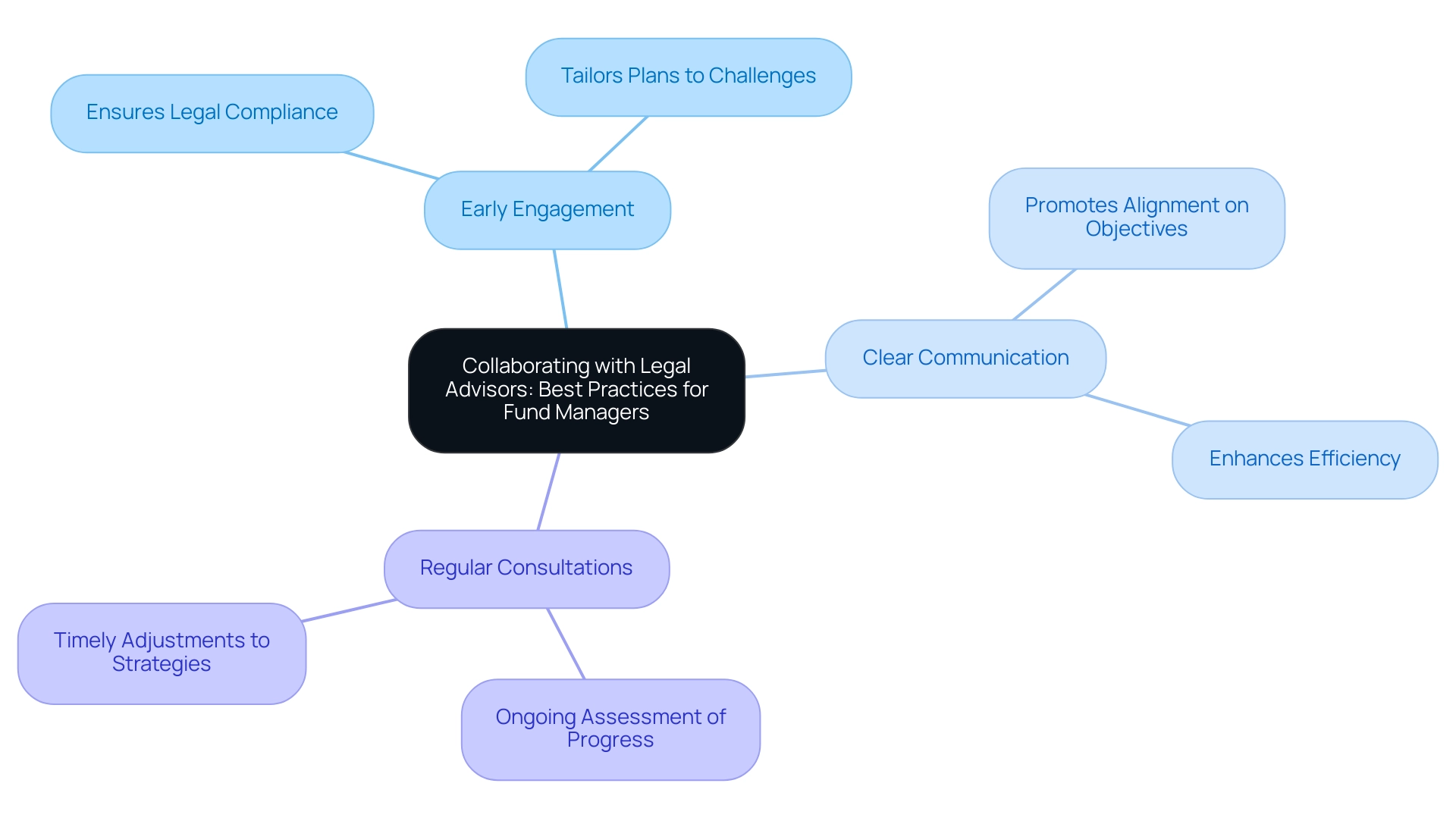

Collaboration with legal advisors is essential during the reorganisation process. Implementing best practices can significantly enhance outcomes, including:

- Early Engagement: Involving legal advisors at the outset of the restructuring process is crucial. This proactive approach ensures adherence to legal requirements and promotes the creation of effective plans tailored to the specific challenges faced by the organisation.

- Clear Communication: Establishing and maintaining open lines of communication with legal advisors is vital. This transparency promotes alignment on objectives and plans, enabling all parties to work towards common goals efficiently.

- Regular Consultations: Scheduling consistent consultations allows for ongoing assessment of progress, identification of challenges, and timely adjustments to strategies. This iterative process is key to navigating the complexities of reorganisation successfully.

Research suggests that early involvement with legal advisors in restructuring and insolvency law can result in more favourable restructuring outcomes, as it enables improved management of uncertainties and a more informed decision-making process. In 2024, the commercial real estate sector experienced significant distress, highlighting the significance of strategic legal collaboration in reducing threats linked to financial instability within the context of restructuring and insolvency law.

By cultivating a cooperative partnership with legal consultants, fund administrators can effectively navigate the complexities of restructuring and insolvency law, ensuring that they are well-prepared to tackle challenges and seize opportunities throughout the process. Furthermore, the case study on commercial real estate distress illustrates the necessity of legal collaboration during such processes, emphasising the importance of restructuring and insolvency law and highlighting the real-world implications of effective legal engagement.

Case Studies: Successful Restructuring in Practice

Analysing successful reorganisation case studies provides invaluable insights for fund managers navigating the complexities of corporate recovery under restructuring and insolvency law. Notable examples below, each demonstrating effective strategies in challenging circumstances.

Company A confronted substantial debt and executed a comprehensive reorganisation plan that prioritised operational efficiencies and strategic debt renegotiation. This multifaceted approach alleviated financial pressures and positioned the company for sustainable growth, ultimately leading to a successful turnaround.

Following its entry into administration, Company B undertook a strategic sale of assets, maximising value for creditors while facilitating a robust recovery. This case emphasises the importance of asset management and strategic decision-making in the reorganisation process.

These case studies showcase the vital role of customised strategies and proactive management in attaining successful outcomes in restructuring and insolvency law. Recent statistics indicate that companies focusing on operational efficiencies during these efforts see a marked improvement in their recovery rates.

This insight aligns with Naismiths’ differentiation in the market, where their commitment to prioritising clients’ commercial interests and navigating sensitive situations with professionalism and empathy has positioned them as a reliable partner in project monitoring and advisory services.

Additionally, the current market landscape reveals weak demand for office space, prompting some owners to consider converting underutilised assets into residential real estate. Such trends emphasise the significance of adaptive strategies in reorganisation efforts, making insights into restructuring and insolvency law crucial for investment fund supervisors aiming to understand the dynamics of effective reorganisation in practice.

Future Trends in Restructuring and Insolvency Law

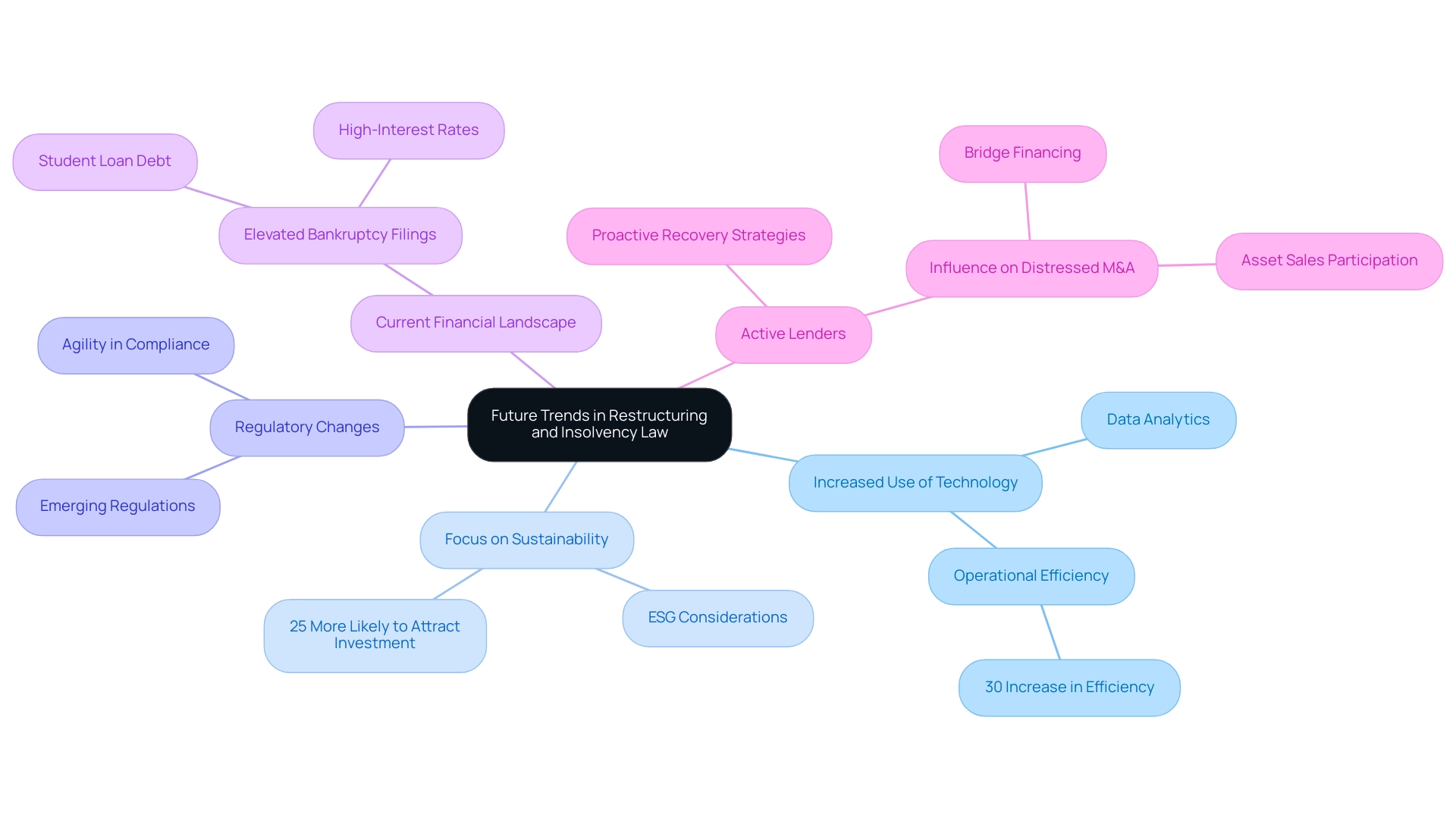

The landscape of reorganisation and insolvency law is undergoing significant transformation, with several key trends emerging that investment managers must closely monitor.

- Increased Use of Technology: The integration of advanced technologies in reorganisation processes is set to revolutionise operations. By leveraging data analytics and digital tools, firms can enhance decision-making, streamline workflows, and improve overall efficiency. Statistics indicate that organisations adopting technology in their transformation efforts report a 30% increase in operational efficiency, underscoring the critical role of innovation in this field. Naismiths, with its expertise in business transformation, exemplifies how technology can be utilised to optimise these processes.

- Focus on Sustainability: There is a marked shift towards sustainable transformation practices that prioritise environmental, social, and governance (ESG) considerations. Fund supervisors are progressively acknowledging the significance of aligning reorganisation plans with sustainability objectives under restructuring and insolvency law, which not only reduces risks but also boosts long-term value generation. This trend is demonstrated in recent studies indicating that companies with strong ESG frameworks are 25% more likely to attract investment during reorganisation phases.

- Regulatory Changes: Anticipated regulatory shifts are poised to impact reorganisation strategies significantly. As governments adapt to economic pressures, new regulations may emerge, necessitating that fund managers remain agile and informed. The ability to navigate these changes effectively will be crucial for maintaining compliance and optimising outcomes of the adjustment.

- Current Financial Landscape: Long-term projections indicate that filings will likely remain elevated due to factors such as high-interest rates. This context is vital for understanding the urgency and relevance of effective strategies in restructuring and insolvency law.

- Active Lenders: As companies face increased financial pressures, active sophisticated lenders are taking a more assertive role in recovering value from distressed borrowers. This proactive approach allows lenders to recover value efficiently while minimising business disruptions, influencing distressed M&A outcomes by providing bridge financing and participating in asset sales. Staying abreast of these trends is essential for fund managers as they navigate the complexities of restructuring and insolvency law in the coming years. The proactive adoption of technology, commitment to sustainability, and readiness to adapt to regulatory changes will not only enhance resilience but also position firms for success in an increasingly competitive landscape.

Conclusion

Understanding the intricacies of restructuring and insolvency law is paramount for investment fund managers dealing with distressed assets. This article highlights the fundamental concepts of insolvency, restructuring, and bankruptcy, emphasising the importance of grasping these legal frameworks to navigate potential financial pitfalls effectively. With rising insolvency rates and the dynamic nature of market conditions, fund managers must remain vigilant and adaptable in their strategies.

Investment managers encounter a range of challenges throughout the restructuring process, from complex legal frameworks to stakeholder conflicts and resource constraints. By proactively addressing these challenges with well-informed strategies and effective communication, managers can foster collaboration and enhance the likelihood of successful outcomes. The case studies presented illustrate the practical application of these strategies, underscoring the importance of tailored approaches in achieving recovery and growth.

Looking ahead, the future of restructuring and insolvency law will be shaped by technological advancements, an increased focus on sustainability, and evolving regulatory landscapes. Fund managers who embrace these trends while prioritising risk management and collaboration will be better positioned to navigate the complexities of this ever-changing environment. Ultimately, the insights shared in this article serve as a crucial guide for investment fund managers seeking to optimize their strategies in the face of financial distress and ensure long-term success.